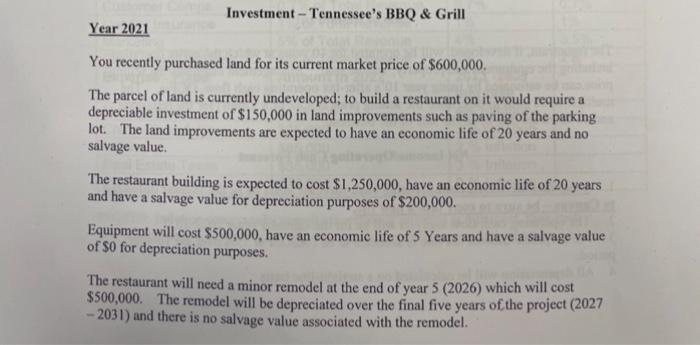

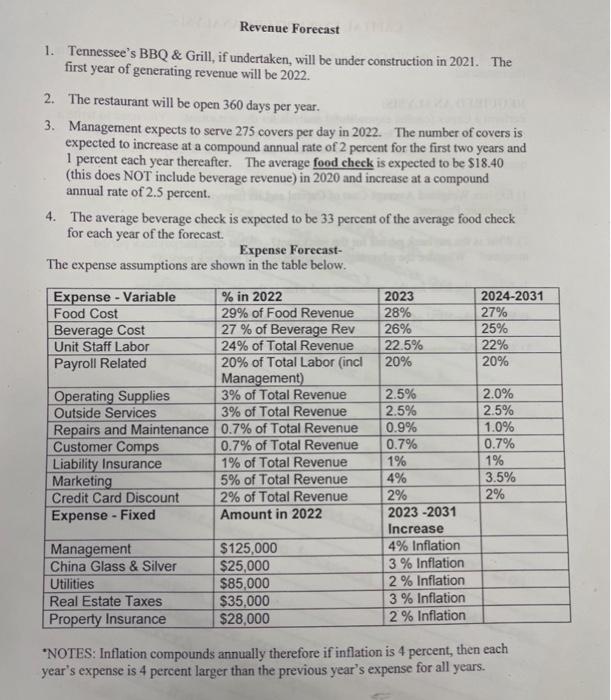

Investment - Tennessee's BBQ & Grill Year 2021 You recently purchased land for its current market price of $600,000 The parcel of land is currently undeveloped; to build a restaurant on it would require a depreciable investment of $150,000 in land improvements such as paving of the parking lot. The land improvements are expected to have an economic life of 20 years and no salvage value. The restaurant building is expected to cost $1,250,000, have an economic life of 20 years and have a salvage value for depreciation purposes of $200,000. Equipment will cost $500,000, have an economic life of 5 Years and have a salvage value of $0 for depreciation purposes. The restaurant will need a minor remodel at the end of year 5 (2026) which will cost $500,000. The remodel will be depreciated over the final five years of the project (2027 -2031) and there is no salvage value associated with the remodel. Working Capital Requirements Net working capital is needed for any restaurant operation. The following table indicates the incremental net working capital needs: Net Working Capital Requirements Timing Year Year 1 Amount $100,000 $100,000 You are to assume that after Year 1 no new additional Net Working Capital will be required and you will recover any working capital invested when you sell the business in year 10 Financing The following table indicates the financing needs Financing Conditions You plan on borrowing $780,000 at an interest rate of 7.0%. In order to estimate the internal equity (kc). for the project, you must use the Capital Asset Pricing Model (CAPM). The estimated return on the market portfolio (km)is 11.5%, the risk-free rate (Rp) is 3% and beta is estimated to be 1.29. There are 5780,000 in new retained carnings to use for this project. The premium to raise external equity is 2.0% points. Sale of Restaurant The restaurant, if developed will be operated for 10 years at which the entire operation, including the equipment and property, will be sold. Management estimates the selling price can be estimated by using year 10's after-tax operating cash flow, OCF). The multiple to be used to determine the selling price is 4,8x (4.8 Times) for the restaurant and all taxes are due upon the sale of the business. Net Income/Operating Cash Forecast 1. Your income statement operating cash forecast must be in the format uploaded to Canvas - be sure to copy into a new file. 2. The operating cash flow anaysis will be for the calendar years 2022-2031 3. The corporate income tax rate is assumed to be constant at 33% over the 10-year period. 4. All depreciation will be calculated on a straight-line basis Revenue Forecast 1. Tennessee's BBQ & Grill, if undertaken, will be under construction in 2021. The first year of generating revenue will be 2022. 2. The restaurant will be open 360 days per year. 3. Management expects to serve 275 covers per day in 2022. The number of covers is expected to increase at a compound annual rate of 2 percent for the first two years and 1 percent each year thereafter. The average food check is expected to be $18.40 (this does NOT include beverage revenue) in 2020 and increase at a compound annual rate of 2.5 percent. 