Answered step by step

Verified Expert Solution

Question

1 Approved Answer

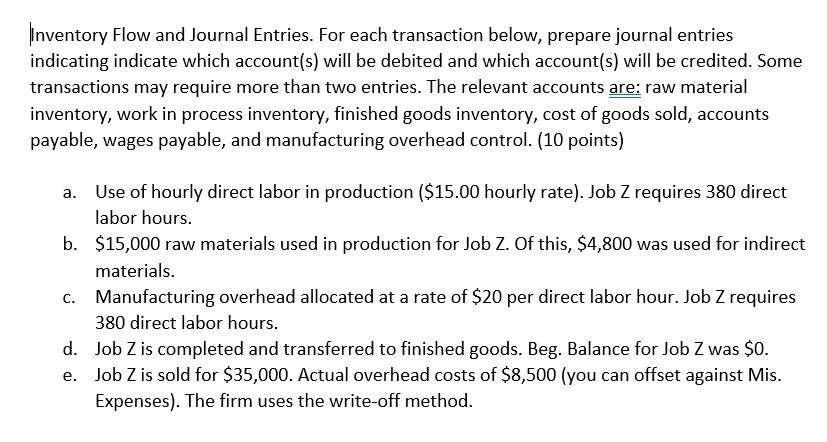

Inventory Flow and Journal Entries. For each transaction below, prepare journal entries indicating indicate which account(s) will be debited and which account(s) will be

Inventory Flow and Journal Entries. For each transaction below, prepare journal entries indicating indicate which account(s) will be debited and which account(s) will be credited. Some transactions may require more than two entries. The relevant accounts are: raw material inventory, work in process inventory, finished goods inventory, cost of goods sold, accounts payable, wages payable, and manufacturing overhead control. (10 points) Use of hourly direct labor in production ($15.00 hourly rate). Job Z requires 380 direct labor hours. b. $15,000 raw materials used in production for Job Z. Of this, $4,800 was used for indirect materials. c. Manufacturing overhead allocated at a rate of $20 per direct labor hour. Job Z requires 380 direct labor hours. d. Job Z is completed and transferred to finished goods. Beg. Balance for Job Z was $0. e. Job Z is sold for $35,000. Actual overhead costs of $8,500 (you can offset against Mis. Expenses). The firm uses the write-off method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

You can se...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started