Answered step by step

Verified Expert Solution

Question

1 Approved Answer

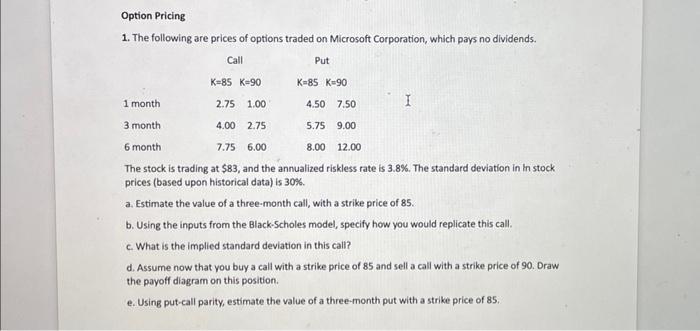

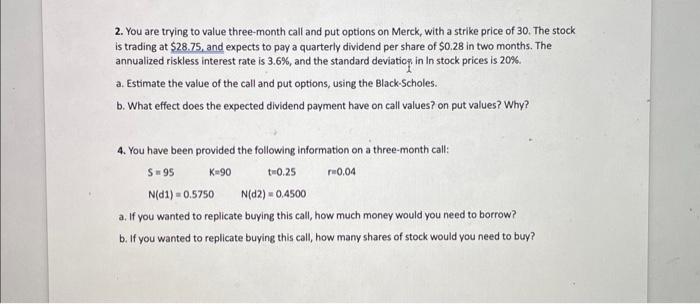

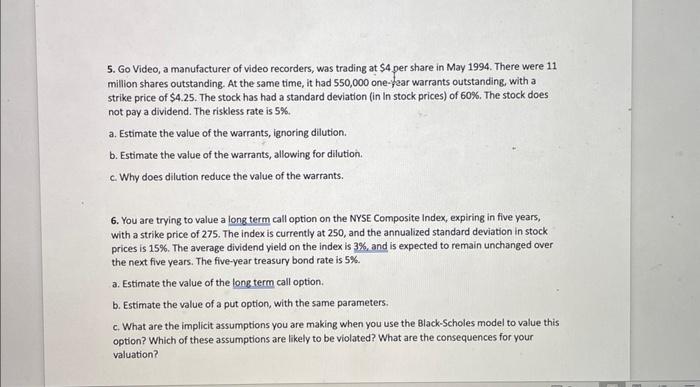

investments and financial strategies assigbment please solve in external paper and post the answer thank you 1. The following are prices of options traded on

investments and financial strategies assigbment please solve in external paper and post the answer thank you

