Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Investment? 6. Maria purchased 100 shares of Carter, Inc. stock for $100 per share one year ago. She just received a dividend of $4

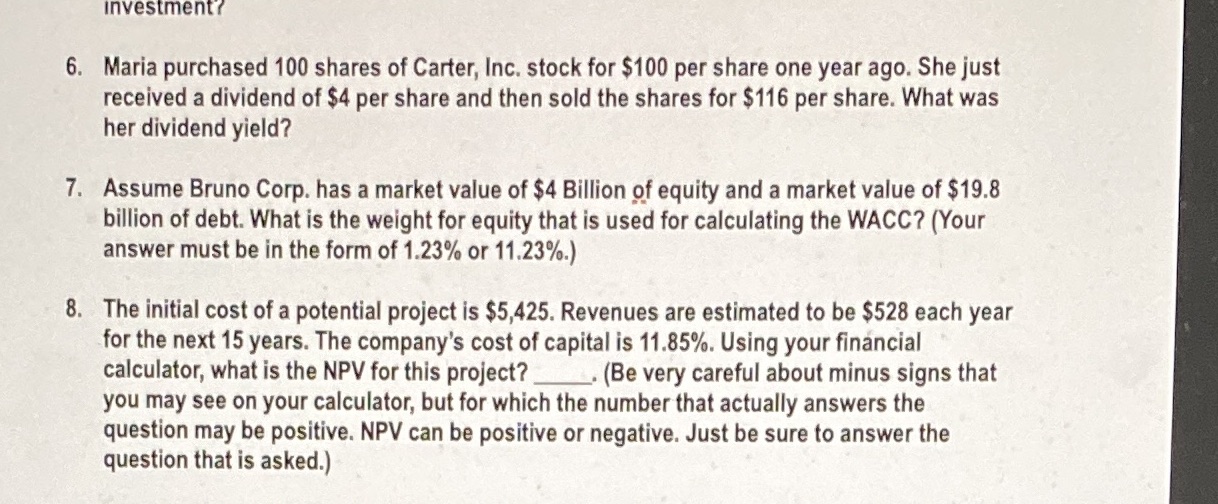

Investment? 6. Maria purchased 100 shares of Carter, Inc. stock for $100 per share one year ago. She just received a dividend of $4 per share and then sold the shares for $116 per share. What was her dividend yield? 7. Assume Bruno Corp. has a market value of $4 Billion of equity and a market value of $19.8 billion of debt. What is the weight for equity that is used for calculating the WACC? (Your answer must be in the form of 1.23% or 11.23%.) 8. The initial cost of a potential project is $5,425. Revenues are estimated to be $528 each year for the next 15 years. The company's cost of capital is 11.85%. Using your financial calculator, what is the NPV for this project? (Be very careful about minus signs that you may see on your calculator, but for which the number that actually answers the question may be positive. NPV can be positive or negative. Just be sure to answer the question that is asked.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure Lets address each of your questions step by step 6 Dividend Yield Calculation Formula for Divid...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started