Question

Introduction Conscientious Colas is considering introducing a new product line, Low Cost Light (LCL). LCL is the brainchild of a brilliant but eccentric marketing genius

Introduction

Conscientious Colas is considering introducing a new product line, Low Cost Light (LCL). LCL is the brainchild of a brilliant but eccentric marketing genius (Joe Smith) who founded Conscientious Colas 5 years ago. Obesity is a well-known problem in the US and certain other developed countries, but Smith has become aware that it is a growing problem in developing countries where the poorer population in particular is consuming empty calories at alarming rates. Obesity rates have tripled in Africa over the past 20 years and in some cases are approaching those in the US!

Smith discussed the LCL idea with his key managers, Susan who runs finance, Sam who runs sales and marketing and Mary who runs production. LCL is going to be a private label product line of reduced calorie and no calorie sodas that is to be sold at a lower price point than the products sold by Coca Cola, Pepsi etc. Smith thinks that the financial potential of LCL is very attractive and if Conscientious Colas is able to be successful with LCL there is the added benefit of at least partially addressing a growing health issue among poor people.

The Project

Although Smith is biased towards action and is ready to move ahead with LCL, his Director of Finance, Susan counsels him to be cautious and look at the numbers. Susan is constantly advising Smith to only grow the company when it makes financial sense, and the company has the financial resources to comfortably fund the project. Although Smiths nature is to charge ahead, he recognizes the wisdom in Susans advice and restrains himself - most of the time. Conscientious Colas has had strong financial performance over the past 5 years resulting in having a large amount of cash on hand. In addition, a bank recently offered to loan Conscientious Colas $5,000,000 for 10 years where the interest cost would be 8% annually. Susan suggested that this project be financed with 50/50 mix of debt and equity resulting in a cost of capital of 12.5%.

Before proceeding, the biggest outstanding question is the potential level of sales. Will the target segment embrace reduced calorie sodas, or will they continue to drink high sugar content traditional products? Sam, VP of Sales and Marketing, hired a consultant who took 45 days to complete his study. Conscientious Colas paid the consultant $100,000. The forecast resulting from the study is as follows:

| forecasts in Gallons | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

| LCL | 300,000 | 350,000 | 400,000 | 600,000 | 800,000 |

| Reduction in sales of existing products | 100,000 | 100,000 | 100,000 | 100,000 | 100,000 |

Since Conscientious Colas existing equipment is running full out producing existing products, new bottling equipment is needed for production of LCL. Automated bottling equipment with the capacity to produce up to 1,000,000 gallons per year could be purchased for $2,500,000. In addition, the cost of installation would be $500,000. The total amount could be depreciated straight line to zero over a five-year period. In addition, Mary said that there is an active market for used bottling equipment and Conscientious Colas should be able to sell the equipment after year 5 for $125,000.

The good news is that there is unused space in Conscientious Colas plant that is adequate to house the new equipment, raw materials and finished product. Smith had been thinking about launching a line of CBD infused waters, but after expanding the size of the plant at a cost of $175,000 he decided not to move forward. Smith recently received a proposal to rent the extra space for $10,000/month for 5 years. While production does not require inventory of raw materials (suppliers are willing and able to deliver raw materials just in time as they are needed for production), at the start pf the project Conscientious Colas must increase working capital by $400,000 to support sales of LCL. Conscientious Colas will be able to recapture all of the increase in working capital after 5 years. Raw material costs are forecasted to be $.25/gallon, the labor costs are estimated to be $20,000/month in the first two years and $50,000/month in years 3-5 and $10,000/month. Similarly, electricity costs are expected to be $5,000/month in years 1-2 and $10,000/month in years 3-5.

Sam forecasts that Conscientious Colas can sell LCL for $7.00/gallon and since the existing sales force and distribution channels can handle LCL, the additional S,G&A expense required for this project is only $400,000/year. The sales price and margins are the same for LCL and existing products.

Conscientious Colas tax rate is 22%.

Analyze this opportunity and make a recommendation.

