Investment Planning/Asset Allocation Development

John Harris recently inherited $500,000 from the passing of his parents. John is 48 years old, recently divorced and makes child and spousal support payments to his ex-spouse. His son, Ronald is 13.

John has come to you, his financial planner because he would like to invest this money intelligently so that he ensures that he's maximizing his return. Assume he has no other investments.

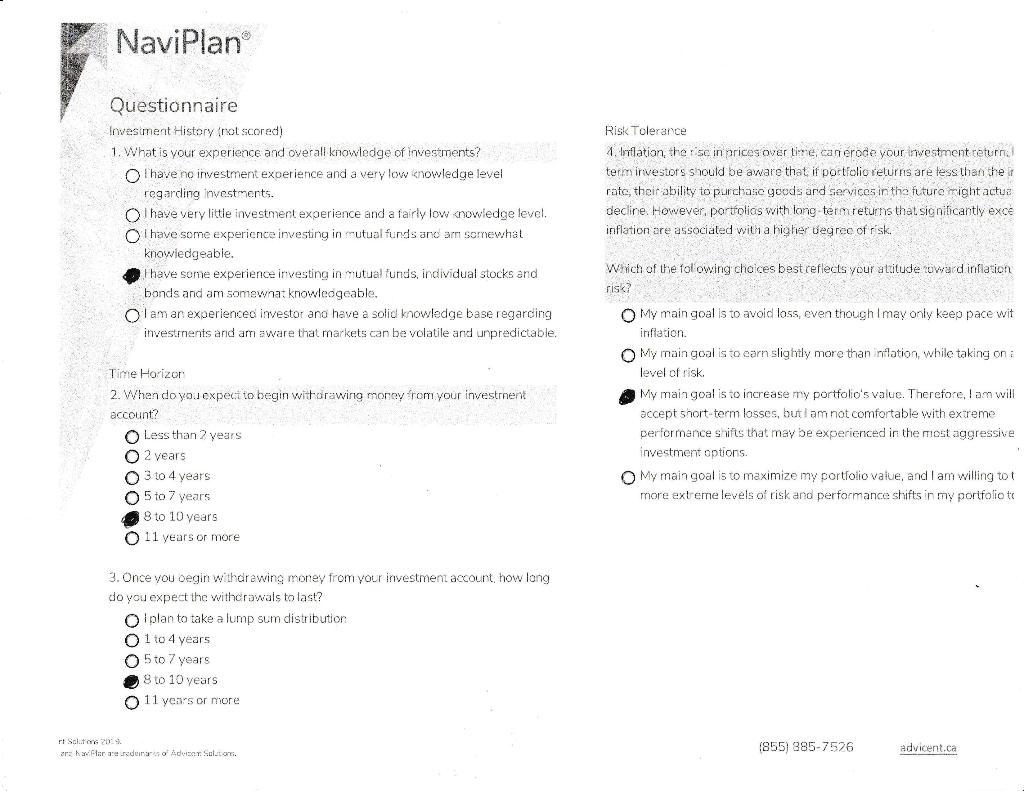

You've asked him to fill in an investment questionnaire, which is attached here to this assignment.

Your task: For your meeting with John:

Part 1 (10 Marks): Help Him Build an asset allocation model based on John's answers to the questionnaire. Using the questionnaire. explain your rationale for recommending and utilizing various asset classes.

Part 2 (10 marks): Help Him build an investment portfolio for John. Using mutual funds and/or exchange traded funds from that company only, choose the securities you'll use that will correspond to the recommended asset allocation.

