Answered step by step

Verified Expert Solution

Question

1 Approved Answer

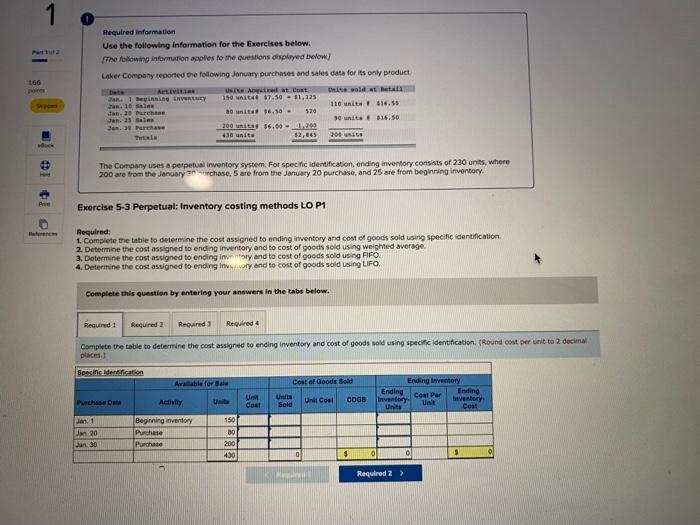

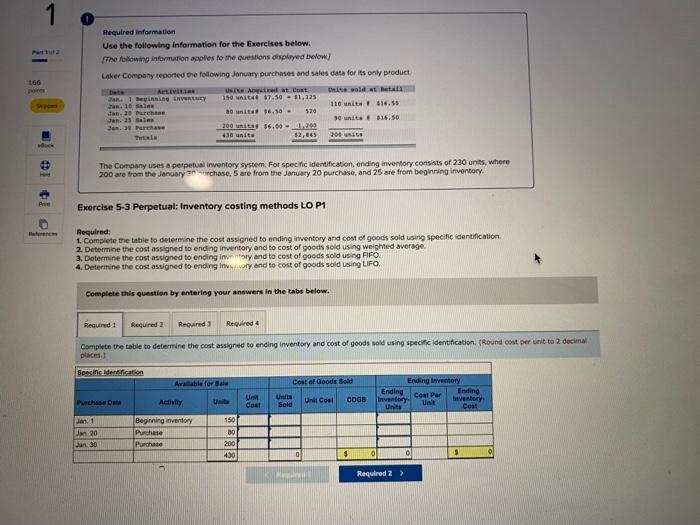

inventory costing methods perpetual 1 166 Required information Use the following information for the Exercises below. The following information applies to the questions played below)