Just as Smith is about to make the final decision Sam comes running into the room and starts yelling that he has found a soccer star in Nigeria who he can sign as a celebrity endorser for LCL. The cost of signing him is only $1,000,000 up front, plus $700,000/year for 5 years, plus 5% of LCL sales. While signing him will not change the risk of the project, it does increase expected sales by 200,000 gallons/year.

Should they sign the celebrity endorser?

In addition to a spreadsheet showing your financial analysis, please write a memo that discusses the following:

- Rationale for your recommendation.

- Since forecasts are by their nature only estimates, please determine those assumptions that you think have the largest financial impact on the project.

- At what cost of capital/hurdle rate would you be indifferent about pursuing the project?

- How do you feel about the non-financial aspects of the project?

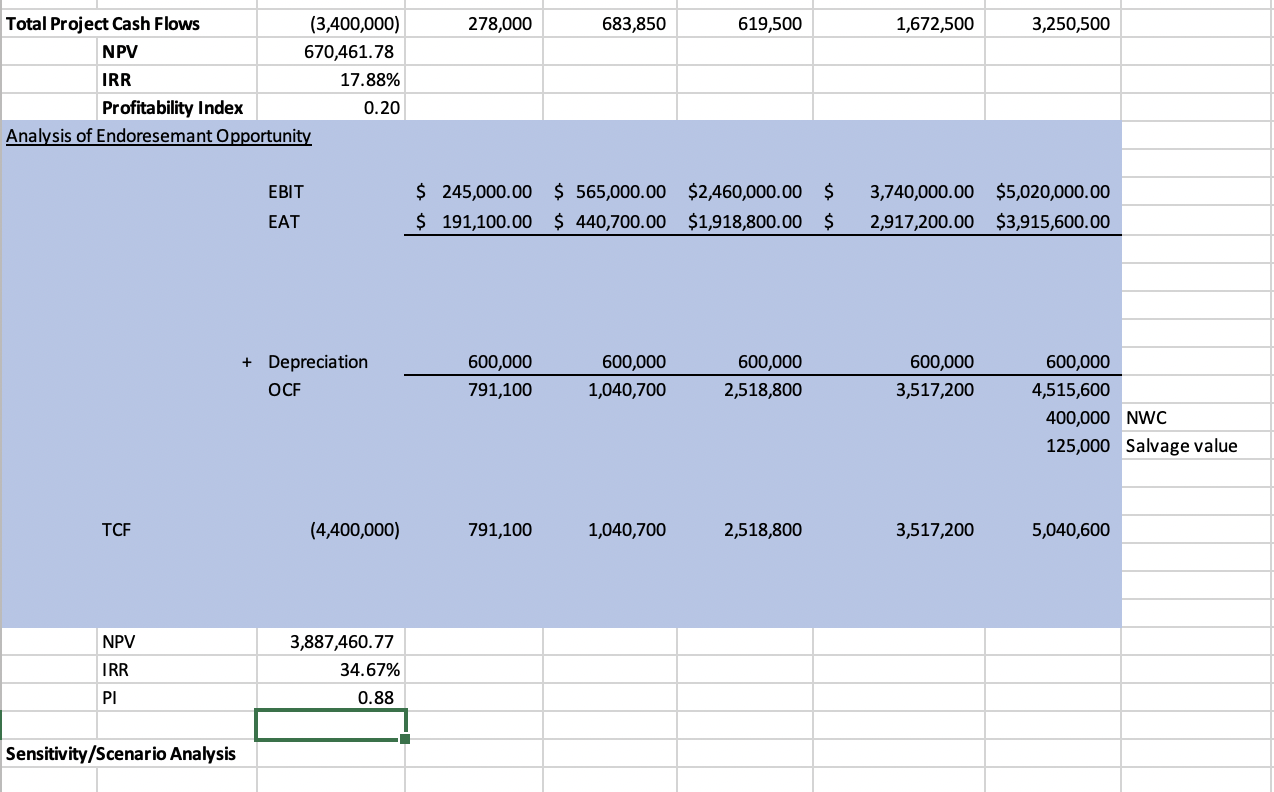

I just don't understand the last questions that well. Here are my calculations:

