Answered step by step

Verified Expert Solution

Question

1 Approved Answer

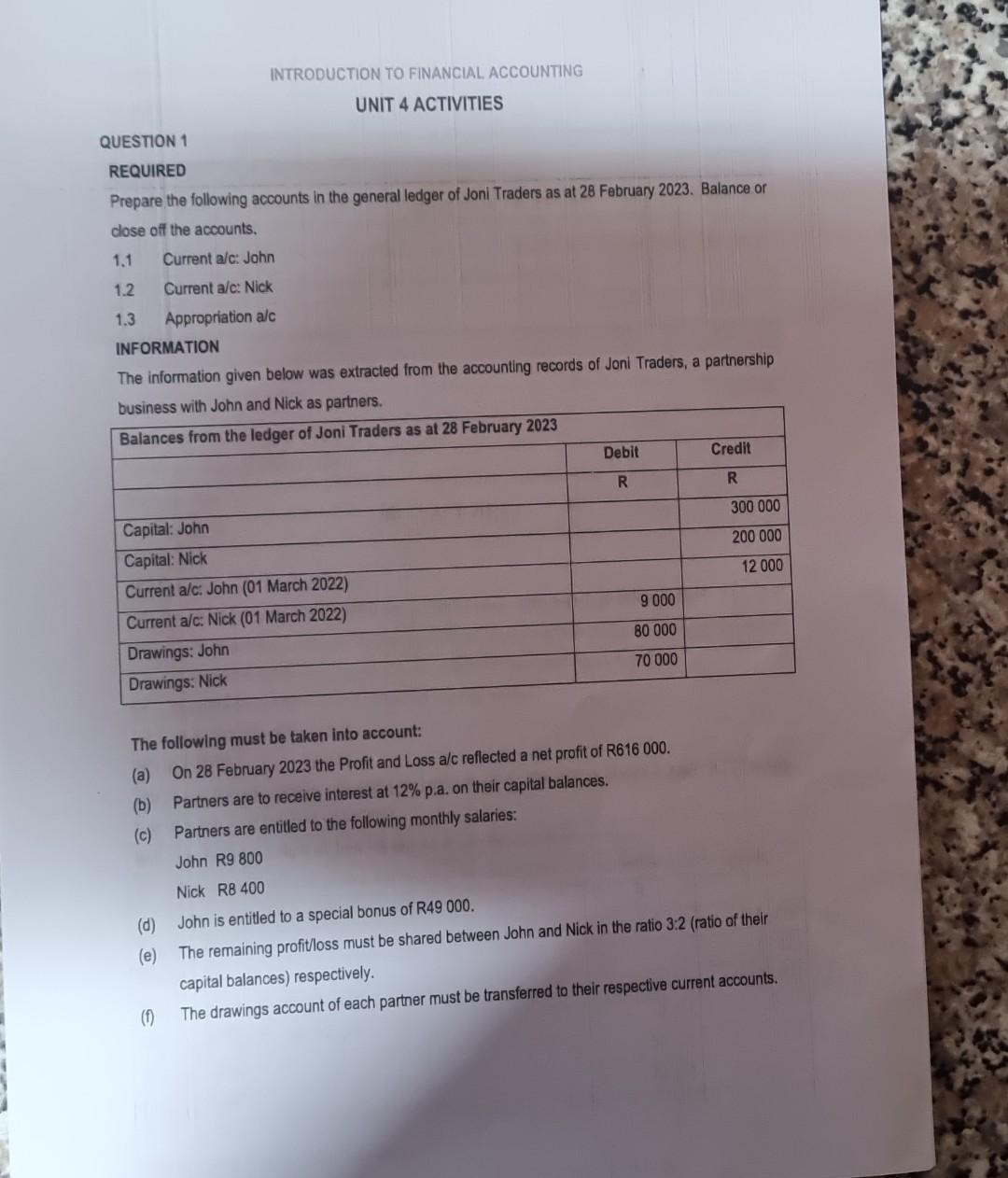

INTROOUCTION TO FINANCIAL ACCOUNTING UNIT 4 ANSWER BOOK QUESTION 1 QUESTION 2 QUESTION 1 REQUIRED Prepare the following accounts in the general ledger of Joni

