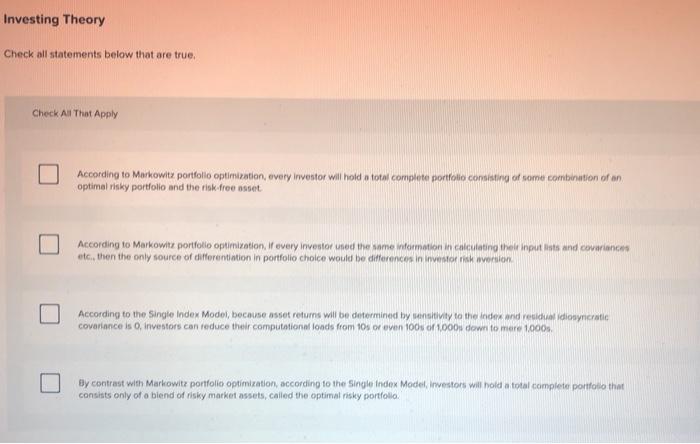

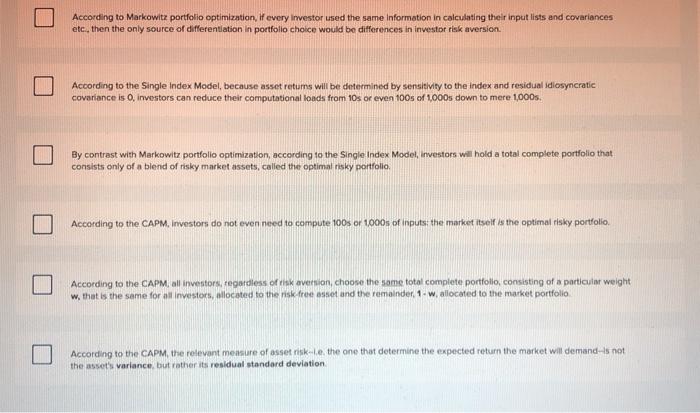

Investing Theory Check all statements below that are true, Check All That Apply According to Markowitz portfolio optimization, every investor will hold a total complete portfolio consisting of some combination of an optimalnky portfolio and the risk tros esset According to Markowitz portfolio optimization, if every investor used the same information in calculating the input lists and covariances etc, then the only source of differentiation in portfolio cholce would be differences in investor risk wertion According to the Single Index Model, because asset returns will be determined by entity to the oder and residuw dosyncratic coverience is o investors can reduce their computational loads from 10s or even 1001 1000 down to mere 1000 By contrast with Markowitz portfolio optimization, according to the Single Index Model Investors will hold a total complete portfolio that consists only of a blend of risky market assets, called the optimal risky portfolio According to Markowitz portfolio optimization, if every investor used the same Information in calculating their input lists and covariances etc., then the only source of differentiation in portfolio choice would be differences in investor risk aversion According to the Single Index Model, because asset returns will be determined by sensitivity to the index and residual idiosyncratic covariance is 0, investors can reduce their computational loads from 10s or even 100s of 1,000s down to mere 1,000s. By contrast with Markowitz portfolio optimization, according to the Single Index Modet, investors will hold a total complete portfolio that consists only of a blend of risky market assets, called the optimal risky portfolio According to the CAPM. Investors do not even need to compute 100s or 1000s of inputs: the market itself is the optimal risky portfolio According to the CAPM all investors, regardless of risk aversion, choose the same total complete portfollo, consisting of a particular weight w, that is the same for an investors, allocated to the risk free asset and the remainder. 1. wallocated to the market portfolio According to the CAPM, the relevant measure of assetrike the one that determine the expected return the market will demands not the asso's variance, but rather its residual standard deviation Investing Theory Check all statements below that are true, Check All That Apply According to Markowitz portfolio optimization, every investor will hold a total complete portfolio consisting of some combination of an optimalnky portfolio and the risk tros esset According to Markowitz portfolio optimization, if every investor used the same information in calculating the input lists and covariances etc, then the only source of differentiation in portfolio cholce would be differences in investor risk wertion According to the Single Index Model, because asset returns will be determined by entity to the oder and residuw dosyncratic coverience is o investors can reduce their computational loads from 10s or even 1001 1000 down to mere 1000 By contrast with Markowitz portfolio optimization, according to the Single Index Model Investors will hold a total complete portfolio that consists only of a blend of risky market assets, called the optimal risky portfolio According to Markowitz portfolio optimization, if every investor used the same Information in calculating their input lists and covariances etc., then the only source of differentiation in portfolio choice would be differences in investor risk aversion According to the Single Index Model, because asset returns will be determined by sensitivity to the index and residual idiosyncratic covariance is 0, investors can reduce their computational loads from 10s or even 100s of 1,000s down to mere 1,000s. By contrast with Markowitz portfolio optimization, according to the Single Index Modet, investors will hold a total complete portfolio that consists only of a blend of risky market assets, called the optimal risky portfolio According to the CAPM. Investors do not even need to compute 100s or 1000s of inputs: the market itself is the optimal risky portfolio According to the CAPM all investors, regardless of risk aversion, choose the same total complete portfollo, consisting of a particular weight w, that is the same for an investors, allocated to the risk free asset and the remainder. 1. wallocated to the market portfolio According to the CAPM, the relevant measure of assetrike the one that determine the expected return the market will demands not the asso's variance, but rather its residual standard deviation