Question: Inventory 933,400 Total current assets $ 1,967,860 Long-term debt $ 5,050,000 Fixed assets Owners' equity Net plant and equipment $15,411,620 Common stock $ 322,500 Retained

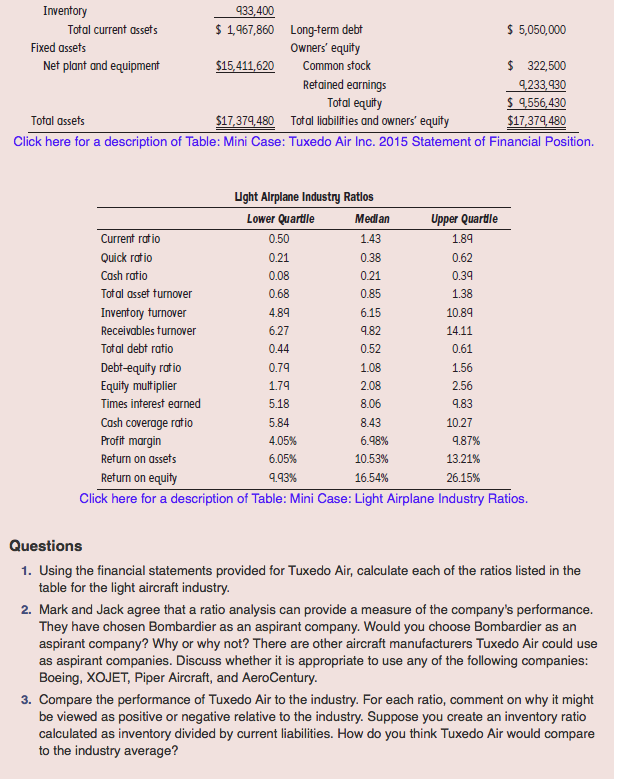

Inventory 933,400 Total current assets $ 1,967,860 Long-term debt $ 5,050,000 Fixed assets Owners' equity Net plant and equipment $15,411,620 Common stock $ 322,500 Retained earnings 9,233,930 Total equity $ 9,556,430 Total assets $17,379,480 Total liabilities and owners' equity $17,379,480 Click here for a description of Table: Mini Case: Tuxedo Air Inc. 2015 Statement of Financial Position. Ught Airplane Industry Ratlos Lower Quartile Medlan Upper Quartile Current ratio 0.50 1.43 1.89 Quick ratio 0.21 0.38 0.62 Cash ratio 0.08 0.21 0.39 Total asset turnover 0.68 0.85 1.38 Inventory turnover 4.89 6.15 10.89 Receivables turnover 6.27 9.82 14.11 Total debt ratio 0.44 0.52 0.61 Debt-equity ratio 0.79 1.08 1.56 Equity multiplier 1.79 2.08 2.56 Times interest earned 5.18 8.06 9.83 Cash coverage ratio 5.84 8.43 10.27 Profit margin 4.05% 6.98% 4.87% Return on assets 6,05% 10.53% 13.21% Return on equity 9.93% 16.54% 26.15% Click here for a description of Table: Mini Case: Light Airplane Industry Ratios. Questions 1. Using the financial statements provided for Tuxedo Air, calculate each of the ratios listed in the table for the light aircraft industry. 2. Mark and Jack agree that a ratio analysis can provide a measure of the company's performance. They have chosen Bombardier as an aspirant company. Would you choose Bombardier as an aspirant company? Why or why not? There are other aircraft manufacturers Tuxedo Air could use as aspirant companies. Discuss whether it is appropriate to use any of the following companies: Boeing, XOJET, Piper Aircraft, and AeroCentury. 3. Compare the performance of Tuxedo Air to the industry. For each ratio, comment on why it might be viewed as positive or negative relative to the industry. Suppose you create an inventory ratio calculated as inventory divided by current liabilities. How do you think Tuxedo Air would compare to the industry average

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts