Answered step by step

Verified Expert Solution

Question

1 Approved Answer

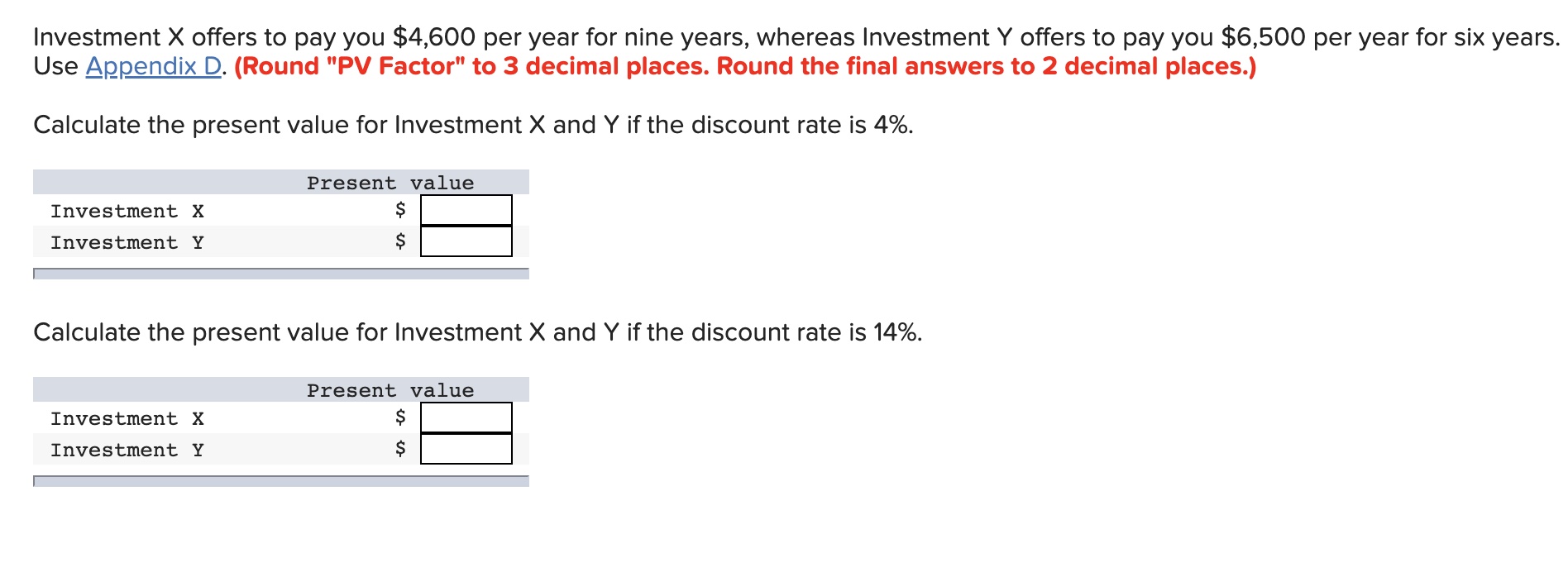

Investment X offers to pay you $4,600 per year for nine years, whereas Investment Y offers to pay you $6,500 per year for six

