Answered step by step

Verified Expert Solution

Question

1 Approved Answer

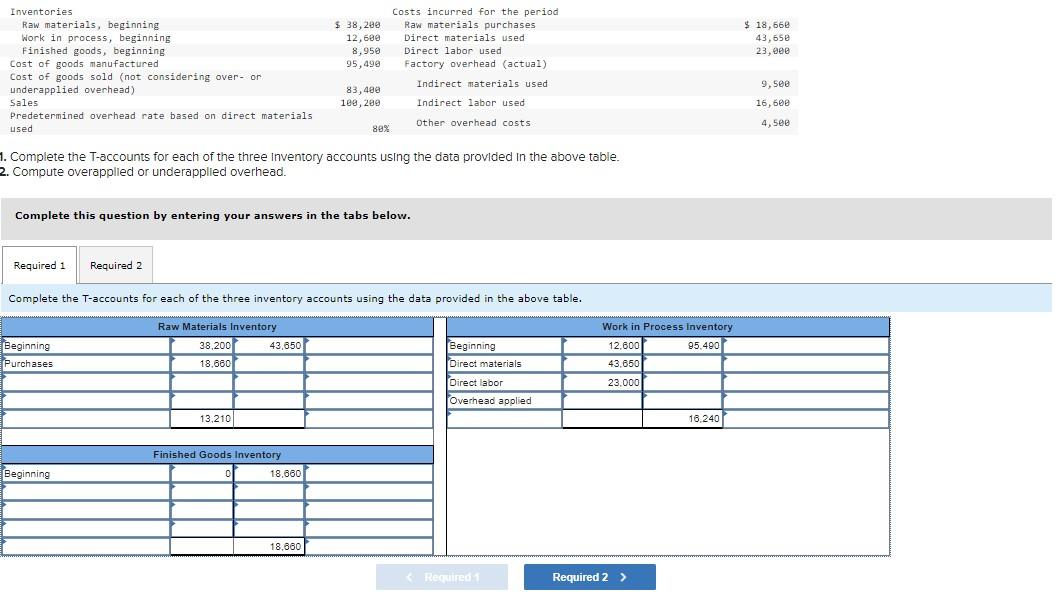

Inventories Raw materials, beginning Work in process, beginning Finished goods, beginning Cost of goods manufactured $ 38,200 12,600 8,950 95,490 Cost of goods sold

Inventories Raw materials, beginning Work in process, beginning Finished goods, beginning Cost of goods manufactured $ 38,200 12,600 8,950 95,490 Cost of goods sold (not considering over- or underapplied overhead) Costs incurred for the period Raw materials purchases Direct materials used Direct labor used Factory overhead (actual) Indirect materials used 83,400 Sales 100, 200 Indirect labor used Predetermined overhead rate based on direct materials used Other overhead costs 80% 1. Complete the T-accounts for each of the three Inventory accounts using the data provided in the above table. 2. Compute overapplied or underapplied overhead. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the T-accounts for each of the three inventory accounts using the data provided in the above table. Raw Materials Inventory Work in Process Inventory Beginning Purchases 38,200 43,650 Beginning 12,600 95.490 18,660 Direct materials 43.650 Direct labor 23,000 Overhead applied Beginning 13.210 Finished Goods Inventory 0 18,660 18,660 16.240 $ 18,660 43,650 23,000 9,500 16,600 4,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started