4. The average beverage check is expected to be 33 percent of the average food check for each year of the forecast. Expense Forecast- The expense assumptions are shown in the table below. Expense - Variable % in 2022 2023 2024-2031 Food Cost 29% of Food Revenue 28% 27% Beverage Cost 27 % of Beverage Rev 26% 25% Unit Staff Labor 24% of Total Revenue 22.5% 22% Payroll Related 20% of Total Labor (incl 20% 20% Management) Operating Supplies 3% of Total Revenue 2.5% 2.0% Outside Services 3% of Total Revenue 2.5% 2.5% Repairs and Maintenance 0.7% of Total Revenue 0.9% 1.0% Customer Comps 0.7% of Total Revenue 0.7% 0.7% Liability Insurance 1% of Total Revenue 1% 1% Marketing 5% of Total Revenue 4% 3.5% Credit Card Discount 2% of Total Revenue 2% 2% Expense - Fixed Amount in 2022 2023-2031 Increase Management $125,000 4% Inflation China Glass & Silver $25,000 3 % Inflation Utilities $85,000 2% Inflation Real Estate Taxes $35,000 3 % Inflation Property Insurance $28,000 2 % Inflation *NOTES: Inflation compounds annually therefore if inflation is 4 percent, then each year's expense is 4 percent larger than the previous year's expense for all years. CAPITAL EXPENDITURE ANALYSIS You will be using the WACC (Weighted Average Cost of Capital) approach to evaluate the restaurant. REQUIRED ANALYSIS: Perform a Capex (capital expenditure) analysis for the restaurant. You need to write a recommendation to the Chief Executive Officer as to whether or not to build this restaurant. Insert a Text Box at the bottom of the analysis and answer the following questions: a 1) Explain Weighted Average Cost of Capital and its importance in analyzing Capital Expenditure Projects. 2) What is the payback period for the restaurant? What does the payback period measure? What are the advantages/disadvantages of payback period? 3) What is the IRR for this restaurant and what is the significance of IRR? 4) What is the NPV of the restaurant? What does NPV measure? 5) Should the restaurant be undertaken and why? Investment - Tennessee's BBQ & Grill Year 2021 You recently purchased land for its current market price of $600,000 The parcel of land is currently undeveloped; to build a restaurant on it would require a depreciable investment of $150,000 in land improvements such as paving of the parking lot. The land improvements are expected to have an economic life of 20 years and no salvage value. The restaurant building is expected to cost $1,250,000, have an economic life of 20 years and have a salvage value for depreciation purposes of $200,000. Equipment will cost $500,000, have an economic life of 5 Years and have a salvage value of $0 for depreciation purposes. The restaurant will need a minor remodel at the end of year 5 (2026) which will cost $500,000. The remodel will be depreciated over the final five years of the project (2027 -2031) and there is no salvage value associated with the remodel. Working Capital Requirements Net working capital is needed for any restaurant operation. The following table indicates the incremental net working capital needs: Net Working Capital Requirements Timing Year Year 1 Amount $100,000 $100,000 You are to assume that after Year 1 no new additional Net Working Capital will be required and you will recover any working capital invested when you sell the business in year 10 Financing The following table indicates the financing needs Financing Conditions You plan on borrowing $780,000 at an interest rate of 7.0%. In order to estimate the internal equity (kc). for the project, you must use the Capital Asset Pricing Model (CAPM). The estimated return on the market portfolio (km)is 11.5%, the risk-free rate (Rp) is 3% and beta is estimated to be 