Answered step by step

Verified Expert Solution

Question

1 Approved Answer

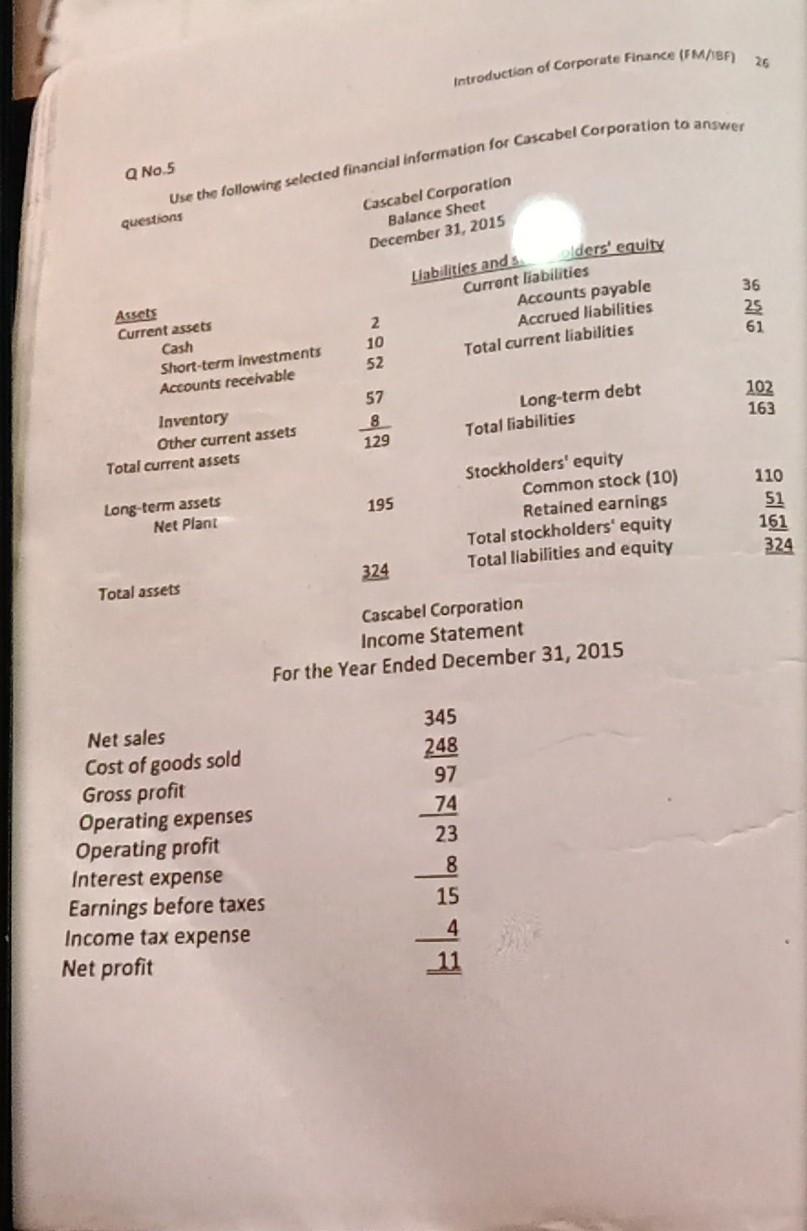

Introduction of Corporate Finance (FM/IBF 26 Q No.5 Use the following selected financial information for Cascabel Corporation to answer questions Cascabel Corporation Balance Sheet December

Introduction of Corporate Finance (FM/IBF 26 Q No.5 Use the following selected financial information for Cascabel Corporation to answer questions Cascabel Corporation Balance Sheet December 31, 2015 Liabilities and olders' equity Current liabilities Accounts payable Accrued liabilities Total current liabilities 36 25 61 Assets Current 2 sets Cash Short-term investments Accounts receivable 2 10 52 102 163 57 8 129 Long-term debt Total liabilities Inventory Other current assets Total current assets 195 Long-term assets Net Plant Stockholders' equity Common stock (10) Retained earnings Total stockholders' equity Total liabilities and equity 110 51 161 324 324 Total assets Cascabel Corporation Income Statement For the Year Ended December 31, 2015 Net sales Cost of goods sold Gross profit Operating expenses Operating profit Interest expense Earnings before taxes Income tax expense Net profit 345 248 97 74 23 8 15 Introduction of Corporate Finance (FM/IBF 26 Q No.5 Use the following selected financial information for Cascabel Corporation to answer questions Cascabel Corporation Balance Sheet December 31, 2015 Liabilities and olders' equity Current liabilities Accounts payable Accrued liabilities Total current liabilities 36 25 61 Assets Current 2 sets Cash Short-term investments Accounts receivable 2 10 52 102 163 57 8 129 Long-term debt Total liabilities Inventory Other current assets Total current assets 195 Long-term assets Net Plant Stockholders' equity Common stock (10) Retained earnings Total stockholders' equity Total liabilities and equity 110 51 161 324 324 Total assets Cascabel Corporation Income Statement For the Year Ended December 31, 2015 Net sales Cost of goods sold Gross profit Operating expenses Operating profit Interest expense Earnings before taxes Income tax expense Net profit 345 248 97 74 23 8 15

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started