Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Investment manager Max Gaines has several clients who wish to own a mutual fund portfolio that matches, as a whole, the performance of the

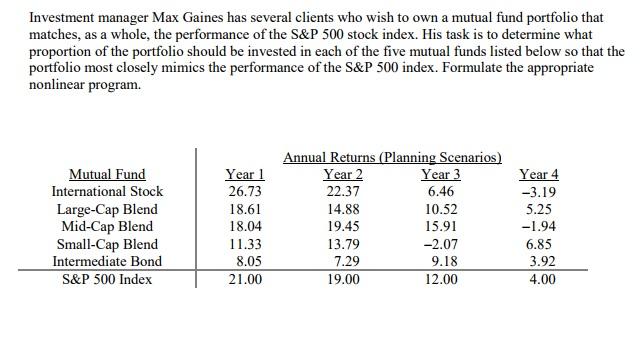

Investment manager Max Gaines has several clients who wish to own a mutual fund portfolio that matches, as a whole, the performance of the S&P 500 stock index. His task is to determine what proportion of the portfolio should be invested in each of the five mutual funds listed below so that the portfolio most closely mimics the performance of the S&P 500 index. Formulate the appropriate nonlinear program. Annual Returns (Planning Scenarios) Mutual Fund International Stock Year 1 Year 2 Year 3 Year 4 26.73 22.37 6.46 -3.19 Large-Cap Blend 18.61 14.88 10.52 5.25 Mid-Cap Blend 18.04 19.45 15.91 -1.94 Small-Cap Blend 11.33 13.79 -2.07 6.85 Intermediate Bond 8.05 7.29 9.18 3.92 S&P 500 Index 21.00 19.00 12.00 4.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solutions Step 1 Let X1 proportion ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started