Note: Any mutual funds you recommend should be the A-series only. Please list the fund code beside the fund (ex. RBF100)

Investments that you may not recommend:

- No individual stock or bonds

- No Asset Allocation funds

- No Fund of Funds strategies

- No Multi-style/strategy funds

- what the investment is or does, who the portfolio manager is, what their style or approach is, etc. For each of your recommended funds/ETFs, a paragraph, explaining:

- how it fits in within your asset allocation model, and

- how or why it's suitable for John

Questionnaire is attached below

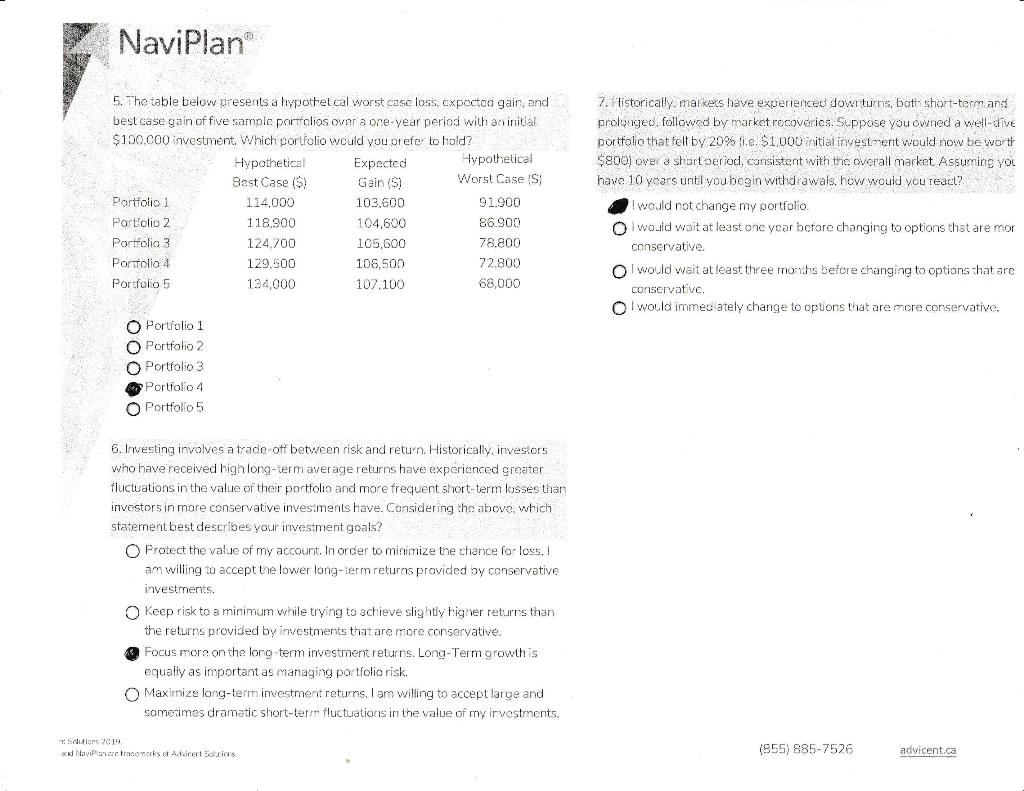

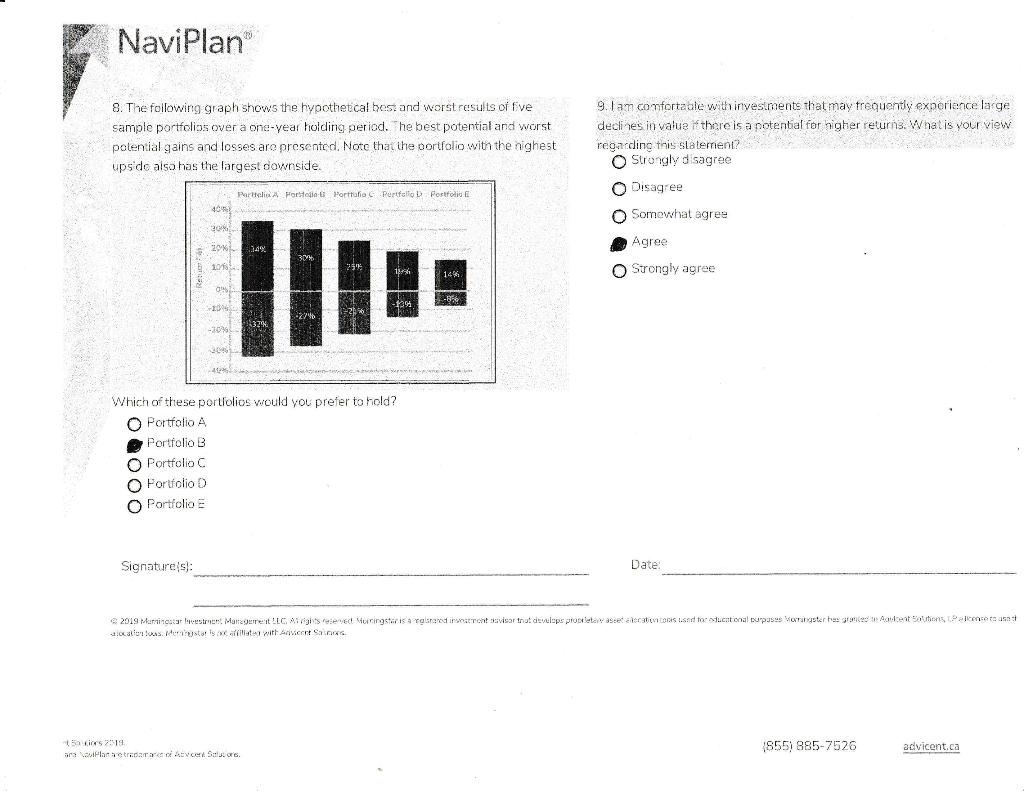

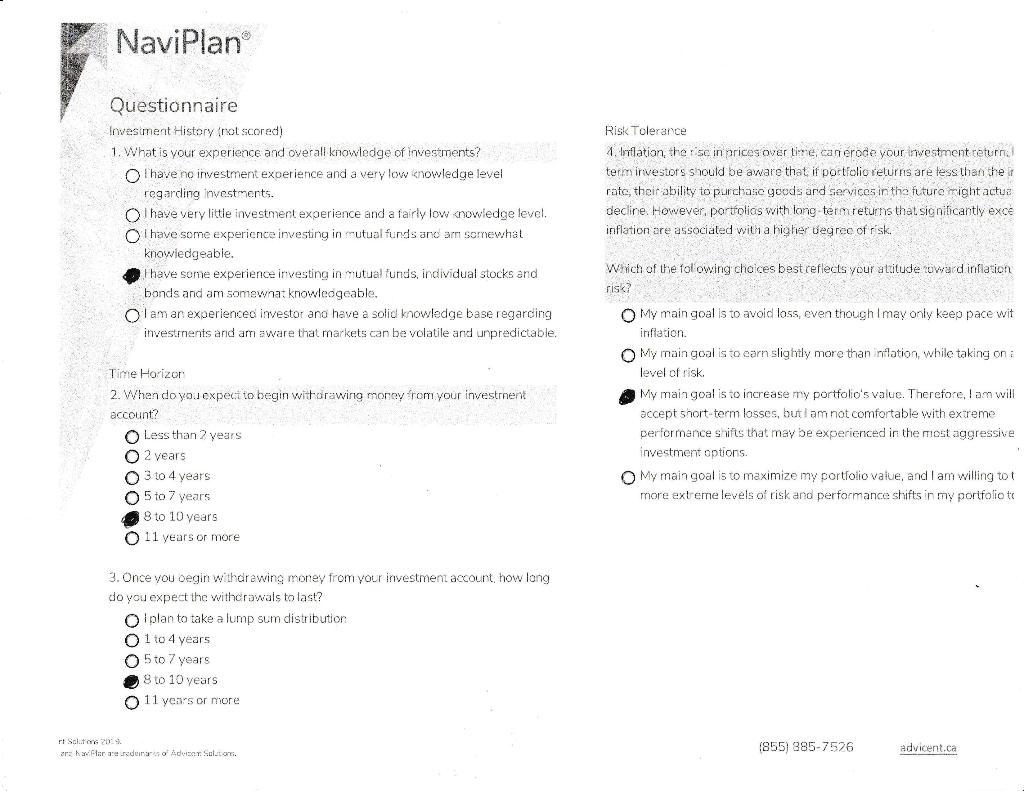

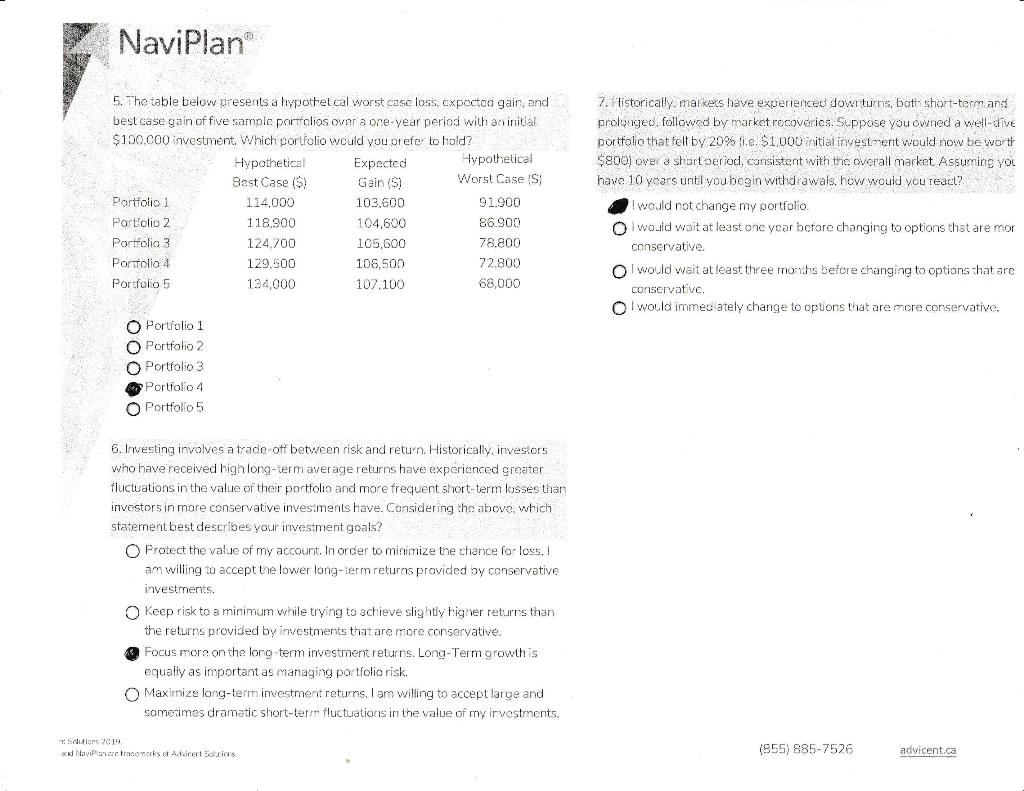

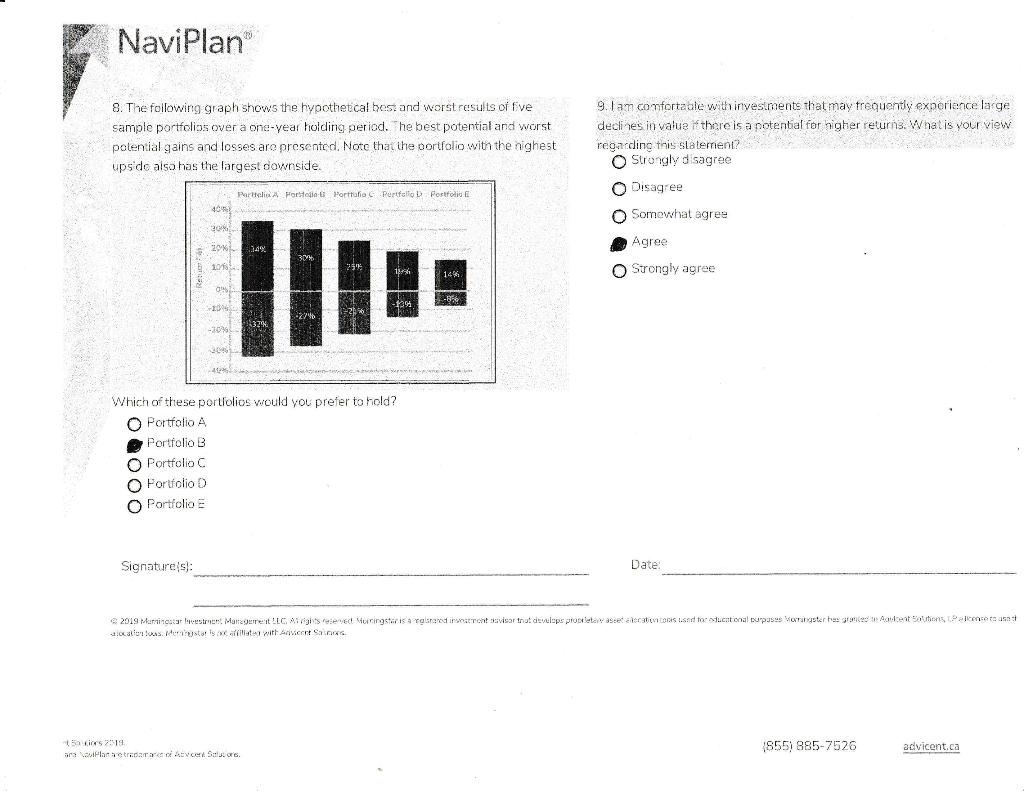

NaviPlan Questionnaire Investment History rot scored) 1. What is your experience and overall knowledge of investments? Risk Tolerance 4. Imation, the risc in prices over time, canerode your investment returns term investors should be aware that if portfolio returns are tess than the rate, their ability to purchase goods and services in the future might actua decline. However, portfolias with long-term returns that significantly exce inflation are associated with a higher degree of risk. Thave no investment experience and a very low knowledge level regarding investments. have very little investment experience and a fairly low knowledge level. OT have some experience investing in rutual funds and a somewhat knowledgeable. Thave some experience investing in mutual funds, individual stocks and bonds and am somewhat knowledgeable. Olaman experienced investor and have a solid knowledge base regarding investments and am aware that markets can be volatile and unpredictable. Which of the folowing choices best reflects your attitude toward