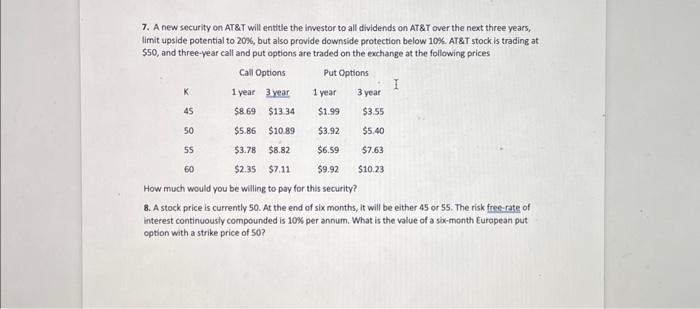

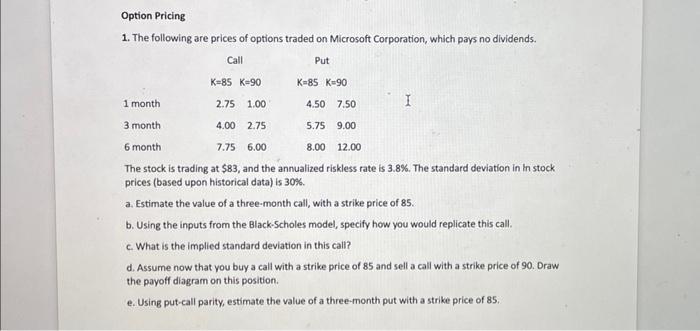

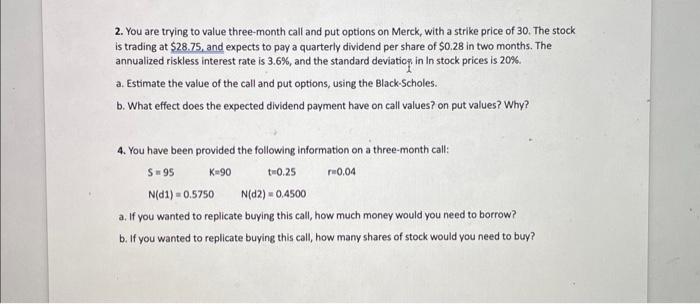

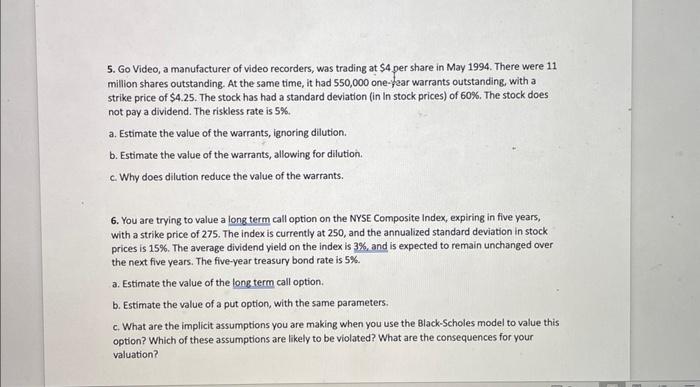

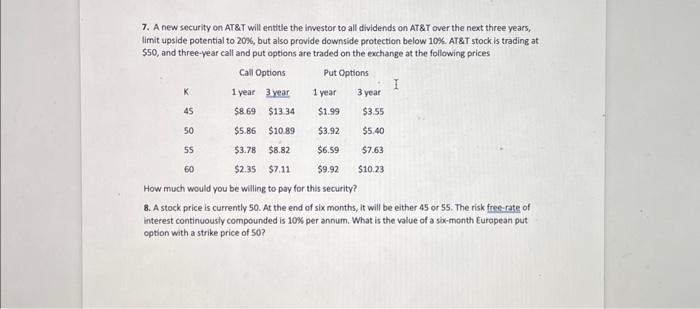

1. The following are prices of options traded on Microsoft Corporation, which pays no dividends. The stock is trading at $83, and the annualized riskless rate is 3.8%. The standard deviation in in stock prices (based upon historical data) is 30%. a. Estimate the value of a three-month call, with a strike price of 85 . b. Using the inputs from the Black-Scholes model, specify how you would replicate this call. c. What is the implied standard deviation in this call? d. Assume now that you buy a call with a strike price of 85 and sell a call with a strike price of 90. Draw the payoff diagram on this position. e. Using put-call parity, estimate the value of a three-month put with a strike price of 85 . 2. You are trying to value three-month call and put options on Merck, with a strike price of 30 . The stock is trading at $28.75, and expects to pay a quarterly dividend per share of $0.28 in two months. The annualized riskless interest rate is 3.6%, and the standard deviatiop in In stock prices is 20%. a. Estimate the value of the call and put options, using the Black-Scholes. b. What effect does the expected dividend payment have on call values? on put values? Why? 4. You have been provided the following information on a three-month call: S=95k=90t=0.25r=0.04N(d1)=0.5750N(d2)=0.4500 a. If you wanted to replicate buying this call, how much money would you need to borrow? b. If you wanted to replicate buying this call, how many shares of stock would you need to buy? 5. Go Video, a manufacturer of video recorders, was trading at $4 per share in May 1994. There were 11 million shares outstanding. At the same time, it had 550,000 one-frar warrants outstanding. with a strike price of $4.25. The stock has had a standard deviation (in In stock prices) of 60%. The stock does not pay a dividend. The riskless rate is 5%. a. Estimate the value of the warrants, ignoring dilution. b. Estimate the value of the warrants, allowing for dilution. c. Why does dilution reduce the value of the warrants. 6. You are trying to value a long term call option on the NYSE Composite index, expiring in five years, with a strike price of 275 . The index is currently at 250 , and the annualized standard deviation in stock prices is 15%. The average dividend yield on the index is 3%, and is expected to remain unchanged over the next five years. The five-year treasury bond rate is 5%. a. Estimate the value of the long term call option. b. Estimate the value of a put option, with the same parameters. c. What are the implicit assumptions you are making when you use the Black-Scholes model to value this option? Which of these assumptions are likely to be violated? What are the consequences for your valuation? 7. A new security on AT\&T will entitle the investor to all dividends on AT\&T over the next three years, limit upside potential to 20%, but also provide downside protection below 10%. AT\&T stock is trading at $50, and three-year call and put options are traded on the exchange at the following prices How much would you be willing to pay for this security? 8. A stock price is currently 50. At the end of six months, it will be either 45 or 55 . The risk free-rate of interest continuously compounded is 10x per annum. What is the value of a six-month European put option with a strike price of 50 ? 