Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Inventory valuation Dave Ltd. had a beginning inventory for May comprising 600 units that had a cost of $30 per unit. A summary of

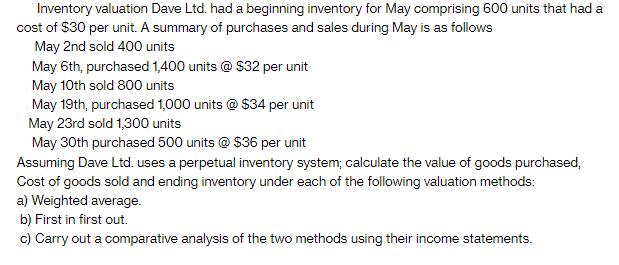

Inventory valuation Dave Ltd. had a beginning inventory for May comprising 600 units that had a cost of $30 per unit. A summary of purchases and sales during May is as follows May 2nd sold 400 units May 6th, purchased 1,400 units @ $32 per unit May 10th sold 800 units May 19th, purchased 1,000 units @ $34 per unit May 23rd sold 1,300 units May 30th purchased 500 units @ $36 per unit Assuming Dave Ltd. uses a perpetual inventory system; calculate the value of goods purchased, Cost of goods sold and ending inventory under each of the following valuation methods: a) Weighted average. b) First in first out. c) Carry out a comparative analysis of the two methods using their income statements.

Step by Step Solution

★★★★★

3.35 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the value of goods purchased cost of goods sold and ending inventory under the weighted average and firstin firstout FIFO valuation methods we need to determine the cost of each unit sold ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started