Question

Investment Planning/Asset Allocation Development Bill Smith recently inherited $250,000 from the passing of his parents. Bill is 48 years old, recently divorced and makes child

Investment Planning/Asset Allocation Development

Bill Smith recently inherited $250,000 from the passing of his parents. Bill is 48 years old, recently divorced and makes child and spousal support payments to his ex-spouse. His son, Jeremy is 14.

Bill has come to you, his financial planner because he would like to invest this money intelligently so that he ensures that hes maximizing his return. Assume he has no other investments.

Youve asked him to fill in an investment questionnaire, which is attached here to this assignment.

Your task: For your meeting with Bill:

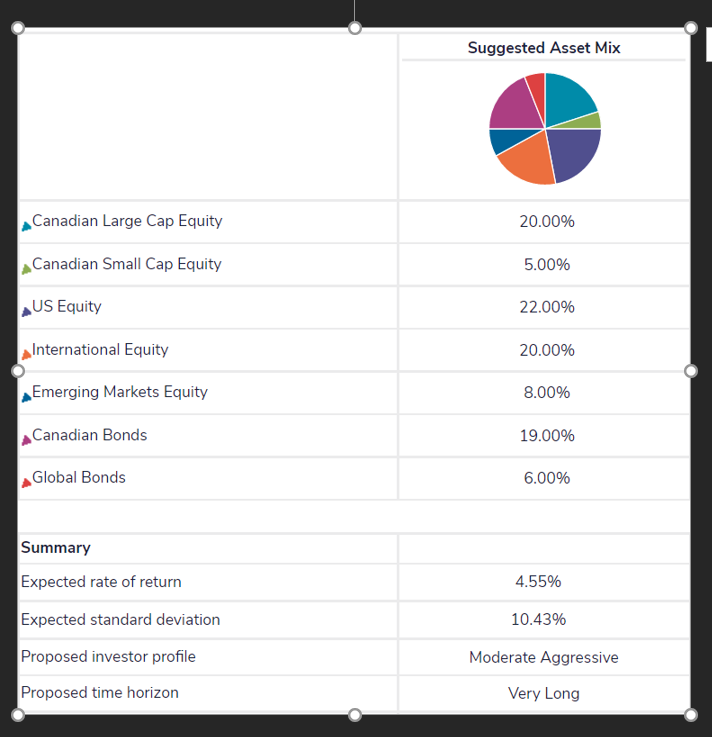

Part 1 (10 Marks): Build an asset allocation model based on Bills answers to the questionnaire. Using the questionnaire and information from the textbook, explain your rationale for recommending and utilizing various asset classes.

Part 2 (10 marks): Using your own research, build an investment portfolio for Bill (i.e. choose the securities youll use that will correspond to the recommended asset allocation).

For each of your security selections, write a paragraph, explaining:

what the investment is or does,

how it fits in within your asset allocation model, and

how or why its suitable for Bill

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started