Answered step by step

Verified Expert Solution

Question

1 Approved Answer

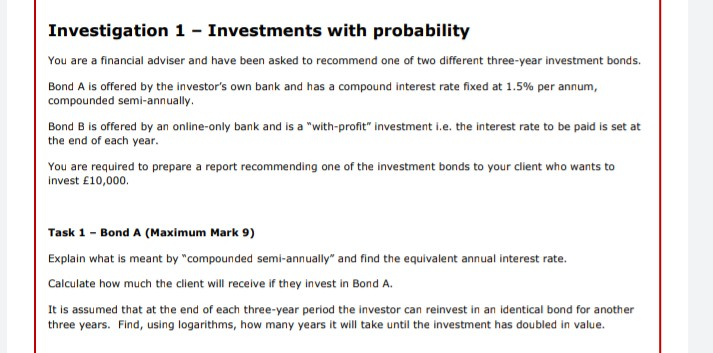

Investigation 1 - Investments with probability You are a financial adviser and have been asked to recommend one of two different three-year investment bonds. Bond

Investigation 1 - Investments with probability You are a financial adviser and have been asked to recommend one of two different three-year investment bonds. Bond A is offered by the investor's own bank and has a compound interest rate fixed at 1.5% per annum, compounded semi-annually. Bond B is offered by an online-only bank and is a "with-profit" investment i.e. the interest rate to be paid is set at the end of each year. You are required to prepare a report recommending one of the investment bonds to your client who wants to invest 10,000 Task 1 - Bond A (Maximum Mark 9) Explain what is meant by "compounded semi-annually" and find the equivalent annual interest rate. Calculate how much the client will receive if they invest in Bond A. It is assumed that at the end of each three-year period the investor can reinvest in an identical bond for another three years. Find, using logarithms, how many years it will take until the investment has doubled in value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started