Question

Investment required (remember to depreciate existing long-term assets at the 2008 amount and ignore the half year rule for 2009 new depreciation i.e. apply

Investment required (remember to depreciate existing long-term assets at the 2008 amount and ignore the half year rule for 2009 new depreciation – i.e. apply a full year value for depreciation). • $600,000 software, expected life 3 years, zero residual value. • $1,500,000 warehousing, expected life 10 years $500,000 residual value. • 30% additional inventory versus 2008 year-end amount, for the foreseeable future. Sales will increase by 30% versus 2008 and total gross margin in 2009 will be 50% (note – this will include deferred revenues from prior year and deferred revenue in 2009 will be equal to 2008). A/R and A/P will not change vs 2008 (online = immediate payments both ways). SG&A Expenses will increase by 10% versus 2008 in 2009.

KEY DATA FOR OPTION 2 - BOUTIQUE: Investment required (remember to depreciate existing long-term assets at the 2008 amount and ignore the half year rule for 2009 new depreciation – i.e. apply a full year value for depreciation). • $5,000,000 for new stores, expected life 10 years, $1,000,000 residual value. • 100% additional inventory versus 2008 year-end amount, for the foreseeable future. Sales will double versus 2008 and total gross margin in 2009 will remain at 30% (note – this will include deferred revenues from prior year and deferred revenue in 2009 will be equal to 2008). A/R and A/P double vs 2008 (double sales and same business model). SG&A Expenses will increase by 50% versus 2008 in 2009

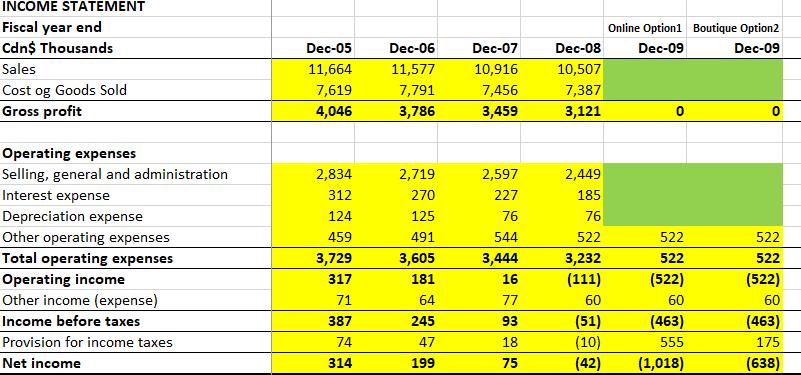

INCOME STATEMENT Fiscal year end Cdn$ Thousands Online Option1 Boutique Option2 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-09 Sales 11,664 11,577 10,916 10,507 Cost og Goods Sold Gross profit 7,619 7,791 7,456 7,387 4,046 3,786 3,459 3,121 Operating expenses Selling, general and administration 2,834 2,719 2,597 2,449 Interest expense 312 270 227 185 Depreciation expense 124 125 76 76 Other operating expenses Total operating expenses 459 491 544 522 522 522 3,729 3,605 3,444 3,232 522 522 Operating income 317 181 16 (111) (522) (522) Other income (expense) 71 64 77 60 60 60 (51) (10) (42) Income before taxes 387 245 93 (463) (463) Provision for income taxes 74 47 18 555 175 Net income 314 199 75 (1,018) (638)

Step by Step Solution

3.43 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Income Statement Fiscal year end option 1 option 2 Cdn Thousands Dec05 Dec06 Dec07 Dec08 Dec09 Dec09 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

6268f21385fdc_Book2333.xlsx

300 KBs Excel File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started