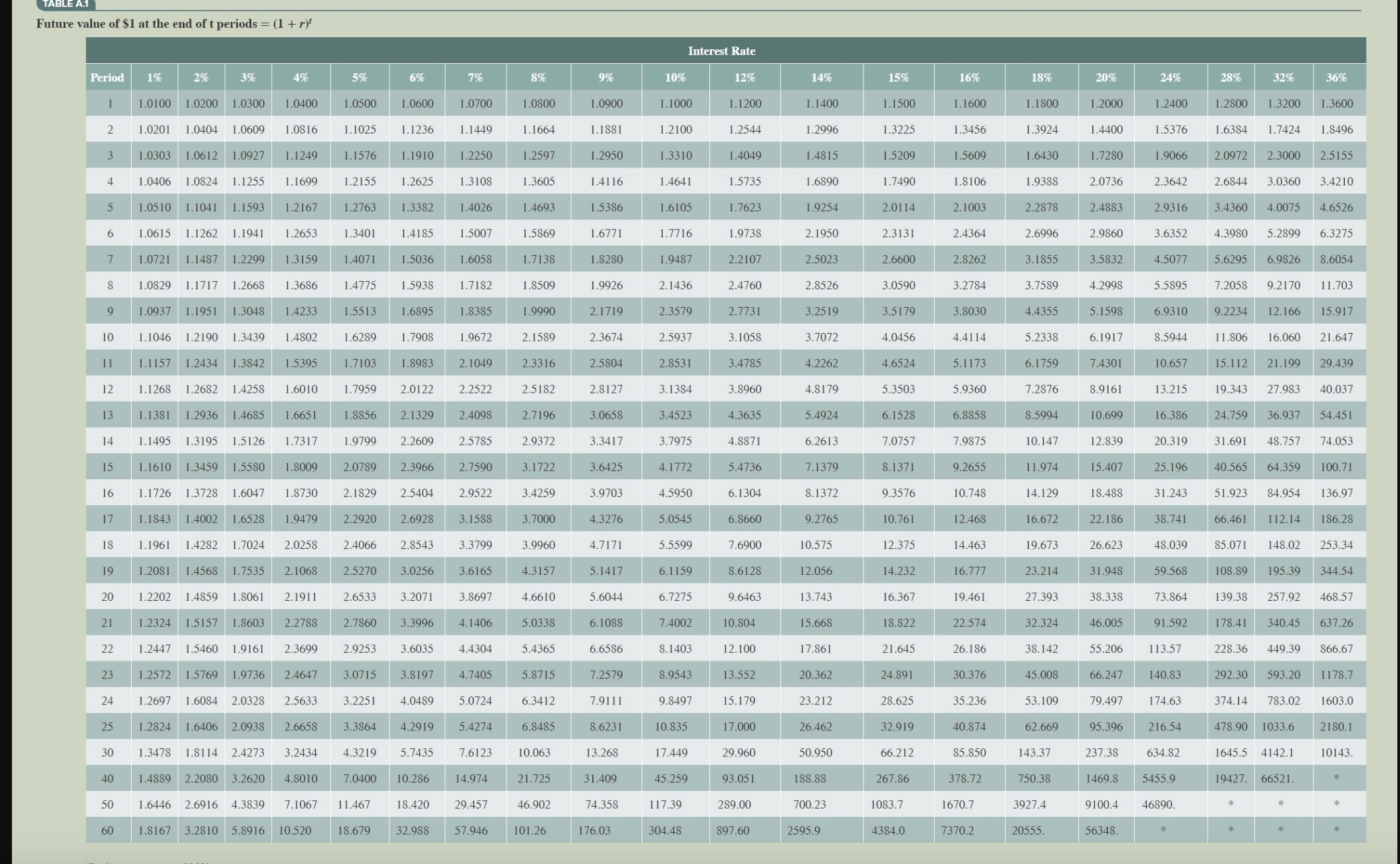

Investment X offers to pay you $4,600 per year for nine years, whereas Investment Y offers to pay you $6,500 per year for six years. Use Appendix D. (Round "PV Factor" to 3 decimal places. Round the final answers to 2 decimal places.) Calculate the present value for Investment X and Y if the discount rate is 4%. Investment X Investment Y Present value. Investment X Investment Y $ Calculate the present value for Investment X and Y if the discount rate is 14%. Present value. $ TABLE A.1 Future value of $1 at the end of t periods = (1 + r) Period 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 30 40 1% 50 2% 3% 1.0829 1.1717 1.2668 1.0937 1.1951 1.3048 1.0100 1.0200 1.0300 1.0400 1.0201 1.0404 1.0609 1.0816 1.0303 1.0612 1.0927 1.0406 1.0824 1.1255 1.1699 1.2155 1.0510 1.1041 1.1593 1.2167 1.2763 1.3382 1.0615 1.1262 1.1941 1.4185 1.0721 1.1487 1.2299 1.3159 1.1046 1.2190 1.3439 1.1495 1.3195 1.5126 4% 1.1610 1.3459 1.5580 1.1249 1.2653 1.3686 1.4889 2.2080 3.2620 1.4802 1.6010 1.1157 1.2434 1.3842 1.5395 1.7103 1.1268 1.2682 1.4258 1.1381 1.2936 1.4685 1.6651 1.8009 1.1726 1.3728 1.6047 1.8730 1.1843 1.4002 1.6528 1.9479 2.0258 1.1961 1.4282 1.7024 1.2081 1.4568 1.7535 2.1068 1.2202 1.4859 1.8061 1.2324 1.5157 1.8603 1.7317 2.1911 5% 2.2788 1.2447 1.5460 1.9161 2.3699 1.2572 1.5769 1.9736 2.4647 1.2697 1.6084 2.0328 2.5633 1.0500 1.4775 1.5938 1.4233 1.5513 1.6895 1.6289 1.7908 1.1025 1.1576 1.3401 1.4071 2.0789 2.1829 2.2920 2.4066 2.5270 2.6533 1.2824 1.6406 2.0938 2.6658 1.3478 1.8114 2.4273 3.2434 4.8010 1.6446 2.6916 4.3839 7.1067 7.0400 11.467 60 1.8167 3.2810 5.8916 10.520 18.679 2.7860 2.9253 3.0715 3.2251 6% 1.0600 3.3864 4.3219 1.1236 1.1910 1.2625 1.5036 1.8983 1.7959 2.0122 1.8856 2.1329 1.9799 2.2609 2.5785 2.8543 7% 3.6035 1.0700 3.8197 1.1449 4.0489 1.2250 4.2919 1.3108 1.4026 1.5007 1.6058 1.7182 1.8385 1.9672 2.3966 2.7590 2.5404 2.9522 2.1049 2.6928 3.1588 2.2522 2.4098 3.0256 3.6165 3.2071 3.8697 3.3996 3.3799 4.1406 4.4304 4.7405 5.0724 5.4274 5.7435 7.6123 10.286 14.974 18.420 29.457 32.988 57.946 8% 1.0800 1.1664 1.2597 1.3605 1.4693 1.5869 1.7138 1.8509 1.9990 2.1589 2.3316 2.5182 2.7196 2.9372 3.1722 3.4259 3.7000 3.9960 4.3157 4.6610 5.0338 5.4365 5.8715 6.3412 6.8485 10.063 21.725 46.902 101.26 9% 1.0900 1.1881 1.2950 1.4116 1.5386 1.6771 1.8280 1.9926 2.1719 2.3674 2.5804 2.8127 3.0658 3.3417 3.6425 3.9703 4.3276 4.7171 5.1417 5.6044 6.1088 6.6586 7.2579 