introduction to financial accounting 135-83

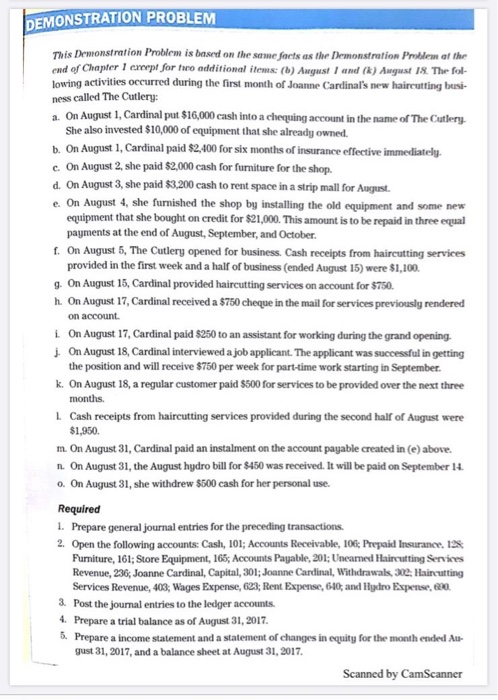

DEMONSTRATION PROBLEM This Demonstration Problem is based on the sime facts as the demonstration Problem of the end of Chapter 1 crept for two additional items: (b) August land (k) August 18. The fol lowing activities occurred during the first month of Joanne Cardinal's new haircutting busi- ness called The Cutlery: 2. On August 1, Cardinal put $16,000 cash into a chequing account in the name of The Cutlery She also invested $10,000 of equipment that she already owned. b. On August 1, Cardinal paid $2,400 for six months of insurance effective immediately. c. On August 2, she paid $2,000 cash for furniture for the shop. d. On August 3, she paid $3,200 cash to rent space in a strip mall for August e. On August 4, she furnished the shop by installing the old equipment and some new equipment that she bought on credit for $21,000. This amount is to be repaid in three equal payments at the end of August, September, and October f. On August 5, The Cutlery opened for business. Cash receipts from haircutting services provided in the first week and a half of business (ended August 15) were $1,100. 9. On August 15, Cardinal provided haircutting services on account for $750. h. On August 17, Cardinal received a $750 cheque in the mail for services previously rendered on account. i On August 17, Cardinal paid $250 to an assistant for working during the grand opening j. On August 18, Cardinal interviewed a job applicant. The applicant was successful in getting the position and will receive $750 per week for part-time work starting in September k. On August 18, a regular customer paid $500 for services to be provided over the next three months. 1. Cash receipts from haircutting services provided during the second half of August were $1,950 m. On August 31, Cardinal paid an instalment on the account payable created in (e) above. n. On August 31, the August hydro bill for $450 was received. It will be paid on September 14. o. On August 31, she withdrew $500 cash for her personal use. Required 1. Prepare general journal entries for the preceding transactions. 2. Open the following accounts: Cash, 101; Accounts Receivable, 106, Prepaid Insurance, 128 Furniture, 161; Store Equipment, 165Accounts Payable, 201: Unearned Haircutting Services Revenue, 236, Joanne Cardinal, Capital, 301; Joanne Cardinal, Withdrawals, 302: Haircutting Services Revenue, 403, Wages Expense, 623; Rent Expense, 640, and Hydro Expense, 620 3. Post the journal entries to the ledger accounts. 4. Prepare a trial balance as of August 31, 2017 5. Prepare a income statement and a statement of changes in equity for the month ended Au- gust 31, 2017, and a balance sheet at August 31, 2017 Scanned by CamScanner DEMONSTRATION PROBLEM This Demonstration Problem is based on the sime facts as the demonstration Problem of the end of Chapter 1 crept for two additional items: (b) August land (k) August 18. The fol lowing activities occurred during the first month of Joanne Cardinal's new haircutting busi- ness called The Cutlery: 2. On August 1, Cardinal put $16,000 cash into a chequing account in the name of The Cutlery She also invested $10,000 of equipment that she already owned. b. On August 1, Cardinal paid $2,400 for six months of insurance effective immediately. c. On August 2, she paid $2,000 cash for furniture for the shop. d. On August 3, she paid $3,200 cash to rent space in a strip mall for August e. On August 4, she furnished the shop by installing the old equipment and some new equipment that she bought on credit for $21,000. This amount is to be repaid in three equal payments at the end of August, September, and October f. On August 5, The Cutlery opened for business. Cash receipts from haircutting services provided in the first week and a half of business (ended August 15) were $1,100. 9. On August 15, Cardinal provided haircutting services on account for $750. h. On August 17, Cardinal received a $750 cheque in the mail for services previously rendered on account. i On August 17, Cardinal paid $250 to an assistant for working during the grand opening j. On August 18, Cardinal interviewed a job applicant. The applicant was successful in getting the position and will receive $750 per week for part-time work starting in September k. On August 18, a regular customer paid $500 for services to be provided over the next three months. 1. Cash receipts from haircutting services provided during the second half of August were $1,950 m. On August 31, Cardinal paid an instalment on the account payable created in (e) above. n. On August 31, the August hydro bill for $450 was received. It will be paid on September 14. o. On August 31, she withdrew $500 cash for her personal use. Required 1. Prepare general journal entries for the preceding transactions. 2. Open the following accounts: Cash, 101; Accounts Receivable, 106, Prepaid Insurance, 128 Furniture, 161; Store Equipment, 165Accounts Payable, 201: Unearned Haircutting Services Revenue, 236, Joanne Cardinal, Capital, 301; Joanne Cardinal, Withdrawals, 302: Haircutting Services Revenue, 403, Wages Expense, 623; Rent Expense, 640, and Hydro Expense, 620 3. Post the journal entries to the ledger accounts. 4. Prepare a trial balance as of August 31, 2017 5. Prepare a income statement and a statement of changes in equity for the month ended Au- gust 31, 2017, and a balance sheet at August 31, 2017 Scanned by CamScanner