inflation Time Horizon 2. When do you expect to begin wittorawing money from your investment account? Less than 2 years O 2 years 3 to 4 years 05 to 7 years 8 to 10 years 11 years or more My main goal is to avoid loss, even though I may only keep pace wit inflation My main goal is to earn slightly more than inflation, while taking on a level of risk My main goal is to increase my portfolio's value. Therefore, I am will accept short-term losses, but I am not comfortable with extreme performance shifts that may be experienced in the most aggressive investment options. My main goal is to maximize my portfolio value, and I am willing tot more extreme levels of risk and performance shifts in my portfolio to 3. Once you oegin withdrawing money from your investment account how long do you expect the withdrawals to last? O plan to take a lump sum distribution 01 to 4 years 05 to 7 years 8 to 10 years 11 years or more rt Solution 2 or har reduino Adecer Salto. (855) 385-7526 advicent.ca 10 NaviPlan 5. The table below presents a hypothet cal worst case loss, expected gain, and best case gain of five samplo portolios over a one-year period with an initial $100.000 nvestment which portfolio would you prefer to hold? Hypothetical Expected Hypothetical Best Case ($) Gain (S! Worst Case (S) Portfolio 1 114,000 103,600 91.900 Portfolio 2 118.900 104,600 86.900 Portfolia 3 124.700 105,600 78.800 Portfolio 4 120 500 106.500 72,800 Portfolio 5 134,000 107.100 68,000 7. Historically, markers have experienced Jowi turns, both short-term and prolougeo, followed by market recoveries. Suppose you owned a well-dive portfolio that fell by 20% .e $1,000 initial investment would now be worth $800) over a short period, consistent with the overall market Assuming you have 10 ycars until you begin withdrawals how would you react? I would not change