Answered step by step

Verified Expert Solution

Question

1 Approved Answer

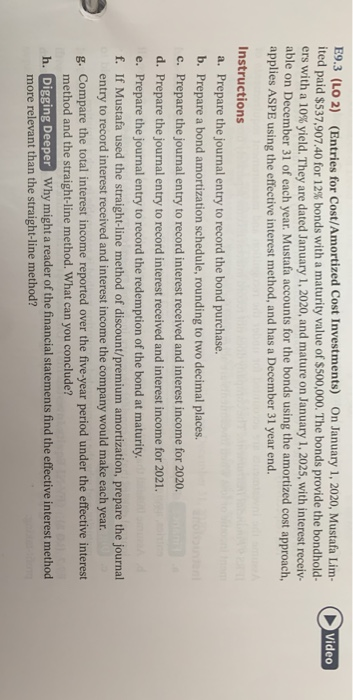

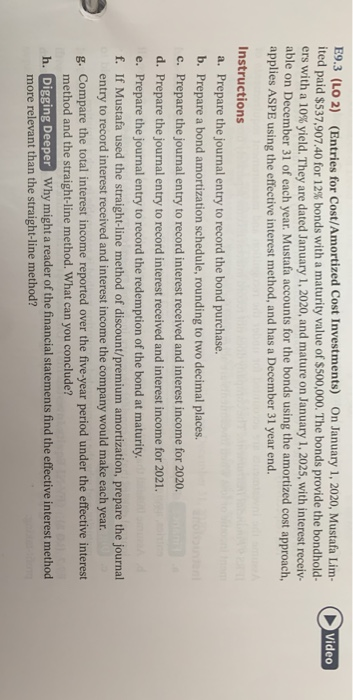

investments PART A AND C ONLY Video E9.3 (LO 2) (Entries for Cost/Amortized Cost Investments) On January 1, 2020, Mustafa Lim ited paid $537,907.40 for

investments

PART A AND C ONLY

Video E9.3 (LO 2) (Entries for Cost/Amortized Cost Investments) On January 1, 2020, Mustafa Lim ited paid $537,907.40 for 12% bonds with a maturity value of $500,000. The bonds provide the bondhold. ers with a 10% yield. They are dated January 1, 2020, and mature on January 1, 2025, with interest receiv. able on December 31 of each year. Mustafa accounts for the bonds using the amortized cost approach, applies ASPE using the effective interest method, and has a December 31 year end. Instructions a. Prepare the journal entry to record the bond purchase. b. Prepare a bond amortization schedule, rounding to two decimal places. c. Prepare the journal entry to record interest received and interest income for 2020. d. Prepare the journal entry to record interest received and interest income for 2021. e. Prepare the journal entry to record the redemption of the bond at maturity. f. If Mustafa used the straight-line method of discount/premium amortization, prepare the journal entry to record interest received and interest income the company would make each year. g. Compare the total interest income reported over the five-year period under the effective interest method and the straight-line method. What can you conclude? h. Digging Deeper Why might a reader of the financial statements find the effective interest method more relevant than the straight-line method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started