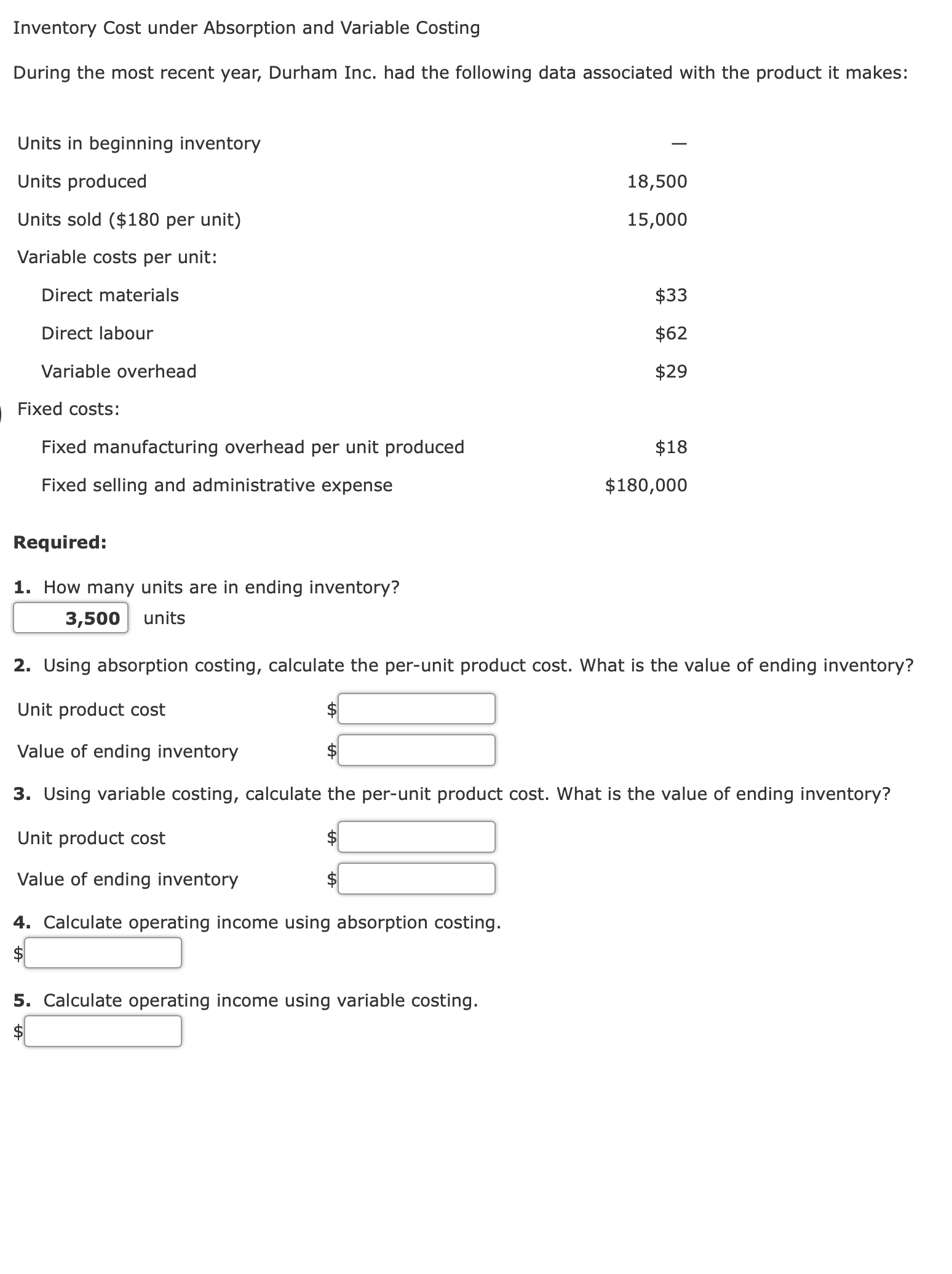

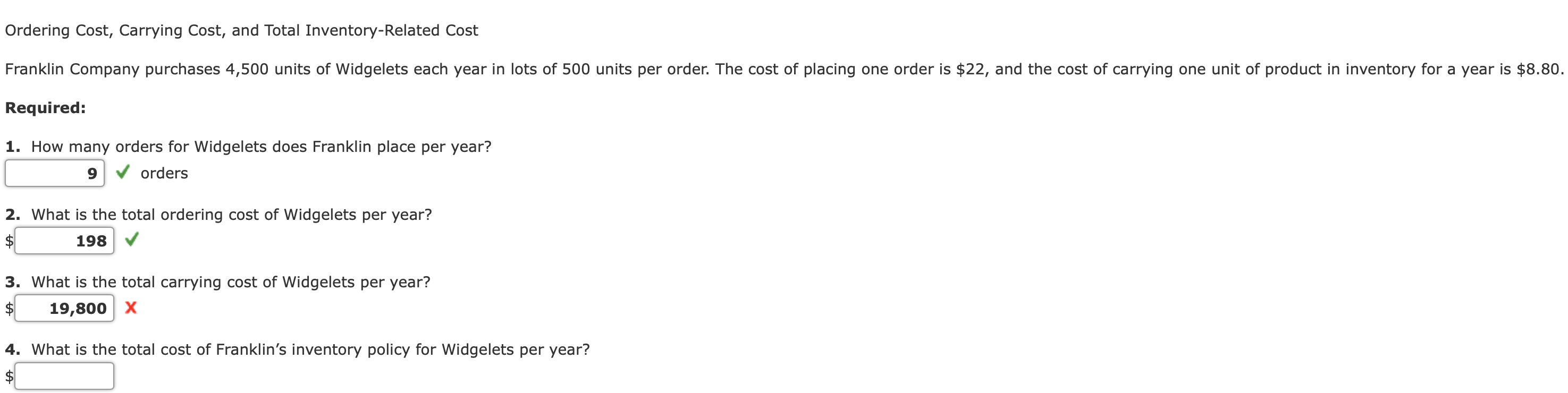

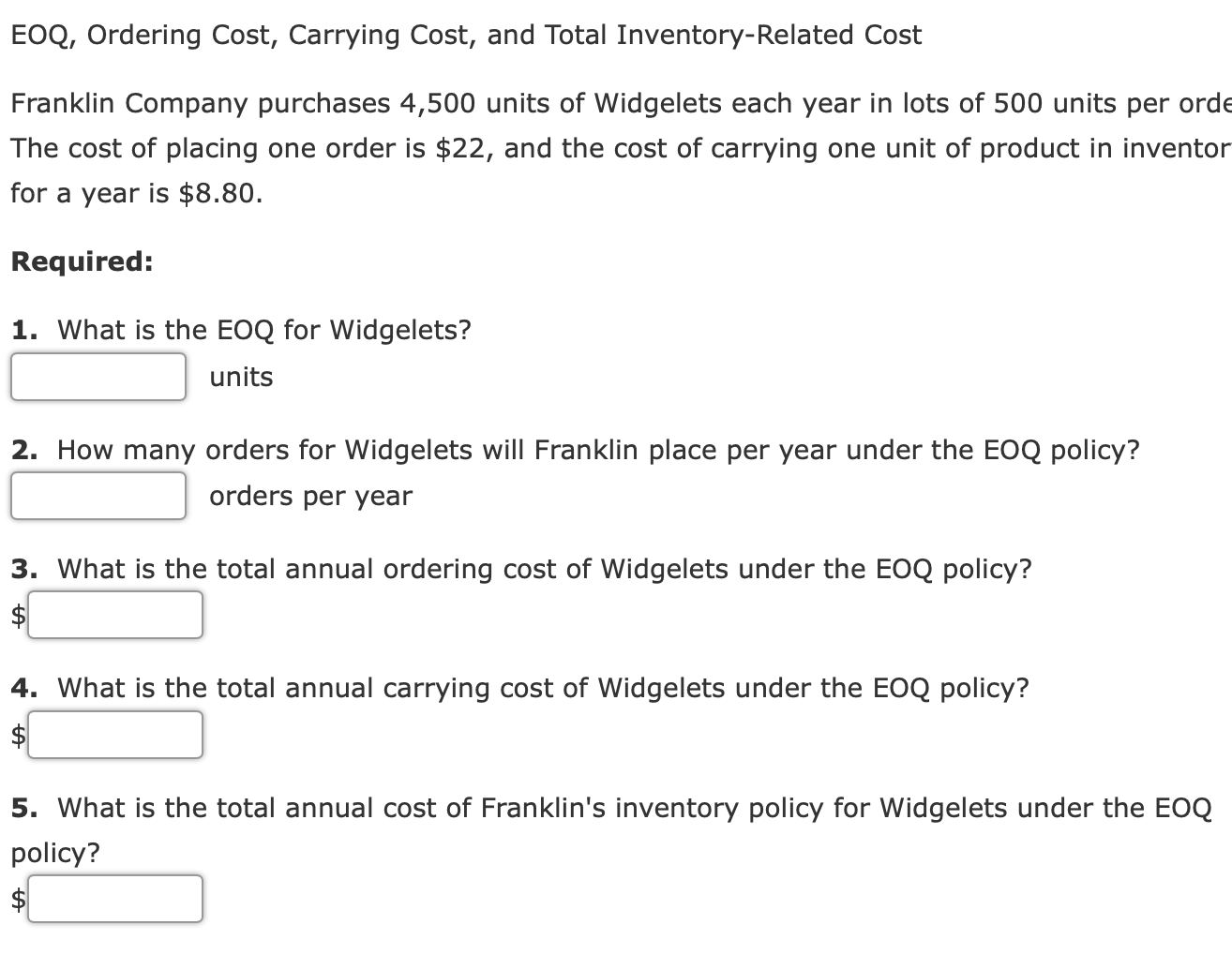

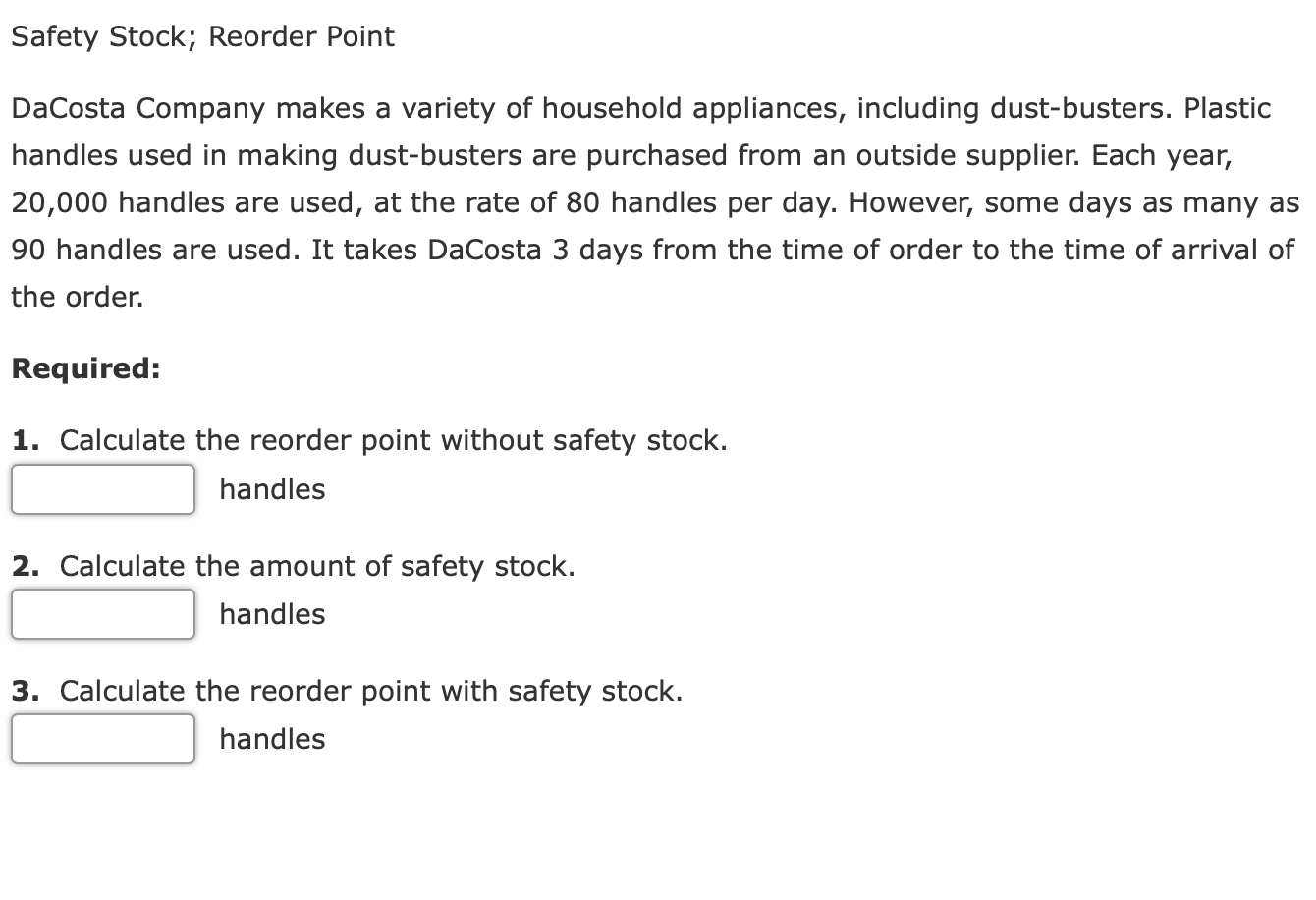

Inventory Cost under Absorption and Variable Costing During the most recent year, Durham Inc. had the following data associated with the product it makes: Units in beginning inventory Units produced 18,500 Units sold ($180 per unit) 15,000 Variable costs per unit: Direct materials $33 Direct labour $62 Variable overhead $29 | Fixed costs: Fixed manufacturing overhead per unit produced $18 Fixed selling and administrative expense $180,000 Required: 1. How many units are in ending inventory? 