my portfolio would wait at least one year before changing to options that are mor conservative I would wait at least three months before changing to options that are conservative I would immediately change to options that are more conservative. Portfolio 1 O Portfolio 2 Portfolio 3 Portfolio 4 Portfolio 5 6. Investing involves a trade ott between risk and return. Historically, investors who have received high long-term average returns have experienced greater fluctuations in the value of their portfolio and more frequent short-term losses than investors in more conservative investments have. Considering the above, which statement best describes your investment goals? O Protect the value of my account. In order to minimize the chance for loss, am willing to accept the lower long-term returns provided by conservative investments, Keep risk to a minimum while trying to achieve slightly higher returns than the returns provided by investments that are more conservative. Focus more on the long-term investment returns. Long-Term growth is equally as important as managing portfolio risk. Maximize long-term investment returns. I am willing to accept large and somerimas dramatic short-term fluctuations in the value of my investments. dition 2015 a Navonaretracemarks or Advicerte's (955) 885-7526 advicent.ca NaviPlan Questionnaire Investment History rot scored) 1. What is your experience and overall knowledge of investments? Risk Tolerance 4. Imation, the risc in prices over time, canerode your investment returns term investors should be aware that if portfolio returns are tess than the rate, their ability to purchase goods and services in the future might actua decline. However, portfolias with long-term returns that significantly exce inflation are associated with a higher degree of risk. Thave no investment experience