1.29. There are 5780,000 in new retained carnings to use for this project. The premium to raise external equity is 2.0% points. Sale of Restaurant The restaurant, if developed will be operated for 10 years at which the entire operation, including the equipment and property, will be sold. Management estimates the selling price can be estimated by using year 10's after-tax operating cash flow, OCF). The multiple to be used to determine the selling price is 4,8x (4.8 Times) for the restaurant and all taxes are due upon the sale of the business. Net Income/Operating Cash Forecast 1. Your income statement operating cash forecast must be in the format uploaded to Canvas - be sure to copy into a new file. 2. The operating cash flow anaysis will be for the calendar years 2022-2031 3. The corporate income tax rate is assumed to be constant at 33% over the 10-year period. 4. All depreciation will be calculated on a straight-line basis Revenue Forecast 1. Tennessee's BBQ & Grill, if undertaken, will be under construction in 2021. The first year of generating revenue will be 2022. 2. The restaurant will be open 360 days per year. 3. Management expects to serve 275 covers per day in 2022. The number of covers is expected to increase at a compound annual rate of 2 percent for the first two years and 1 percent each year thereafter. The average food check is expected to be $18.40 (this does NOT include beverage revenue) in 2020 and increase at a compound annual rate of 2.5 percent. 4. The average beverage check is expected to be 33 percent of the average food check for each year of the forecast. Expense Forecast- The expense assumptions are shown in the table below. Expense - Variable % in 2022 2023 2024-2031 Food Cost 29% of Food Revenue 28% 27% Beverage Cost 27 % of Beverage Rev 26% 25% Unit Staff Labor 24% of Total Revenue 22.5% 22% Payroll Related 20% of Total Labor (incl 20% 20% Management) Operating Supplies 3% of Total Revenue 2.5% 2.0% Outside Services 3% of Total Revenue 2.5% 2.5% Repairs and Maintenance 0.7% of Total Revenue 0.9% 1.0% Customer Comps 0.7% of Total Revenue 0.7% 0.7% Liability Insurance 1% of Total Revenue 1% 1% Marketing 5% of Total Revenue 4% 3.5% Credit Card Discount 2% of Total Revenue 2% 2% Expense - Fixed Amount in 2022 2023-2031 Increase Management $125,000 4% Inflation China Glass & Silver $25,000 3 % Inflation Utilities $85,000 2% Inflation Real Estate Taxes $35,000 3 % Inflation Property Insurance $28,000 2 % Inflation *NOTES: Inflation compounds annually therefore if inflation is 4 percent, then each year's expense is 4 percent larger than the previous year's expense for all years. CAPITAL EXPENDITURE ANALYSIS You will be using the WACC (Weighted Average Cost of Capital) approach to evaluate the restaurant. REQUIRED ANALYSIS: Perform a Capex (capital expenditure) analysis for the restaurant. You need to write a recommendation to the Chief Executive Officer as to whether or not to build this restaurant. Insert a Text Box at the bottom of the analysis and answer the following questions: a 1) Explain Weighted Average Cost of Capital and its importance in analyzing Capital Expenditure Projects. 2) What is the payback period for the restaurant? What does the payback period measure? What are the advantages/disadvantages of payback period? 3) What is the IRR for this restaurant and what is the significance of IRR? 4) What is the NPV of the restaurant? What does NPV measure? 5) Should the restaurant be undertaken and why