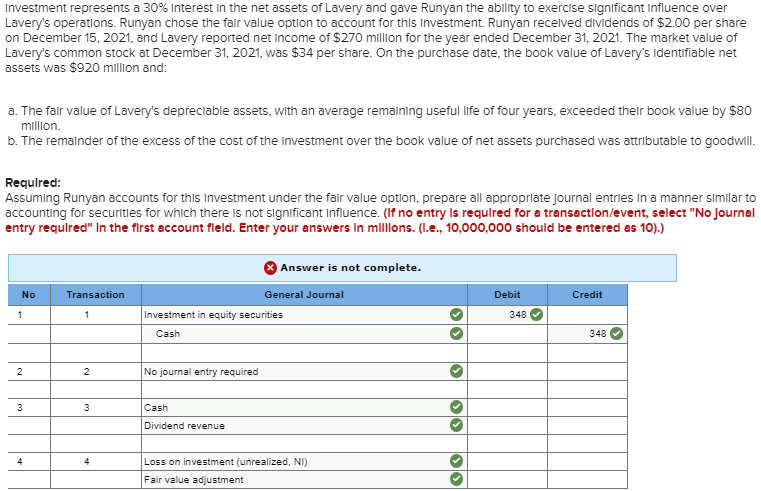

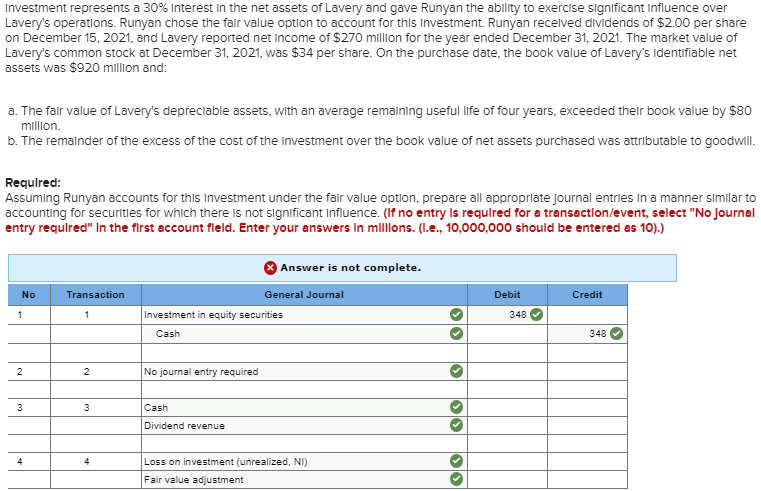

Investment represents a 30% Interest in the net assets of Lavery and gave Runyan the ability to exercise significant Influence over Lavery's operations. Runyan chose the fair value option to account for this Investment. Runyan received dividends of $2.00 per share on December 15, 2021, and Lavery reported net Income of $270 million for the year ended December 31, 2021. The market value of Lavery's common stock at December 31, 2021, was $34 per share. On the purchase date, the book value of Lavery's Identifiable net assets was $920 million and: a. The fair value of Lavery's depreciable assets, with an average remaining useful life of four years, exceeded their book value by $80 million. b. The remainder of the excess of the cost of the Investment over the book value of net assets purchased was attributable to goodwill. Required: Assuming Runyan accounts for this Investment under the fair value option, prepare all appropriate Journal entries in a manner similar to accounting for securities for which there is not significant Influence. (If no entry is required for a transaction/event, select "No Journal entry required" In the first account field. Enter your answers in millions. (I.e., 10,000,000 should be entered as 10).) > Answer is not complete. No Transaction General Journal Credit Debit 348 Investment in equity securities Cash 348 No journal entry required Cash Dividend revenue Loss on investment (unrealized, NI) Fair value adjustment Investment represents a 30% Interest in the net assets of Lavery and gave Runyan the ability to exercise significant Influence over Lavery's operations. Runyan chose the fair value option to account for this Investment. Runyan received dividends of $2.00 per share on December 15, 2021, and Lavery reported net Income of $270 million for the year ended December 31, 2021. The market value of Lavery's common stock at December 31, 2021, was $34 per share. On the purchase date, the book value of Lavery's Identifiable net assets was $920 million and: a. The fair value of Lavery's depreciable assets, with an average remaining useful life of four years, exceeded their book value by $80 million. b. The remainder of the excess of the cost of the Investment over the book value of net assets purchased was attributable to goodwill. Required: Assuming Runyan accounts for this Investment under the fair value option, prepare all appropriate Journal entries in a manner similar to accounting for securities for which there is not significant Influence. (If no entry is required for a transaction/event, select "No Journal entry required" In the first account field. Enter your answers in millions. (I.e., 10,000,000 should be entered as 10).) > Answer is not complete. No Transaction General Journal Credit Debit 348 Investment in equity securities Cash 348 No journal entry required Cash Dividend revenue Loss on investment (unrealized, NI) Fair value adjustment