and a very low knowledge level regarding investments. have very little investment experience and a fairly low knowledge level. OT have some experience investing in rutual funds and a somewhat knowledgeable. Thave some experience investing in mutual funds, individual stocks and bonds and am somewhat knowledgeable. Olaman experienced investor and have a solid knowledge base regarding investments and am aware that markets can be volatile and unpredictable. Which of the folowing choices best reflects your attitude toward inflation Time Horizon 2. When do you expect to begin wittorawing money from your investment account? Less than 2 years O 2 years 3 to 4 years 05 to 7 years 8 to 10 years 11 years or more My main goal is to avoid loss, even though I may only keep pace wit inflation My main goal is to earn slightly more than inflation, while taking on a level of risk My main goal is to increase my portfolio's value. Therefore, I am will accept short-term losses, but I am not comfortable with extreme performance shifts that may be experienced in the most aggressive investment options. My main goal is to maximize my portfolio value, and I am willing tot more extreme levels of risk and performance shifts in my portfolio to 3. Once you oegin withdrawing money from your investment account how long do you expect the withdrawals to last? O plan to take a lump sum distribution 01 to 4 years 05 to 7 years 8 to 10 years 11 years or more rt Solution 2 or har reduino Adecer Salto. (855) 385-7526 advicent.ca 10 NaviPlan 5. The table below presents a hypothet cal worst case loss, expected gain, and best case gain of five samplo portolios over a one-year period with an initial $100.000 nvestment which portfolio would you prefer to hold? Hypothetical Expected Hypothetical Best Case ($) Gain (S! Worst Case (S) Portfolio 1 114,000 103,600 