Investment Portfolio and Risk diversification. Analyze the situations that arise in each of the problems and calculate the value or values ?? required for each

Investment Portfolio and Risk diversification.

Analyze the situations that arise in each of the problems and calculate the value or values ?? required for each of these.

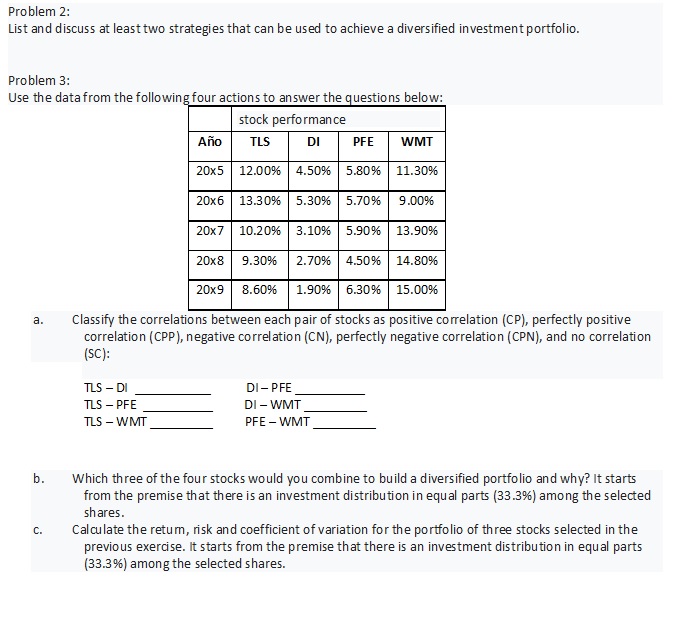

Problem 2: List and discuss at least two strategies that can be used to achieve a diversified investment portfolio. Problem 3: Use the data from the following four actions to answer the questions below: a. b. C. stock performance Ao TLS DI PFE WMT 20x5 12.00% 4.50% 5.80% 11.30% 20x6 13.30% 5.30% 5.70% 9.00% TLS - DI TLS - PFE TLS - WMT 20x7 10.20% 3.10% 5.90% 13.90% 20x8 9.30% 2.70% 4.50% 14.80% 20x9 8.60% 1.90% 6.30% 15.00% Classify the correlations between each pair of stocks as positive correlation (CP), perfectly positive correlation (CPP), negative correlation (CN), perfectly negative correlation (CPN), and no correlation (SC): DI-PFE DI - WMT PFE - WMT Which three of the four stocks would you combine to build a diversified portfolio and why? It starts from the premise that there is an investment distribution in equal parts (33.3%) among the selected shares. Calculate the retum, risk and coefficient of variation for the portfolio of three stocks selected in the previous exercise. It starts from the premise that there is an investment distribution in equal parts (33.3%) among the selected shares.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Problem 2 To achieve a diversified investment portfolio two strategies that can be used are 1 Asset Allocation This strategy involves dividing investm...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started