2. Using absorption costing, calculate the per-unit product cost. What is the value of ending inventory? Unit product cost $:] Value of ending inventory $:] 3. Using variable costing, calculate the per-unit product cost. What is the value of ending inventory? Unit product cost $:] Value of ending inventory $[:] 4. Calculate operating income using absorption costing. $:] 5. Calculate operating income using variable costing. $l:] Ordering Cost, Carrying Cost, and Total InventoryRelated Cost Franklin Company purchases 4,500 units of Widgelets each year in lots of 500 units per order. The cost of placing one order is $22, and the cost of carrying one unit of product in inventory for a year is $8.80. Required: 1. How many orders for Widgelets does Franklin place per year? E v 2. What is the total ordering cost of Widgelets per year? 3. What is the total carrying cost of Widgelets per year? $ 19,800 x 4. What is the total cost of Franklin's inventory policy for Widgelets per year? $[:J EOQ, Ordering Cost, Carrying Cost, and Total Inventory-Related Cost Franklin Company purchases 4,500 units of Widgelets each year in lots of 500 units per orde The cost of placing one order is $22, and the cost of carrying one unit of product in inventor for a year is $8.80. Required: 1. What is the EOQ for Widgelets? units 2. How many orders for Widgelets will Franklin place per year under the EOQ policy? orders per year 3. What is the total annual ordering cost of Widgelets under the EOQ policy? 4. What is the total annual carrying cost of Widgelets under the EOQ policy? 5. What is the total annual cost of Franklin's inventory policy for Widgelets under the EOQ policy? tASafety Stock; Reorder Point DaCosta Company makes a variety of household appliances, including dust-busters. Plastic handles used in making dust-busters are purchased from an outside supplier. Each year, 20,000 handles are used, at the rate of 80 handles per day. However, some days as many as 90 handles are used. It takes DaCosta 3 days from the time of order to the time of arrival of the order. Required: 1. Calculate the reorder point without safety stock. handles U 2. Calculate the amount of safety stock. handles U 3. Calculate the reorder point with safety stock. U handles