91.900 Portfolio 2 118.900 104,600 86.900 Portfolia 3 124.700 105,600 78.800 Portfolio 4 120 500 106.500 72,800 Portfolio 5 134,000 107.100 68,000 7. Historically, markers have experienced Jowi turns, both short-term and prolougeo, followed by market recoveries. Suppose you owned a well-dive portfolio that fell by 20% .e $1,000 initial investment would now be worth $800) over a short period, consistent with the overall market Assuming you have 10 ycars until you begin withdrawals how would you react? I would not change my portfolio would wait at least one year before changing to options that are mor conservative I would wait at least three months before changing to options that are conservative I would immediately change to options that are more conservative. Portfolio 1 O Portfolio 2 Portfolio 3 Portfolio 4 Portfolio 5 6. Investing involves a trade ott between risk and return. Historically, investors who have received high long-term average returns have experienced greater fluctuations in the value of their portfolio and more frequent short-term losses than investors in more conservative investments have. Considering the above, which statement best describes your investment goals? O Protect the value of my account. In order to minimize the chance for loss, am willing to accept the lower long-term returns provided by conservative investments, Keep risk to a minimum while trying to achieve slightly higher returns than the returns provided by investments that are more conservative. Focus more on the long-term investment returns. Long-Term growth is equally as important as managing portfolio risk. Maximize long-term investment returns. I am willing to accept large and somerimas dramatic short-term fluctuations in the value of my investments. dition 2015 a Navonaretracemarks or Advicerte's (955) 885-7526 advicent.ca