Question

Intructions: COMPUTRON Case 1. Calculate the net cash flow for operating, investing, and financing activties for COMPUTRON. Use the Statement of Cash Flows (2016) format

Intructions:

COMPUTRON Case

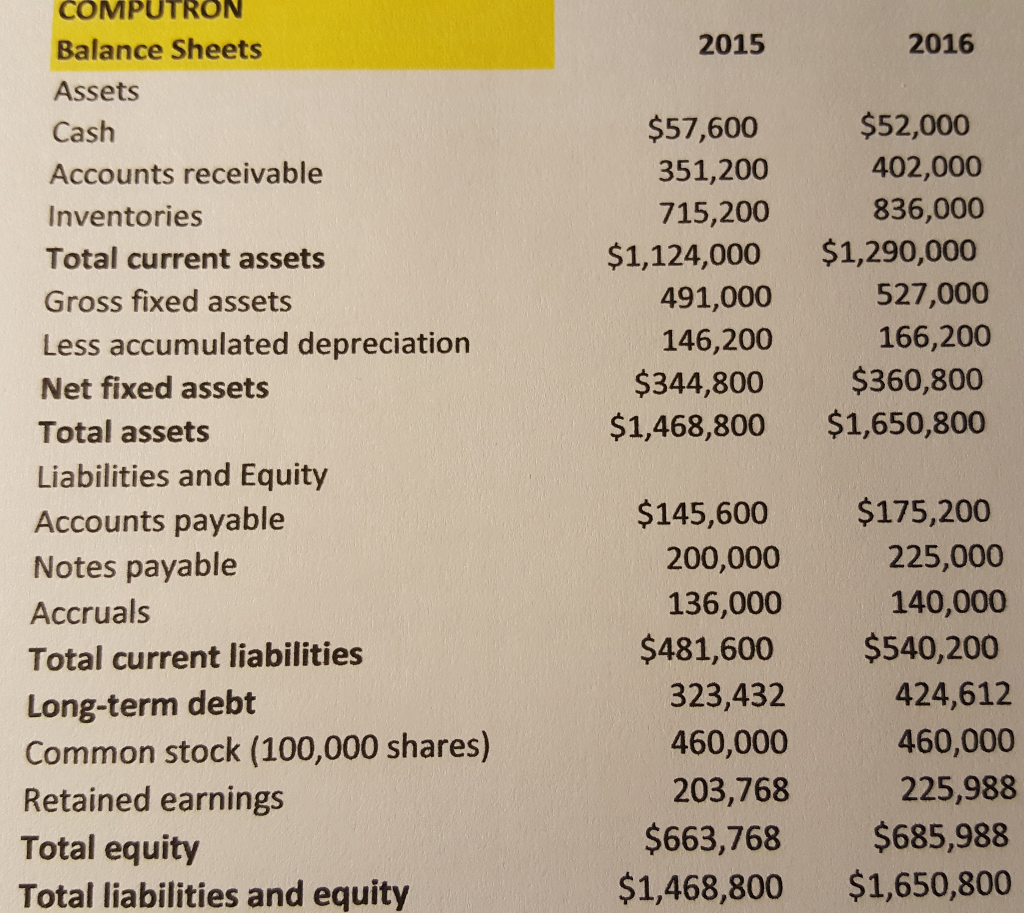

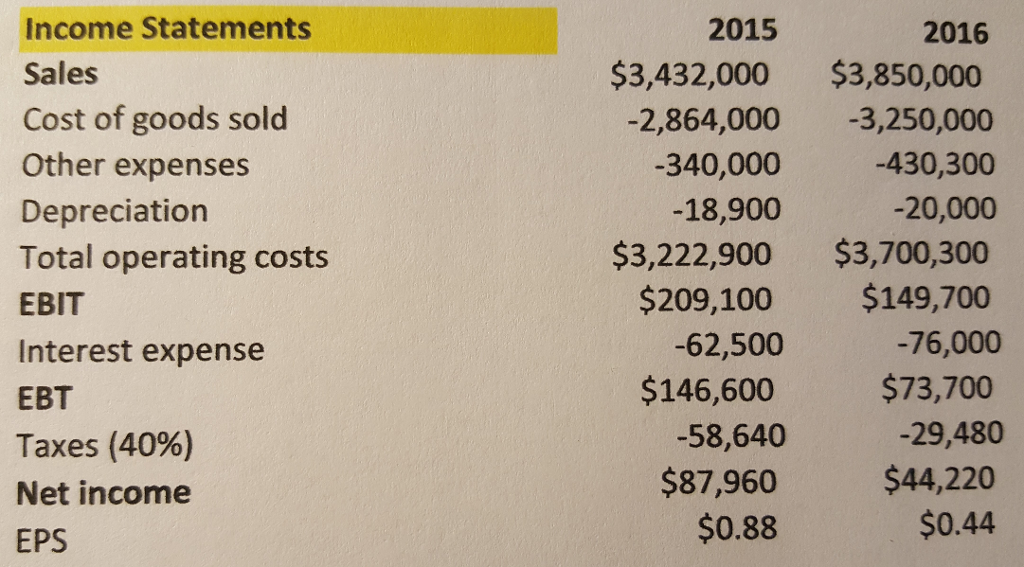

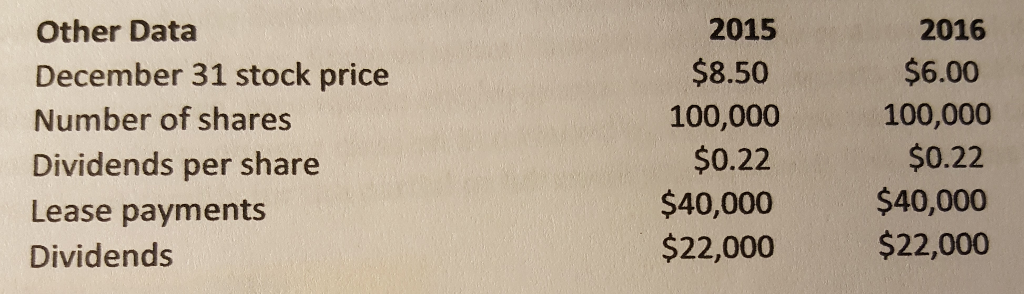

1. Calculate the net cash flow for operating, investing, and financing activties for COMPUTRON. Use the Statement of Cash Flows (2016) format below for your calculations. Show how and why Cash declines by $5600 from 2015 to 2016.

2. Calculate the Statement of Retained Earnings using the format below and show how and why Retained Earnings increased by $22220 from 2015 to 2016

3. Calculate the 2016 Ratios below for Computron and compare them to the Industry Average Ratios. State whether Computron is below or above the Industry Average.

COMPUTRON Balance Sheets 2015 2016 Assets $52,000 402,000 836,000 $1,124,000 $1,290,000 527,000 166,200 $344,800 $360,800 $1,468,800 $1,650,800 $57,600 351,200 715,200 Cash Accounts receivable Inventories Total current assets Gross fixed assets Less accumulated depreciation Net fixed assets Total assets Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term debt Common stock (100,000 shares) 491,000 146,200 $145,600 $175,200 200,000 136,000 225,000 140,000 $481, $540,200 424,612 460,000 225,988 $663,768 $685,988 $1,468,800 $1,650,800 600 323,432 460,000 203,768 Retained earnings Total equity Total liabilities and equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started