Answered step by step

Verified Expert Solution

Question

1 Approved Answer

INVESTMENT IN BONDS 1. II. PROBLEMS: On July 1, 2023, AAA Corporation purchased bonds as trading investment with a P2,000,000 face value and a

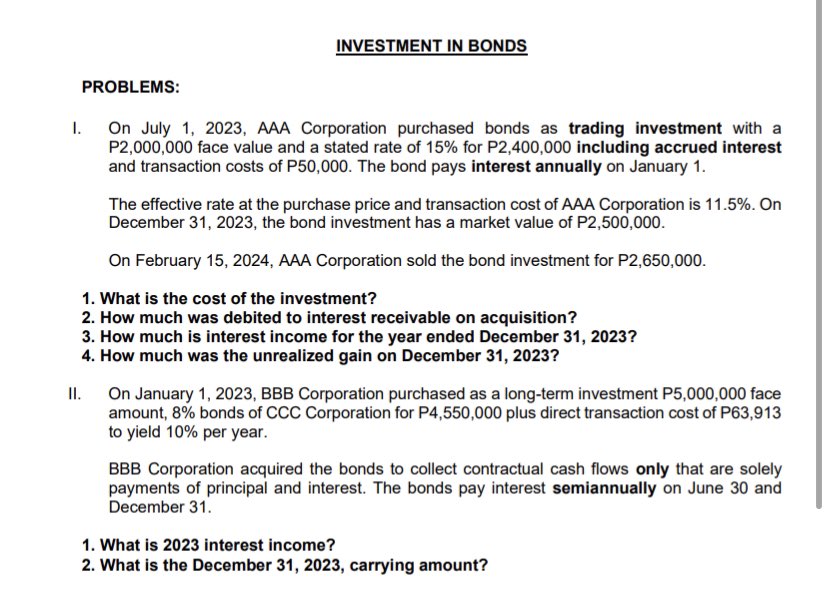

INVESTMENT IN BONDS 1. II. PROBLEMS: On July 1, 2023, AAA Corporation purchased bonds as trading investment with a P2,000,000 face value and a stated rate of 15% for P2,400,000 including accrued interest and transaction costs of P50,000. The bond pays interest annually on January 1. The effective rate at the purchase price and transaction cost of AAA Corporation is 11.5%. On December 31, 2023, the bond investment has a market value of P2,500,000. On February 15, 2024, AAA Corporation sold the bond investment for P2,650,000. 1. What is the cost of the investment? 2. How much was debited to interest receivable on acquisition? 3. How much is interest income for the year ended December 31, 2023? 4. How much was the unrealized gain on December 31, 2023? On January 1, 2023, BBB Corporation purchased as a long-term investment P5,000,000 face amount, 8% bonds of CCC Corporation for P4,550,000 plus direct transaction cost of P63,913 to yield 10% per year. BBB Corporation acquired the bonds to collect contractual cash flows only that are solely payments of principal and interest. The bonds pay interest semiannually on June 30 and December 31. 1. What is 2023 interest income? 2. What is the December 31, 2023, carrying amount?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

An...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started