Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Introduction / Problem Description In the following case study, you will be utilizing the balance sheets from two separate companies to make an investment

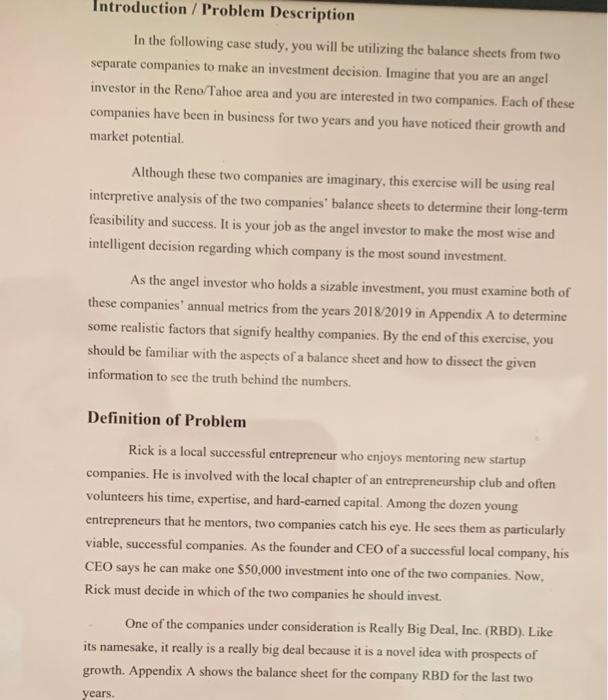

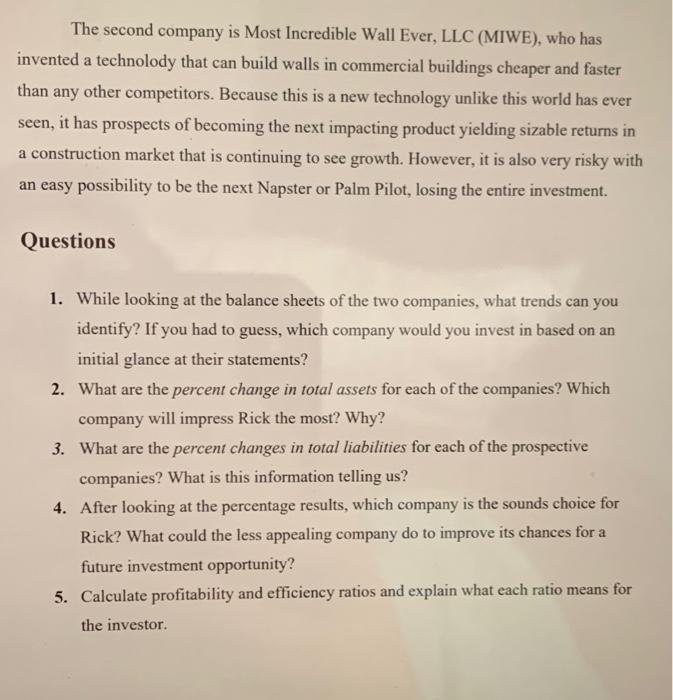

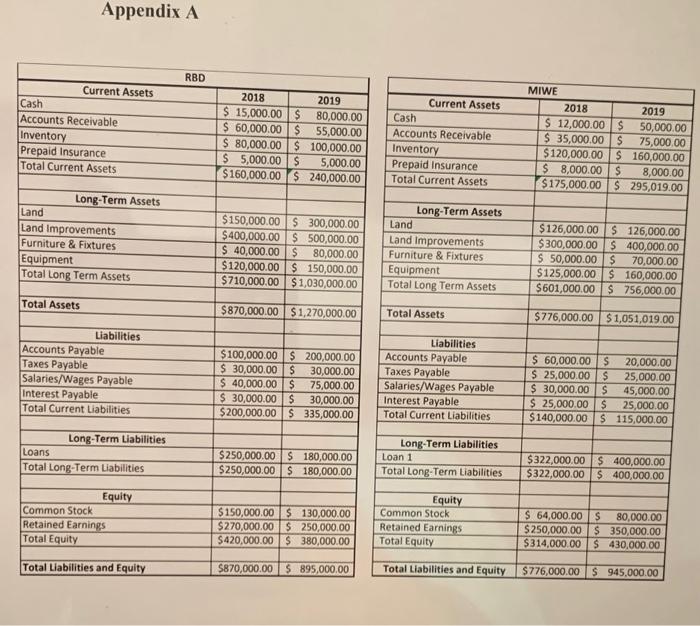

Introduction / Problem Description In the following case study, you will be utilizing the balance sheets from two separate companies to make an investment decision. Imagine that you are an angel investor in the Reno/Tahoe area and you are interested in two companies. Each of these companies have been in business for two years and you have noticed their growth and market potential. Although these two companies are imaginary, this exercise will be using real interpretive analysis of the two companies' balance sheets to determine their long-term feasibility and success. It is your job as the angel investor to make the most wise and intelligent decision regarding which company is the most sound investment. As the angel investor who holds a sizable investment, you must examine both of these companies' annual metrics from the years 2018/2019 in Appendix A to determine some realistic factors that signify healthy companies. By the end of this exercise, you should be familiar with the aspects of a balance sheet and how to dissect the given information to see the truth behind the numbers. Definition of Problem Rick is a local successful entrepreneur who enjoys mentoring new startup companies. He is involved with the local chapter of an entrepreneurship club and often volunteers his time, expertise, and hard-earned capital. Among the dozen young entrepreneurs that he mentors, two companies catch his eye. He sees them as particularly viable, successful companies. As the founder and CEO of a successful local company, his CEO says he can make one $50,000 investment into one of the two companies. Now, Rick must decide in which of the two companies he should invest. One of the companies under consideration is Really Big Deal, Inc. (RBD). Like its namesake, it really is a really big deal because it is a novel idea with prospects of growth. Appendix A shows the balance sheet for the company RBD for the last two years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started