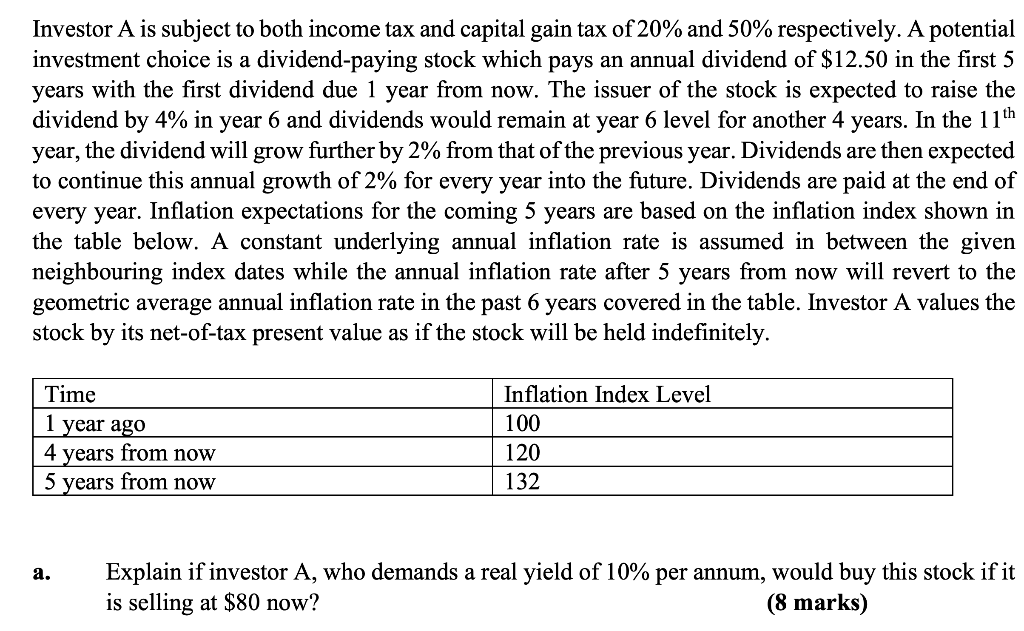

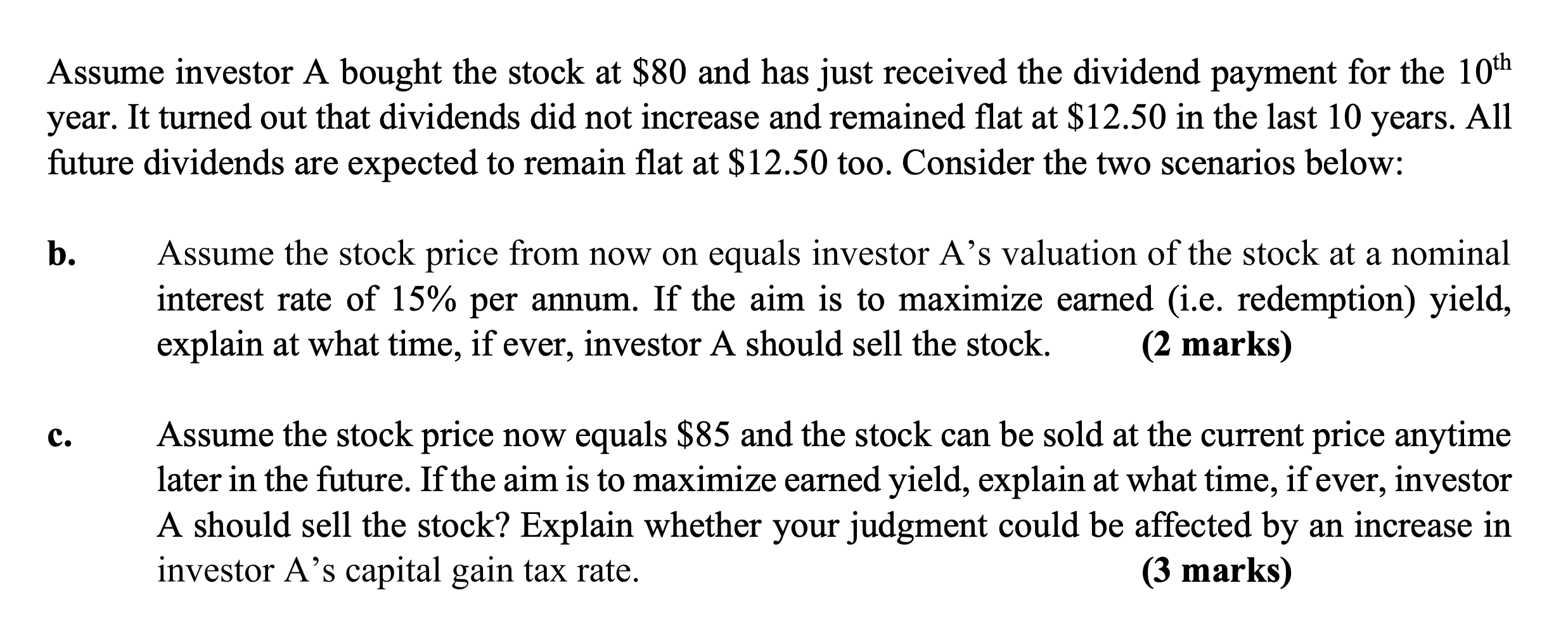

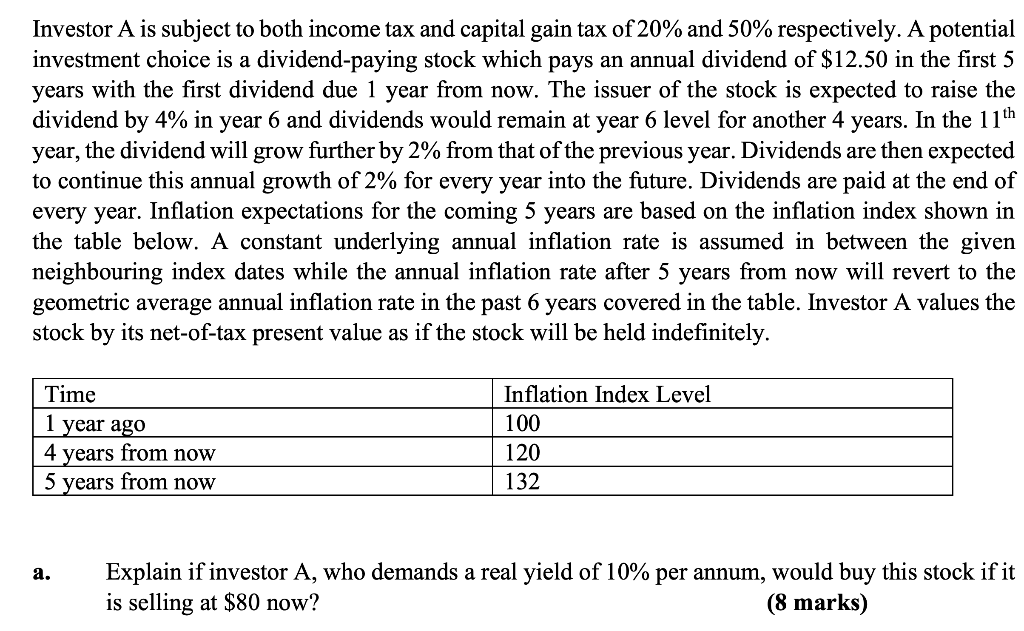

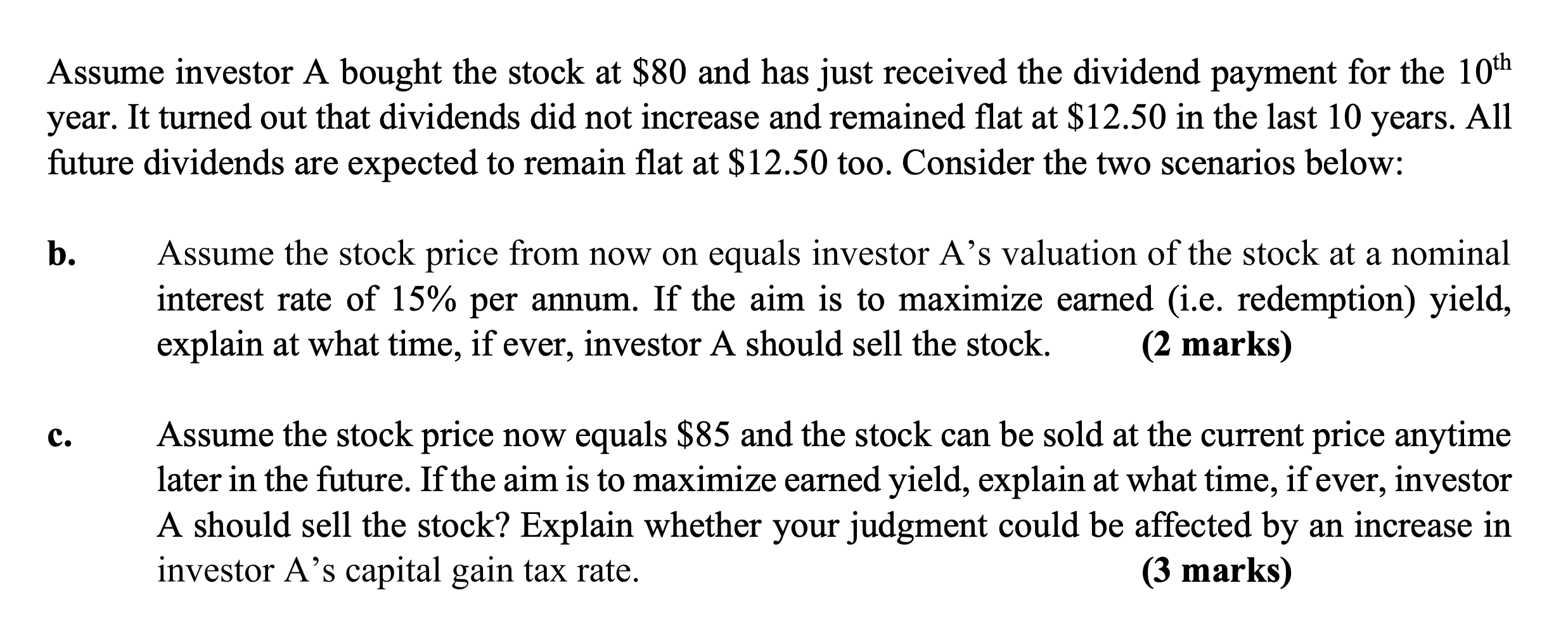

Investor A is subject to both income tax and capital gain tax of 20% and 50% respectively. A potential investment choice is a dividend-paying stock which pays an annual dividend of $12.50 in the first 5 years with the first dividend due 1 year from now. The issuer of the stock is expected to raise the dividend by 4% in year 6 and dividends would remain at year 6 level for another 4 years. In the 11th year, the dividend will grow further by 2% from that of the previous year. Dividends are then expected to continue this annual growth of 2% for every year into the future. Dividends are paid at the end of every year. Inflation expectations for the coming 5 years are based on the inflation index shown in the table below. A constant underlying annual inflation rate is assumed in between the given neighbouring index dates while the annual inflation rate after 5 years from now will revert to the geometric average annual inflation rate in the past 6 years covered in the table. Investor A values the stock by its net-of-tax present value as if the stock will be held indefinitely. Time Inflation Index Level 1 year ago 100 4 years from now 120 5 years from now 132 a. Explain if investor A, who demands a real yield of 10% per annum, would buy this stock if it is selling at $80 now? (8 marks) Assume investor A bought the stock at $80 and