Introduction

In this activity, you will be given data that includes hourly wages, hours worked, overtime hours, tax deductions, and other deductions. You will calculate the net pay for employees and identify the control procedures for payroll systems depending on the execution and recording of the related transactions.

Task 1: Calculating Net Pay

Calculate the following net pay for each of the given set of employees. Deduct the following tax payments from gross earnings to calculate net pay.

Social Security tax: 6.2% of gross earnings

Medicare tax: 1.45% of gross earnings

Federal income tax: 10% of gross earnings

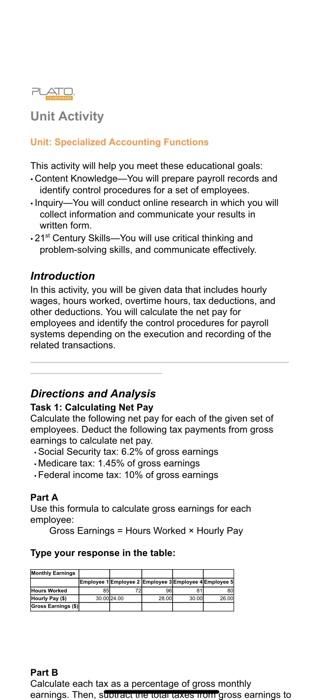

Part A

Use this formula to calculate gross earnings for each employee:

Gross Earnings = Hours Worked Hourly Pay

Type your response in the table:

Monthly Earnings Employee 1 Employee 2 Employee 3 Employee 4 Employee 5 Hours Worked 85 72 96 81 80

Hourly Pay ($) 30.00 24.00 28.00 30.00 26.00

Gross Earnings ($)

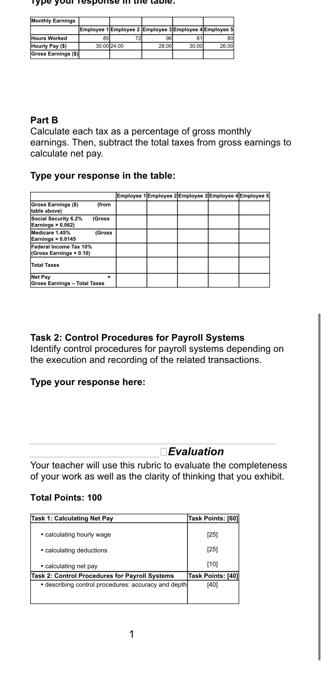

Part B

Calculate each tax as a percentage of gross monthly earnings. Then, subtract the total taxes from gross earnings to calculate net pay.

Type your response in the table:

Employee 1 Employee 2 Employee 3 Employee 4 Employee 5 Gross Earnings ($) (from table above) Social Security 6.2% (Gross Earnings 0.062) Medicare 1.45% (Gross Earnings 0.0145 Federal Income Tax 10% (Gross Earnings 0.10) Total Taxes

Net Pay = Gross Earnings Total Taxes

Task 2: Control Procedures for Payroll Systems

Identify control procedures for payroll systems depending on the execution and recording of the related transactions.

Type your response here:

Unit Activity Unit: Specialized Accounting Functions This activity will help you meet these educational goals: - Content Knowledge-You will prepare payroll records and identify control procedures for a set of employees. - Inquiry-You will conduct online research in which you will collect information and communicate your results in written form. .21s Century Skills-You will use critical thinking and problem-solving skills, and communicate effectively. Introduction In this activity, you will be given data that includes hourly wages, hours worked, overtime hours, tax deductions, and other deductions. You will calculate the net pay for employees and identify the control procedures for payroil systems depending on the execution and recording of the related transactions. Directions and Analysis Task 1: Calculating Net Pay Calculate the following net pay for each of the given set of employees. Deduct the following tax payments from gross earnings to calculate net pay. - Social Security tax: 6.2% of gross earnings - Medicare tax: 1.45% of gross earnings - Federal income tax: 10% of gross eamings Part A Use this formula to calculate gross earnings for each employee: Gross Earnings = Hours Worked Hourly Pay Type your response in the table: Part B Calculate each tax as a percentage of gross monthly Part B Calculate each tax as a percentage of gross monthly earnings. Then, subtract the total taxes from gross earnings to calculate net pay. Type your response in the table: Task 2: Control Procedures for Payroll Systems Identify control procedures for payroll systems depending on the execution and recording of the related transactions. Type your response here: Evaluation Your teacher will use this rubric to evaluate the completeness of your work as well as the clarity of thinking that you exhibit. Total Points: 100 1 Unit Activity Unit: Specialized Accounting Functions This activity will help you meet these educational goals: - Content Knowledge-You will prepare payroll records and identify control procedures for a set of employees. - Inquiry-You will conduct online research in which you will collect information and communicate your results in written form. .21s Century Skills-You will use critical thinking and problem-solving skills, and communicate effectively. Introduction In this activity, you will be given data that includes hourly wages, hours worked, overtime hours, tax deductions, and other deductions. You will calculate the net pay for employees and identify the control procedures for payroil systems depending on the execution and recording of the related transactions. Directions and Analysis Task 1: Calculating Net Pay Calculate the following net pay for each of the given set of employees. Deduct the following tax payments from gross earnings to calculate net pay. - Social Security tax: 6.2% of gross earnings - Medicare tax: 1.45% of gross earnings - Federal income tax: 10% of gross eamings Part A Use this formula to calculate gross earnings for each employee: Gross Earnings = Hours Worked Hourly Pay Type your response in the table: Part B Calculate each tax as a percentage of gross monthly Part B Calculate each tax as a percentage of gross monthly earnings. Then, subtract the total taxes from gross earnings to calculate net pay. Type your response in the table: Task 2: Control Procedures for Payroll Systems Identify control procedures for payroll systems depending on the execution and recording of the related transactions. Type your response here: Evaluation Your teacher will use this rubric to evaluate the completeness of your work as well as the clarity of thinking that you exhibit. Total Points: 100 1