inventory costing methods perpetual

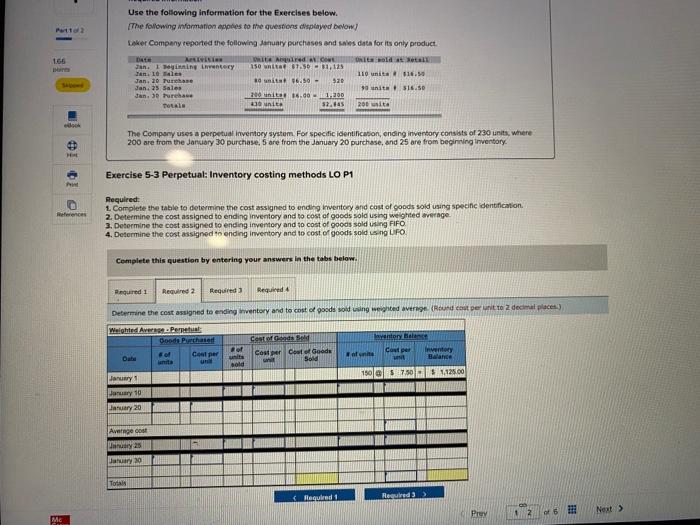

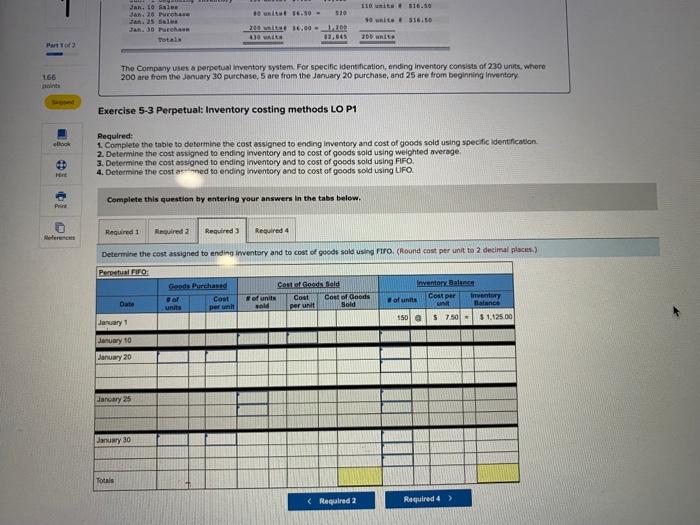

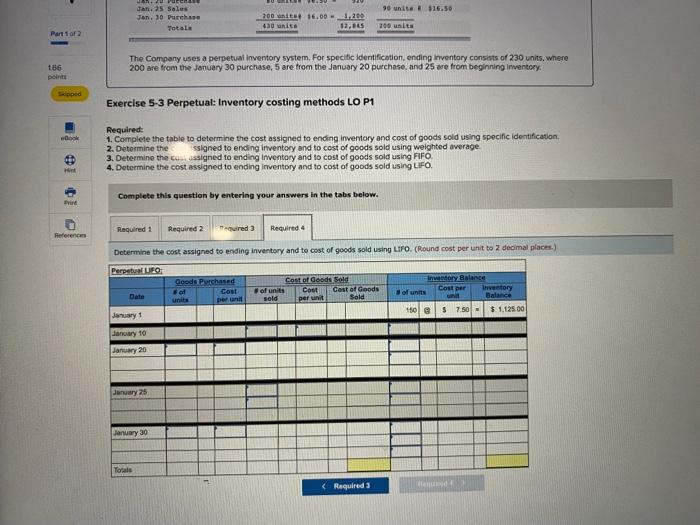

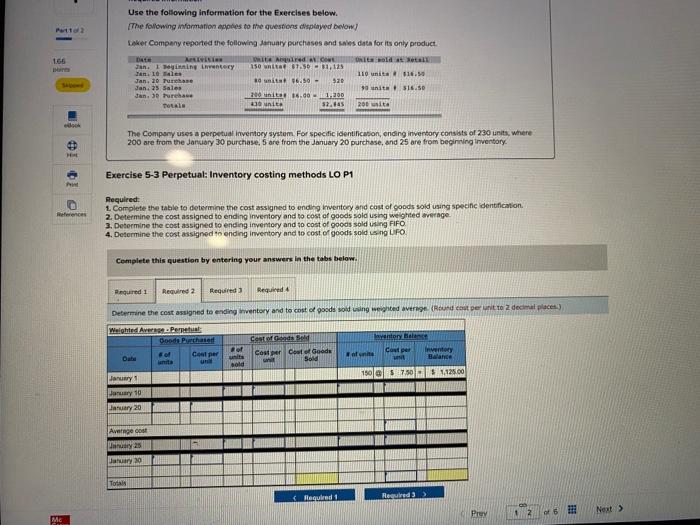

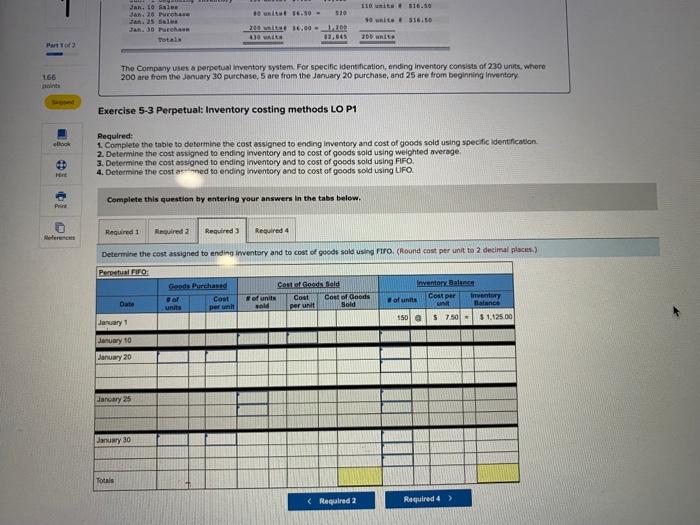

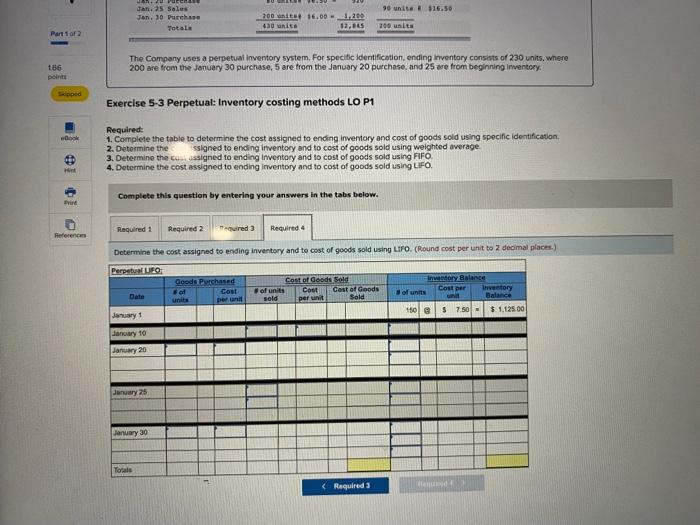

1 166 Required information Use the following information for the Exercises below. The following information applies to the questions played below) Liker Company reported the following January purchases and sales data for its only product bate ALLVILA USIRE A at Cont Diet 1 Dining instry 150 wit 67.50 - $1,125 n. 10 Belas 116 units 16.15 Jan, 20 Marehe 80 nits 36.50 520 Jan 25 Sales Sunita . $16.50 Ben 3 200 unit 36.00 - 430 unita $2,845 200 The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 230 units, where 200 are from the January 20chase, 5 are from the January 20 purchase, and 25 are from beginning inventory Pne Exercise 5-3 Perpetual: Inventory costing methods LO P1 Required: 1. Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification 2. Determine the cost assigned to ending inventory and to cost of goods sold using weighted average 3. Determine the cost assigned to ending intory and to cost of goods sold using FIFO. 4. Determine the cost assigned to ending invory and to cost of goods sold Using LIFO. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required Required Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification (Round cost per unit to 2 decimal places) Specific identification Able for Sale Coat of Goods Sold Ending kwentory Ending Unh Ending Units Peche Date Coal Per Unit Coel Sold Cost COGS Inventory eventory Unit Unit Coal on 1 Beginning inventory 150 Jan 20 Purchase 80 Jan 30 Purchase 200 430 AY Required 2 > Pro 1.66 Use the following information for the Exercises below. The following information appes to the questions displayed below) Loker Company reported the following January purchases and sales data for its only product DATE AVEC ORIE A.com Dista Jan. Den entory 150 wita 6.50 1.125 Tan. 10 Tales 110 units 01. Jan. 20 Purchase nitat 96.50 - 520 Jan. 25 Sales * unita. 316.50 Jan. 30 Purchase 200 unitat 14.000 Totale unite 2.145 20 site The Company uses a perpetuat inventory system. For specific identification, ending inventory consists of 230 units, where 200 are from the January 30 purchase, 5 are from the January 20 purchase, and 25 are from beginning inventory Exercise 5-3 Perpetual: Inventory costing methods LO P1 References Required: 1. Complete the table to determine the cost assigned to ending kwentory and cost of goods sold using specific dentification 2. Determine the cost assigned to ending Inventory and to cost of goods sold using weighted average 3. Determine the cost assigned to ending inventory and to cost of goods sold using FIFO 4. Determine the cost assigned to ending inventory and to cost of goods sold using UFO Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required) Required 4 Determine the cost assigned to ending inventory and to cost of