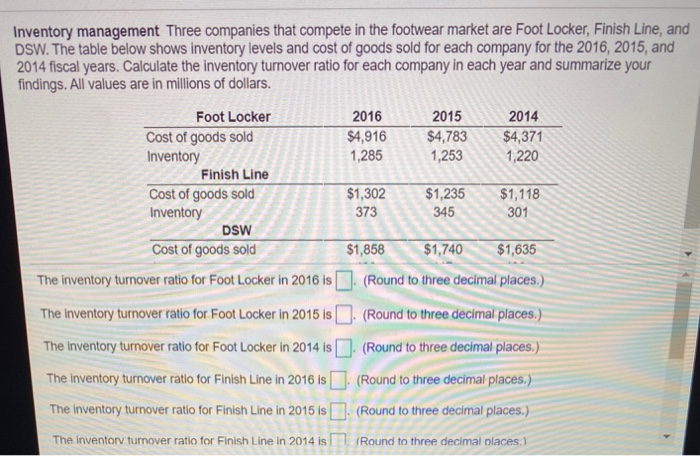

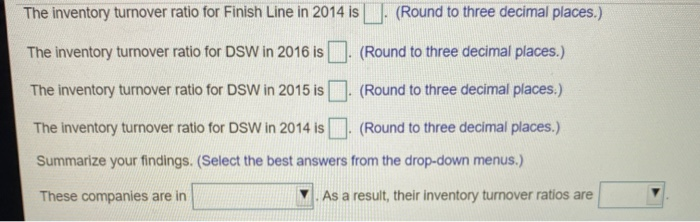

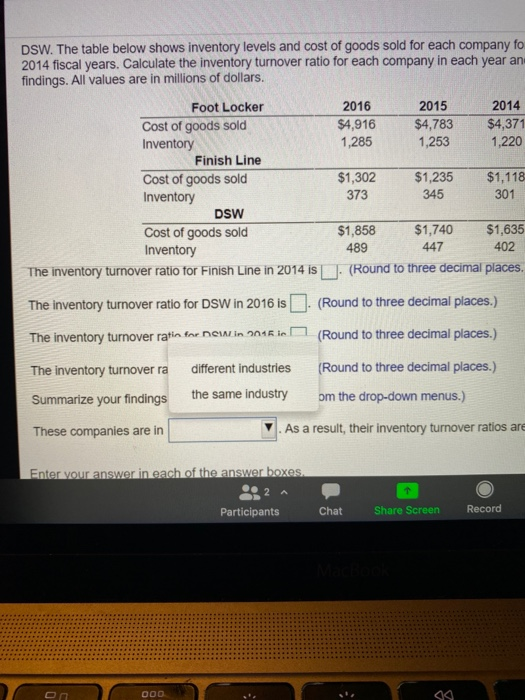

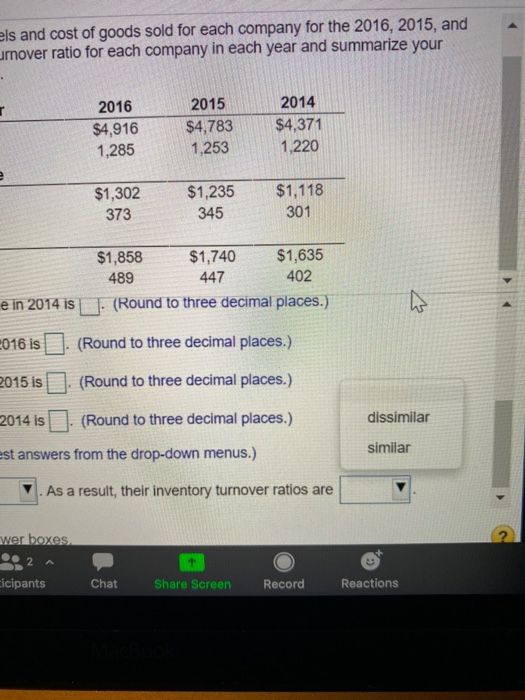

Inventory management Three companies that compete in the footwear market are Foot Locker, Finish Line, and DSW. The table below shows inventory levels and cost of goods sold for each company for the 2016, 2015, and 2014 fiscal years. Calculate the inventory turnover ratio for each company in each year and summarize your findings. All values are in millions of dollars. Foot Locker 2016 2015 2014 Cost of goods sold $4,916 $4,783 $4,371 Inventory 1,285 1,253 1,220 Finish Line Cost of goods sold $1,302 $1,235 $1,118 Inventory 373 345 301 DSW Cost of goods sold $1,858 $1,740 $1,635 The inventory turnover ratio for Foot Locker in 2016 is (Round to three decimal places.) The inventory turnover ratio for Foot Locker in 2015 is (Round to three decimal places.) The inventory turnover ratio for Foot Locker in 2014 is. (Round to three decimal places.) The inventory turnover ratio for Finish Line in 2016 is (Round to three decimal places.) The inventory turnover ratio for Finish Line in 2015 is . (Round to three decimal places.) The inventorv turnover ratio for Finish Line in 2014 is I. (Round to three decimal places.) The inventory turnover ratio for Finish Line in 2014 is. (Round to three decimal places.) The inventory turnover ratio for DSW in 2016 is 1. (Round to three decimal places.) The inventory turnover ratio for DSW in 2015 is 1. (Round to three decimal places.) The inventory turnover ratio for DSW in 2014 is . (Round to three decimal places.) Summarize your findings. (Select the best answers from the drop-down menus.) These companies are in As a result, their inventory turnover ratios are DSW. The table below shows inventory levels and cost of goods sold for each company fo 2014 fiscal years. Calculate the inventory turnover ratio for each company in each year an findings. All values are in millions of dollars. Foot Locker 2016 2015 2014 Cost of goods sold $4,916 $4,783 $4,371 Inventory 1,285 1,253 1,220 Finish Line Cost of goods sold $1,302 $1,235 $1,118 Inventory 373 345 301 DSW Cost of goods sold 858 $1,740 $1,635 Inventory 489 447 402 The inventory turnover ratio for Finish Line in 2014 is 1. (Round to three decimal places, The inventory turnover ratio for DSW in 2016 is I. (Round to three decimal places.) The inventory turnover ratin for DEM.in 15 in (Round to three decimal places.) The inventory turnover ra different industries (Round to three decimal places.) Summarize your findings the same industry om the drop-down menus.) These companies are in 1. As a result, their inventory turnover ratios are Enter your answer in each of the answer boxes 2 T Participants Chat Share Screen Record 000 els and cost of goods sold for each company for the 2016, 2015, and urnover ratio for each company in each year and summarize your 2016 $4,916 1,285 2015 $4,783 1,253 2014 $4,371 1,220 $1,302 373 $1,235 345 $1,118 301 $1,858 $1,740 $1,635 489 447 402 e in 2014 is - (Round to three decimal places.) hs 016 is (Round to three decimal places.) 2015 is (Round to three decimal places.) 2014 is. (Round to three decimal places.) dissimilar est answers from the drop-down menus.) similar As a result, their inventory turnover ratios are wer boxes. cicipants Chat Share Screen Record Reactions