Question

Introduction You are an experienced staff accountant working on the audit of RB Johnson Electric Company (the Company) as of and for the year ended

Introduction

You are an experienced staff accountant working on the audit of RB Johnson Electric Company (the Company) as of and for the year ended December 31, 2022. All of the outstanding common stock of the Company is owned by Barry and Sam Johnson, who are brothers. The Company is engaged in commercial electrical construction on the East Coast of the United States.

The Company was formed on January 1, 1947, and has been in continuous operation since that date. The Company employs approximately 100 people and has normal revenues between $25 and $35 million. The Company's bonding needs and its line of credit agreement, with Truist, require the financial statements to be audited. The Company has a very good Chief Financial Officer, who was at one time a manager with your firm.

Your firm has audited the financial statements for the last 10 years. Adam Silvia is the engagement partner and Joey Sykes is the engagement manager. Based on some staffing issues, you have effectively been assigned the role of engagement senior on this client and you are excited to be working with Joey and having a number of increased responsibilities. The audit has been completed and you and Joey are getting ready to transmit the completed file to Adam for his review.

The Company uses the accrual method of accounting and recognizes revenue on the percentage completion method of accounting. The Company's recent adoption of ASC 606 did not materially impact the Company's revenue recognition. The Company operates as an S Corporation and accordingly the Company does not record any income tax expense.

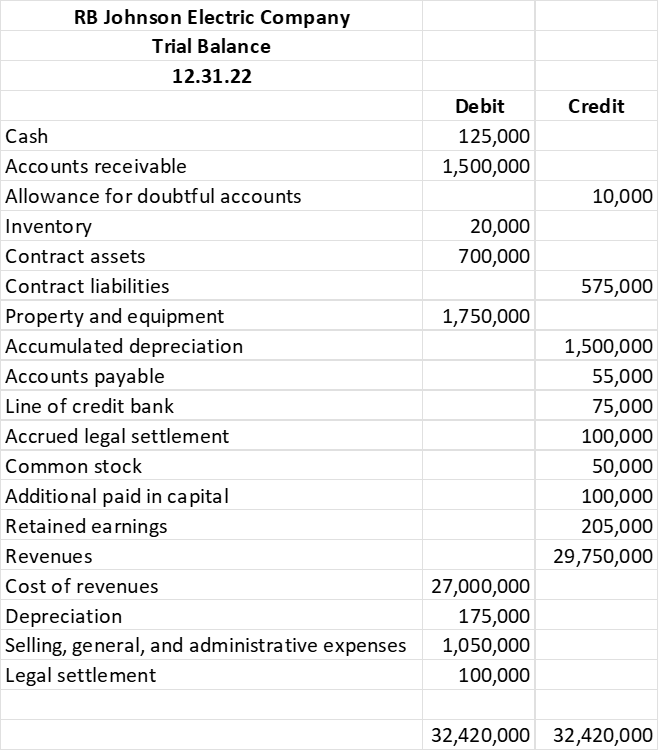

The Company's trial balance, as of and for the year ended December 31, 2022, follows.

NOTE

Portions of this background information may be necessary for the completion of problems 1 and 5.

Problem 1 (Materiality)

During your review of subsequent events for the period January 1, 2023, through March 15, 2023 (the date the financial statements will be available to be issued) the following matter was noted.

• Based on a discussion with the CFO, Barry and Sam Johnson, and a telephone conference with the Company's attorney, you were notified that the settlement of the legal matter, noted during your audit and for which the Company has provided a liability as of December 31, 2022, in the amount of $100,000, will be settled not later than March 31, 2023, for $275,000. The CFO has indicated that he does not want to change the amount of the recorded liability to reflect the update from their attorney.

• Overall materiality for this engagement has been set (based on the preceding trial balance and inclusive of the recorded $100,000 legal settlement) at 5% of the Company's net income. No other uncorrected misstatements have been identified as a part of your firm's audit of the Company's financial statements.

Required:

1. Calculate overall financial statement materiality.

2. Prepare the journal entry that would be necessary to reflect this uncorrected misstatement.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started