goods so sing weighted average (Hound cost per unit to 2 decimal places) Weighted Aver Perpetual Donde Purchase Cost de Sold levantalet of Cooper Cost per cost of Goods Couper an Sold Wanita Balance sold January 150 $ 7.50-12.00 tory January 10 January 20 Avenge cost 25 Juary Total Prey 12 6 Next > ME at 8.30 - 510 Jan. 10 Sales Jan. 24 Purchase Jan 25 Sales Jan. 30 Parehas Totais 110 unite 516.50 it. 556.50 200 16.09 - DR wit 42,845 0 ite Part of The Company uses a perpetual inventory system. For specific identification, ending Inventory consists of 230 units, where 200 are from the January 30 purchase, 5 are from the January 20 purchase, and 25 are from beginning Inventory 166 non Exercise 5-3 Perpetual: Inventory costing methods LO P1 Required: 1. Complete the table to determine the cost assigned to ending Inventory and cost of goods sold using specific identification 2. Determine the cost assigned to ending inventory and to cost of goods sold using weighted average 3. Determine the cost assigned to ending inventory and to cost of goods sold using FIFO. 4. Determine the cost and to ending inventory and to cost of goods sold using UFO PERE Complete this question by entering your answers in the tabs below. Pin Required 1 quired 2 Required 3 Required 4 Determine the cost assigned to ending inventory and to cost of goods sold using FIFO (Round cost per unit to 2 decimal places) Perpetual FIFO Gends Purchased of Cont units per unit Cortet. Goods Sald of units Cost Cost of Goods old per unit Sold Date Inventory Balunga of units Cost per Inventory Balance 150 $ 750 $ 1.125.00 January 1 January 10 January 20 January 25 January 30 Total 90 units $16.50 Jan. 25 Sales Jan. 30 Purchase Totala 200 unite 16.00 -1,200 430 units 12.05 200 units Part 1 of 2 The Company uses a perpetual inventory system. For specific Identification, ending Inventory consists of 230 units, where 200 are from the January 30 purchase, 5 are from the January 20 purchase and 25 are from beginning inventory 166 point oped Exercise 5-3 Perpetual: Inventory costing methods LO P1 Required: 1. Complete the table to determine the cost assigned to ending Inventory and cost of goods sold using specific identification 2. Determine the signed to ending inventory and to cost of goods sold using weighted average 3. Determine the coussigned to ending Inventory and to cost of goods sold using FIFO. 4. Determine the cost assigned to ending Inventory and to cost of goods sold using LIFO Hint Complete this question by entering your answers in the tabs below. Print Required 1 Required 2 mesured 3 Required 4 Reference Determine the cost assigned to ending inventory and to cost of goods sold using LIFO. (Round cost per unit to 2 decimal places) Perpetual UFO Goods Purchased Cost of Goods Sold nemory Balance Date of Cost of units Cost Cost of Goods Cost per Inventory of units unit sold per un Sold per unit Balance January 1 150 $ 7.50 $ 1.125.00 January 10 January 20 January 25 January 30 Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started