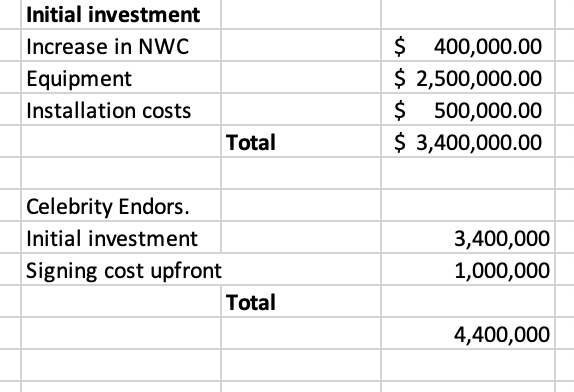

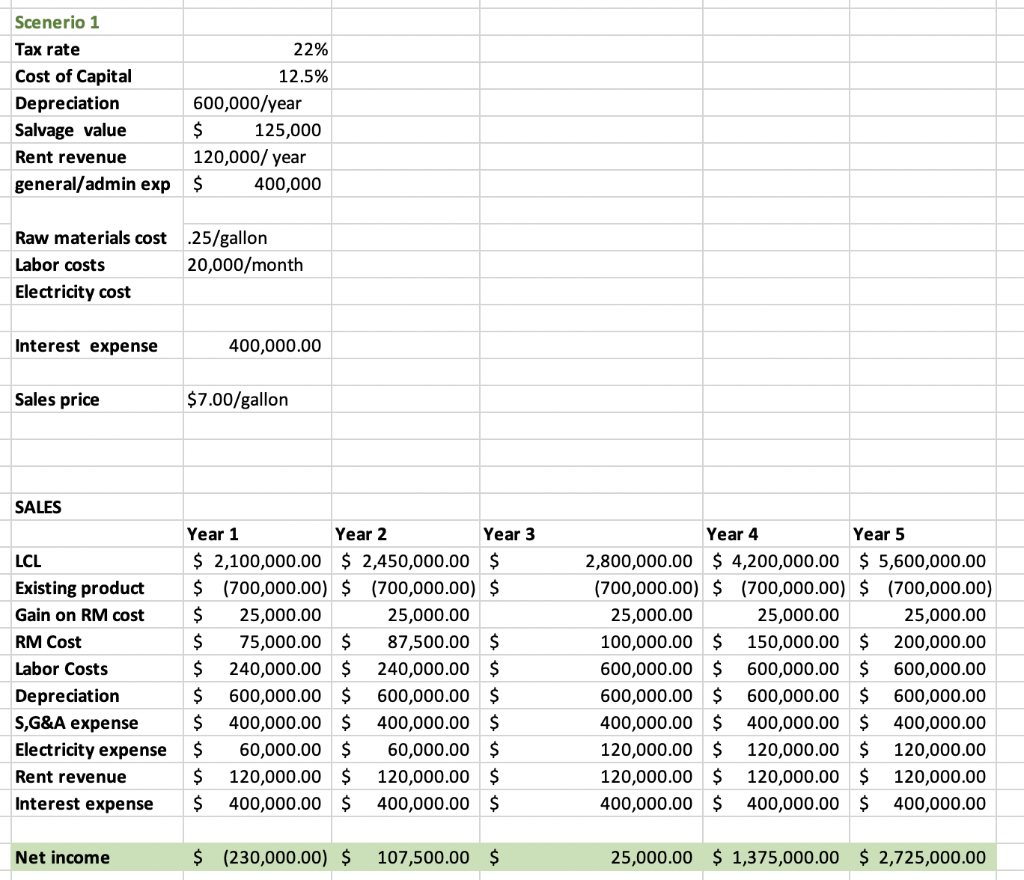

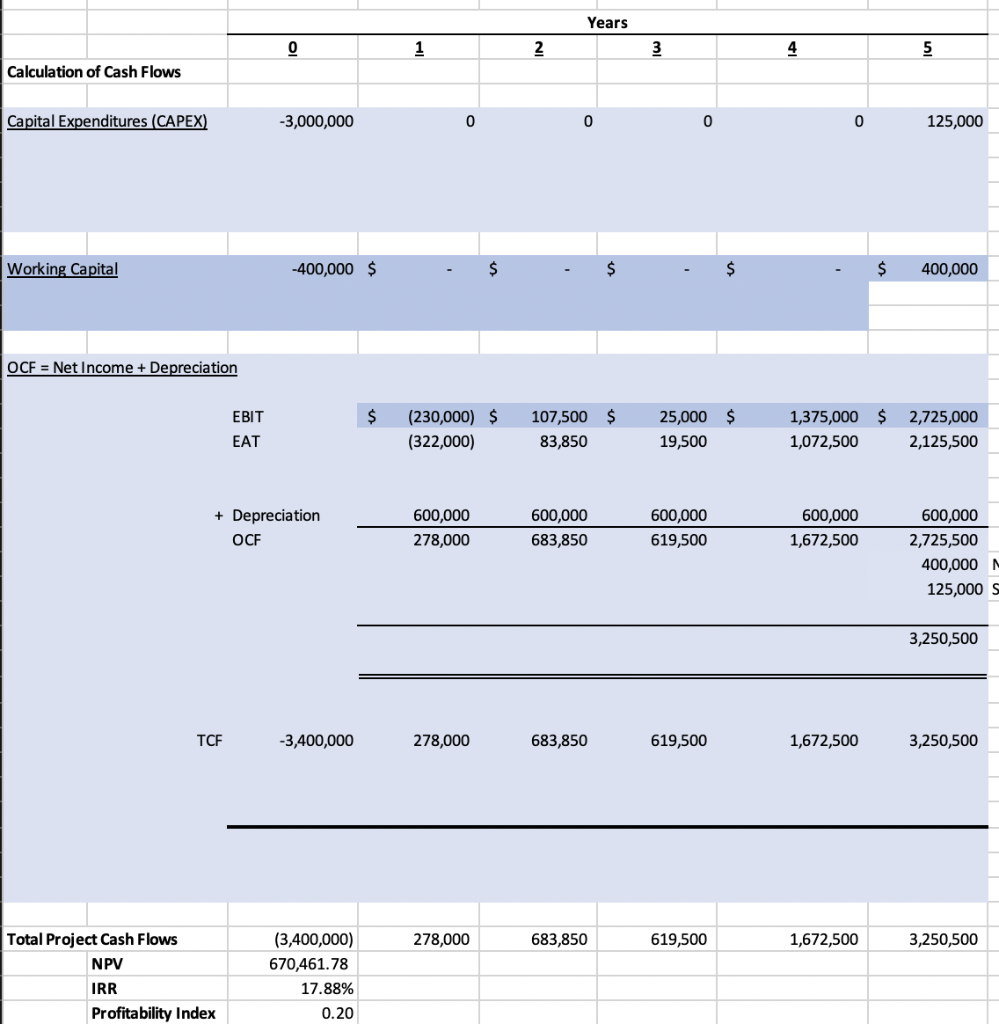

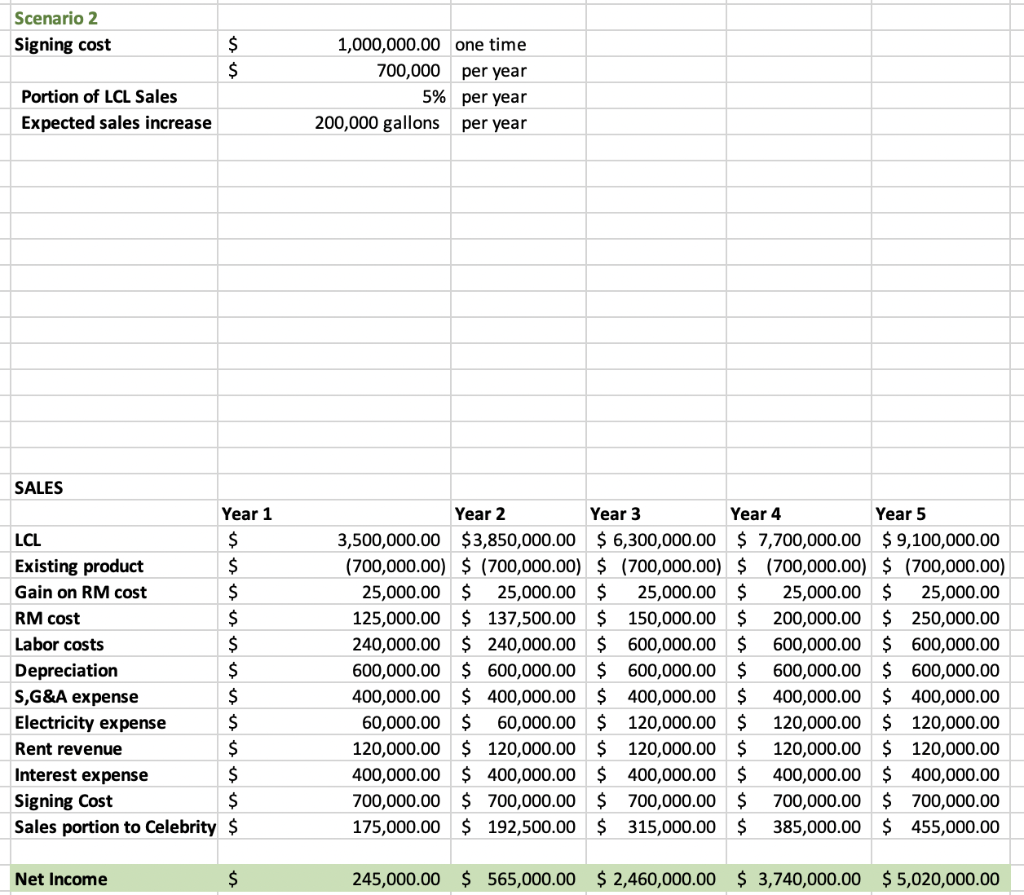

Initial investment Increase in NWC Equipment Installation costs $ 400,000.00 $ 2,500,000.00 $ 500,000.00 $ 3,400,000.00 Total Celebrity Endors. Initial investment Signing cost upfront Total 3,400,000 1,000,000 4,400,000 Scenerio 1 Tax rate Cost of Capital Depreciation Salvage value Rent revenue general/admin exp 22% 12.5% 600,000/year $ 125,000 120,000/year $ 400,000 Raw materials cost Labor costs Electricity cost .25/gallon 20,000/month Interest expense 400,000.00 Sales price $7.00/gallon SALES LCL Existing product Gain on RM cost RM Cost Labor Costs Depreciation S,G&A expense Electricity expense Rent revenue Interest expense Year 1 Year 2 Year 3 $ 2,100,000.00 $ 2,450,000.00 $ $ (700,000.00) $ (700,000.00) $ $ 25,000.00 25,000.00 $ 75,000.00 $ 87,500.00 $ $ 240,000.00 $ 240,000.00 $ $ 600,000.00 $ 600,000.00 $ $ 400,000.00 $ 400,000.00 $ $ 60,000.00 $ 60,000.00 $ $ 120,000.00 $ 120,000.00 $ $ 400,000.00 $ 400,000.00 $ Year 4 Year 5 2,800,000.00 $ 4,200,000.00 $ 5,600,000.00 (700,000.00) $ (700,000.00) $ (700,000.00) 25,000.00 25,000.00 25,000.00 100,000.00 $ 150,000.00 $ 200,000.00 600,000.00 $ 600,000.00 $ 600,000.00 600,000.00 $ 600,000.00 $ 600,000.00 400,000.00 $ 400,000.00 $ 400,000.00 120,000.00 $ 120,000.00 $ 120,000.00 120,000.00 $ 120,000.00 $ 120,000.00 400,000.00 $ 400,000.00 $ 400,000.00 Net income $ (230,000.00) $ 107,500.00 $ 25,000.00 $ 1,375,000.00 $ 2,725,000.00 Years o 1 2 3 4 5 Calculation of Cash Flows Capital Expenditures (CAPEX) -3,000,000 0 0 0 0 125,000 Working Capital -400,000 $ $ $ $ $ 400,000 OCF = Net Income + Depreciation EBIT $ (230,000) $ (322,000) 107,500 $ 83,850 25,000 $ 19,500 1,375,000 $ 1,072,500 2,725,000 2,125,500 EAT + Depreciation OCF 600,000 278,000 600,000 683,850 600,000 619,500 600,000 1,672,500 600,000 2,725,500 400,000 N 125,000 3,250,500 TCF -3,400,000 278,000 683,850 619,500 1,672,500 3,250,500 278,000 683,850 619,500 1,672,500 3,250,500 Total Project Cash Flows NPV IRR Profitability Index (3,400,000) 670,461.78 17.88% 0.20 Scenario 2 Signing cost $ $ 1,000,000.00 one time 700,000 per year 5% per year 200,000 gallons per year Portion of LCL Sales Expected sales increase SALES Year 1 LCL $ Existing product $ Gain on RM cost $ RM cost $ Labor costs $ Depreciation $ S,G&A expense $ Electricity expense $ Rent revenue $ Interest expense $ Signing Cost $ Sales portion to Celebrity $ Year 2 Year 3 Year 4 Year 5 3,500,000.00 $3,850,000.00 $ 6,300,000.00 $ 7,700,000.00 $ 9,100,000.00 (700,000.00) $ (700,000.00) $ (700,000.00) $ (700,000.00) $ (700,000.00) 25,000.00 $ 25,000.00 $ 25,000.00 $ 25,000.00 $ 25,000.00 125,000.00 $ 137,500.00 $ 150,000.00 $ 200,000.00 $ 250,000.00 240,000.00 $ 240,000.00 $ 600,000.00 $ 600,000.00 $ 600,000.00 600,000.00 $ 600,000.00 $ 600,000.00 $ 600,000.00 $ 600,000.00 400,000.00 $ 400,000.00 $ 400,000.00 $ 400,000.00 $ 400,000.00 60,000.00 $ 60,000.00 $ 120,000.00 $ 120,000.00 $ 120,000.00 120,000.00 $ 120,000.00 $ 120,000.00 $ 120,000.00 $ 120,000.00 400,000.00 $ 400,000.00 $ 400,000.00 $ 400,000.00 $ 400,000.00 700,000.00 $ 700,000.00 $ 700,000.00 $ 700,000.00 $ 700,000.00 175,000.00 $ 192,500.00 $ 315,000.00 $ 385,000.00 $ 455,000.00 Net Income $ 245,000.00 $ 565,000.00 $ 2,460,000.00 $ 3,740,000.00 $ 5,020,000.00 278,000 683,850 619,500 1,672,500 3,250,500 Total Project Cash Flows (3,400,000) NPV 670,461.78 IRR 17.88% Profitability Index 0.20 Analysis of Endoresemant Opportunity EBIT $ 245,000.00 $ 565,000.00 $2,460,000.00 $ $ 191,100.00 $ 440,700.00 $1,918,800.00 $ 3,740,000.00 $5,020,000.00 2,917,200.00 $3,915,600.00 EAT + Depreciation OCF 600,000 791,100 600,000 1,040,700 600,000 2,518,800 600,000 3,517,200 600,000 4,515,600 400,000 NWC 125,000 Salvage value TCF (4,400,000) 791,100 1,040,700 2,518,800 3,517,200 5,040,600 NPV IRR 3,887,460.77 34.67% 0.88 PI Sensitivity/Scenario Analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started