7.9111 8.6231 13.268 31.409 74.358 176.03 10% 1.1000 1.2100 Interest Rate 1.3310 1.4641 1.6105 1.7716 1.9487 2.1436 2.3579 2.5937 2.8531 3.1384 3.4523 3.7975 4.1772 4.5950 5.0545 5.5599 6.1159 6.7275 7.4002 8.1403 8.9543 9.8497 10.835 17.449 45.259 117.39 304.48 12% 1.1200 1.2544 1.4049 1.5735 1.7623 1.9738 2.2107 2.4760 2.7731 3.1058 3.4785 3.8960 4.3635 4.8871 5.4736 6.1304 6.8660 7.6900 8.6128 9.6463 10.804 12.100 13.552 15.179 17.000 29.960 93.051 289.00 897.60 14% 1.1400 1.2996 1.4815 1.6890 1.9254 2.1950 2.5023 2.8526 3.2519 3.7072 4.2262 4.8179 5.4924 6.2613 7.1379 8.1372 9.2765 10.575 12.056 13.743 15.668 17.861 20.362 23.212 26.462 50.950 188.88 700.23 2595.9 15% 1.1500 1.3225 1.5209 1.7490 2.0114 2.3131 2.6600 3.0590 3.5179 4.0456 4.6524 5.3503 6.1528 7.0757 8.1371 9.3576 10.761 12.375 14.232 16.367 18.822 21.645 24.891 28.625 32.919 66.212 267.86 1083.7 4384.0 16% 1.1600 1.3456 1.5609 1.8106 2.1003 2.4364 2.8262 3.2784 3.8030 4.4114 5.1173 5.9360 6.8858 7.9875 9.2655 10.748 12.468 14.463 16.777 19.461 22.574 26.186 30.376 35.236 40.874 85.850 378.72 1670.7 7370.2 18% 1.1800 1.3924 1.6430 1.9388 2.2878 2.6996 3.1855 3.7589 4.4355 5.2338 6.1759 7.2876 8.5994 10.147 11.974 14.129 16.672 19.673 23.214 27.393 32.324 38.142 45.008 53.109 62.669 143.37 750.38 3927.4 20555. 20% 1.2000 1.4400 1.7280 2.0736 2.4883 2.9860 3.5832 4.2998 5.1598 6.1917 7.4301 8.9161 10.699 12.839 15.407 18.488 22.186 26.623 31.948 38.338 46.005 24% 79.497 1.2400 1.5376 1.9066 2.3642 2.9316 3.6352 4.5077 5.5895 6.9310 8.5944 10.657 13.215 16.386 20.319 25.196 31.243 38.741 48.039 59.568 73.864 91.592 55.206 66.247 140.83 174.63 95.396 216.54 237.38 634.82 1469.8 5455.9 113.57 9100.4 46890. 56348. 28% 5.6295 1.2800 1.3200 1.3600 1.6384 1.7424 1.8496 2.0972 2.3000 2.5155 2.6844 3.0360 3.4210 3.4360 4.0075 4.6526 4.3980 5.2899 6.3275 32% 11.806 7.2058 9.2170 11.703 9.2234 12.166 15.917 21.647 15.112 6.9826 8.6054 16.060 21.199 19.343 27.983 40.037 24.759 36.937 31.691 48.757 40.565 64.359 36% 292.30 593.20 74.053 100.71 51.923 84.954 136.97 66.461 112.14 186.28 85.071 148.02 108.89 195.39 139.38 257.92 178.41 340.45 228.36 449.39 374.14 783.02 478.90 1033.6 1645.5 4142.1 19427. 66521. 29.439 54.451 253.34 344.54 468.57 637.26 866.67 1178.7 1603.0 2180.1 10143.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the present value of Investment X and Y at different discount rates you can use t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started