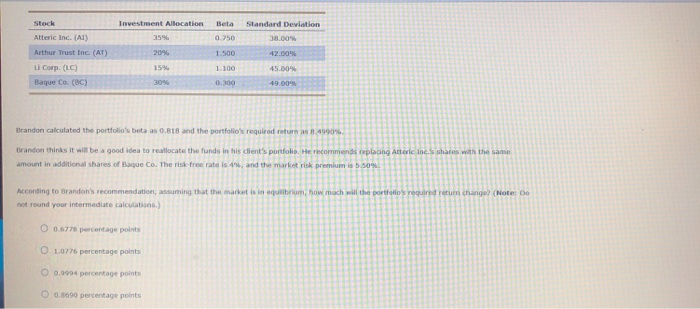

investment Allocation Beta Standard Deviation Aeric Inc. All) Arthur Trust Inc. (AT) 1400 u Cap (LC) Baque Co. (BC) Brandon calculated the portfolio's betaas 0.818 and the portfolio's required return as 84990% Tandon thinks it will be a good idea to reallocate the funds in his client's portfolio. He recommends amount in additional shares of Co, The Free rates and the market rik premium is 5.509 According to Brandon's recommendation, assuming that the market is in equilibrium, how much will not round your intermediate calculati ) O 0.6778 percentage points O 1.0776 percentage points O 0. 4 percentage points O 0.3600 percentage points A stock is in equilibrium if its required return it expected retum. In general, assume that markets and stocks are in equilibrium (or fairly valued), but sometimes investors have different opinions about a stock's prospects and may think that a stock is out of equilibrium (either undervalued or overvalued). Based on the analyst's expected return estimates, stock INOIS stock AIL is in equilibrium, and stock DET is investment Allocation Beta Standard Deviation Aeric Inc. All) Arthur Trust Inc. (AT) 1400 u Cap (LC) Baque Co. (BC) Brandon calculated the portfolio's betaas 0.818 and the portfolio's required return as 84990% Tandon thinks it will be a good idea to reallocate the funds in his client's portfolio. He recommends amount in additional shares of Co, The Free rates and the market rik premium is 5.509 According to Brandon's recommendation, assuming that the market is in equilibrium, how much will not round your intermediate calculati ) O 0.6778 percentage points O 1.0776 percentage points O 0. 4 percentage points O 0.3600 percentage points A stock is in equilibrium if its required return it expected retum. In general, assume that markets and stocks are in equilibrium (or fairly valued), but sometimes investors have different opinions about a stock's prospects and may think that a stock is out of equilibrium (either undervalued or overvalued). Based on the analyst's expected return estimates, stock INOIS stock AIL is in equilibrium, and stock DET is