1. The following are prices of options traded on Microsoft Corporation, which pays no dividends. The stock is trading at $83, and the annualized riskless rate is 3.8%. The standard deviation in in stock prices (based upon historical data) is 30%. a. Estimate the value of a three-month call, with a strike price of 85 . b. Using the inputs from the Black-Scholes model, specify how you would replicate this call. c. What is the implied standard deviation in this call? d. Assume now that you buy a call with a strike price of 85 and sell a call with a strike price of 90. Draw the payoff diagram on this position. e. Using put-call parity, estimate the value of a three-month put with a strike price of 85 . 2. You are trying to value three-month call and put options on Merck, with a strike price of 30 . The stock is trading at $28.75, and expects to pay a quarterly dividend per share of $0.28 in two months. The annualized riskless interest rate is 3.6%, and the standard deviatiop in In stock prices is 20%. a. Estimate the value of the call and put options, using the Black-Scholes. b. What effect does the expected dividend payment have on call values? on put values? Why? 4. You have been provided the following information on a three-month call: S=95k=90t=0.25r=0.04N(d1)=0.5750N(d2)=0.4500 a. If you wanted to replicate buying this call, how much money would you need to borrow? b. If you wanted to replicate buying this call, how many shares of stock would you need to buy? 5. Go Video, a manufacturer of video recorders, was trading at $4 per share in May 1994. There were 11 million shares outstanding. At the same time, it had 550,000 one-frar warrants outstanding. with a strike price of $4.25. The stock has had a standard deviation (in In stock prices) of 60%. The stock does not pay a dividend. The riskless rate is 5%. a. Estimate the value of the warrants, ignoring dilution. b. Estimate the value of the warrants, allowing for dilution. c. Why does dilution reduce the value of the warrants. 6. You are trying to value a long term call option on the NYSE Composite index, expiring in five years, with a strike price of 275 . The index is currently at 250 , and the annualized standard deviation in stock prices is 15%. The average dividend yield on the index is 3%, and is expected to remain unchanged over the next five years. The five-year treasury bond rate is 5%. a. Estimate the value of the long term call option. b. Estimate the value of a put option, with the same parameters. c. What are the implicit assumptions you are making when you use the Black-Scholes model to value this option? Which of these assumptions are likely to be violated? What are the consequences for your valuation? 7. A new security on AT\&T will entitle the investor to all dividends on AT\&T over the next three years, limit upside potential to 20%, but also provide downside protection below 10%. AT\&T stock is trading at $50, and three-year call and put options are traded on the exchange at the following prices How much would you be willing to pay for this security? 8. A stock price is currently 50. At the end of six months, it will be either 45 or 55 . The risk free-rate of interest continuously compounded is 10x per annum. What is the value of a six-month European put option with a strike price of 50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started