has just received the dividend payment for the 10th year. It turned out that dividends did not increase and remained flat at $12.50 in the last 10 years. All future dividends are expected to remain flat at $12.50 too. Consider the two scenarios below: b. Assume the stock price from now on equals investor A's valuation of the stock at a nominal interest rate of 15% per annum. If the aim is to maximize earned (i.e. redemption) yield, explain at what time, if ever, investor A should sell the stock. (2 marks) C. Assume the stock price now equals $85 and the stock can be sold at the current price anytime later in the future. If the aim is to maximize earned yield, explain at what time, if ever, investor A should sell the stock? Explain whether your judgment could be affected by an increase in investor A's capital gain tax rate. (3 marks) Investor A is subject to both income tax and capital gain tax of 20% and 50% respectively. A potential investment choice is a dividend-paying stock which pays an annual dividend of $12.50 in the first 5 years with the first dividend due 1 year from now. The issuer of the stock is expected to raise the dividend by 4% in year 6 and dividends would remain at year 6 level for another 4 years. In the 11th year, the dividend will grow further by 2% from that of the previous year. Dividends are then expected to continue this annual growth of 2% for every year into the future. Dividends are paid at the end of every year. Inflation expectations for the coming 5 years are based on the inflation index shown in the table below. A constant underlying annual inflation rate is assumed in between the given neighbouring index dates while the annual inflation rate after 5 years from now will revert to the geometric average annual inflation rate in the past 6 years covered in the table. Investor A values the stock by its net-of-tax present value as if the stock will be held indefinitely. Time Inflation Index Level 1 year ago 100 4 years from now 120 5 years from now 132 a. Explain if investor A, who demands a real yield of 10% per annum, would buy this stock if it is selling at $80 now? (8 marks) Assume investor A bought the stock at $80 and has just received the dividend payment for the 10th year. It turned out that dividends did not increase and remained flat at $12.50 in the last 10 years. All future dividends are expected to remain flat at $12.50 too. Consider the two scenarios below: b. Assume the stock price from now on equals investor A's valuation of the stock at a nominal interest rate of 15% per annum. If the aim is to maximize earned (i.e. redemption) yield, explain at what time, if ever, investor A should sell the stock. (2 marks) C. Assume the stock price now equals $85 and the stock can be sold at the current price anytime later in the future. If the aim is to maximize earned yield, explain at what time, if ever, investor A should sell the stock? Explain whether your judgment could be affected by an increase in investor A's capital gain tax rate