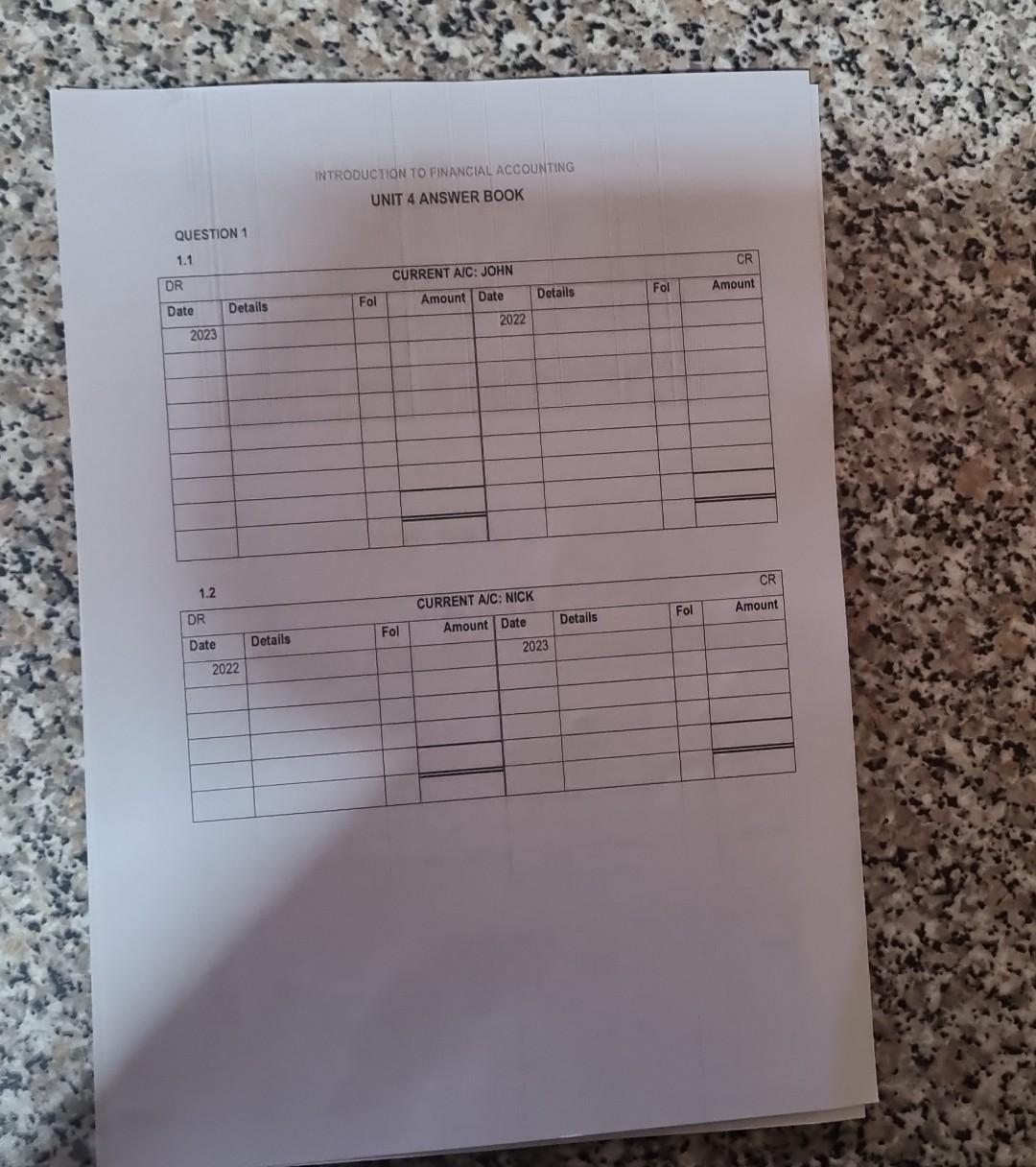

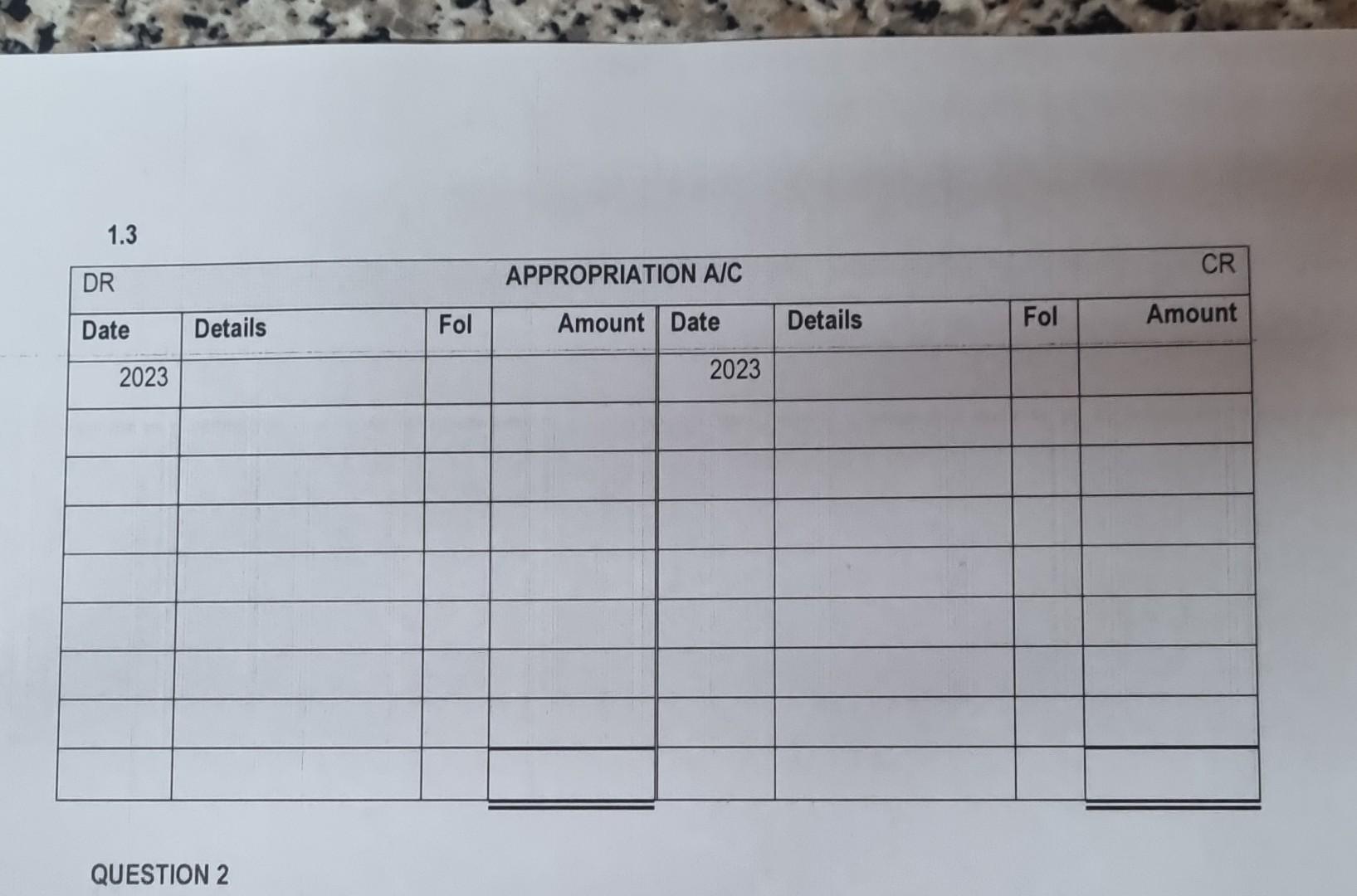

INTROOUCTION TO FINANCIAL ACCOUNTING UNIT 4 ANSWER BOOK QUESTION 1 QUESTION 2 QUESTION 1 REQUIRED Prepare the following accounts in the general ledger of Joni Traders as at 28 February 2023. Balance of close off the accounts. 1.1 Current a/c: John 1.2 Current a/c: Nick 1.3 Appropriation a/c INFORMATION The information given below was extracted from the accounting records of Joni Traders, a partnership hueinace with. Inhn and Nick as partners. The following must be taken into account: (a) On 28 February 2023 the Profit and Loss a/c reflected a net profit of R616 000 . (b) Partners are to receive interest at \12 p.a. on their capital balances. (c) Partners are entitled to the following monthly salaries: John R9 800 Nick R8 400 (d) John is entitled to a special bonus of R49 000 . (e) The remaining profitloss must be shared between John and Nick in the ratio \\( 3: 2 \\) (ratio of their capital balances) respectively. (f) The drawings account of each partner must be transferred to their respective current accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started