Question

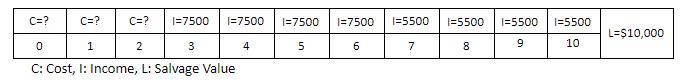

Investment on an asset is expected to yield the following cash flow and the resale (salvage) value will be 10,000 dollars at the end of

Investment on an asset is expected to yield the following cash flow and the resale (salvage) value will be 10,000 dollars at the end of the 10th year. Investment on the asset is evenly split between present time, year 1, and year 2 (investment is equal at present time, year 1, and year 2 in terms of nominal (then-current) dollars). What is the present value of all three costs and the uniform period cost (a single value of C), considering the interest rate of 12% compounded annually? Please explain your work in detail.

C=? C=? C=? |=7500 |=7500 1=7500 I=7500 1=5500 |=5500 1=5500 1=5500 L=$10,000 2 3 4 7 8. 9 10 C: Cost, I: Income, L: Salvage Value 00 6.

Step by Step Solution

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e2ab944796_182018.pdf

180 KBs PDF File

635e2ab944796_182018.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started