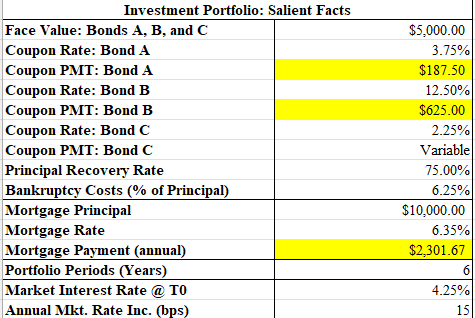

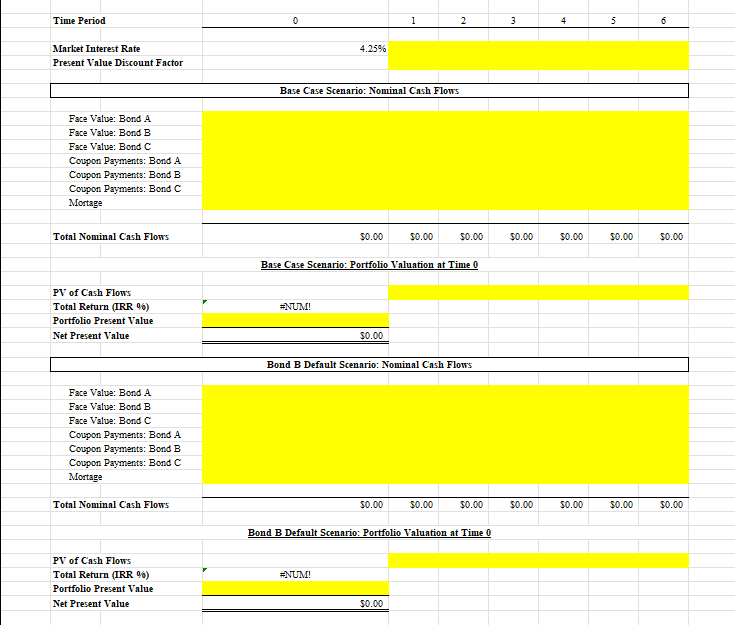

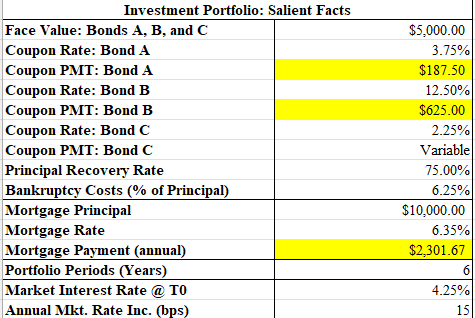

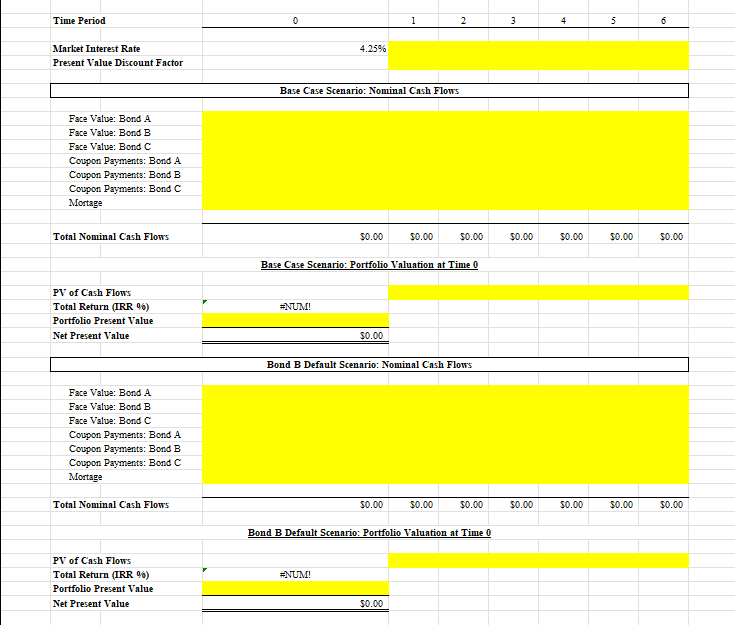

Investment Portfolio: Salient Facts Face Value: Bonds A, B, and C Coupon Rate: Bond A Coupon PMT: Bond A Coupon Rate: Bond B Coupon PMT: Bond B Coupon Rate: Bond C Coupon PMT: Bond C Principal Recovery Rate Bankruptcy Costs (% of Principal) Mortgage Principal Mortgage Rate Mortgage Payment (annual) Portfolio Periods (Years) Market Interest Rate @ TO Annual Mkt. Rate Inc. (bps) $5,000.00 3.75% $187.50 12.50% $625.00 2.25% Variable 75.00% 6.25% $10,000.00 6.35% $2,301.67 6 4.25% 15 Time Period 0 1 2 3 4 5 6 4.25% Marlet Interest Rate Present Value Discount Factor Base Case Scenario: Nominal Cash Flows Face Value: Bond A Face Value: Bond B Face Value: Bond C Coupon Payments: Bond A Coupon Payments: Bond B Coupon Payments: Bond C Mortage Total Nominal Cash Flows $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Base Case Scenario: Portfolio Valuation at Time 0 =NUM! PV of Cash Flows Total Return (IRR 96) Portfolio Present Value Net Present Value $0.00 Bond B Default Scenario: Nominal Cash Flows Face Value: Bond A Face Value: Bond B Face Value: Bond C Coupon Payments: Bond A Coupon Payments: Bond B Coupon Payments: Bond C Mortage Total Nominal Cash Flows $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Bond B Default Scenario: Portfolio Valuation at Time 0 #NUM! PV of Cash Flows Total Return (IRR %6) Portfolio Present Value Net Present Value $0.00 Investment Portfolio: Salient Facts Face Value: Bonds A, B, and C Coupon Rate: Bond A Coupon PMT: Bond A Coupon Rate: Bond B Coupon PMT: Bond B Coupon Rate: Bond C Coupon PMT: Bond C Principal Recovery Rate Bankruptcy Costs (% of Principal) Mortgage Principal Mortgage Rate Mortgage Payment (annual) Portfolio Periods (Years) Market Interest Rate @ TO Annual Mkt. Rate Inc. (bps) $5,000.00 3.75% $187.50 12.50% $625.00 2.25% Variable 75.00% 6.25% $10,000.00 6.35% $2,301.67 6 4.25% 15 Time Period 0 1 2 3 4 5 6 4.25% Marlet Interest Rate Present Value Discount Factor Base Case Scenario: Nominal Cash Flows Face Value: Bond A Face Value: Bond B Face Value: Bond C Coupon Payments: Bond A Coupon Payments: Bond B Coupon Payments: Bond C Mortage Total Nominal Cash Flows $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Base Case Scenario: Portfolio Valuation at Time 0 =NUM! PV of Cash Flows Total Return (IRR 96) Portfolio Present Value Net Present Value $0.00 Bond B Default Scenario: Nominal Cash Flows Face Value: Bond A Face Value: Bond B Face Value: Bond C Coupon Payments: Bond A Coupon Payments: Bond B Coupon Payments: Bond C Mortage Total Nominal Cash Flows $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Bond B Default Scenario: Portfolio Valuation at Time 0 #NUM! PV of Cash Flows Total Return (IRR %6) Portfolio Present Value Net Present Value $0.00