Answered step by step

Verified Expert Solution

Question

1 Approved Answer

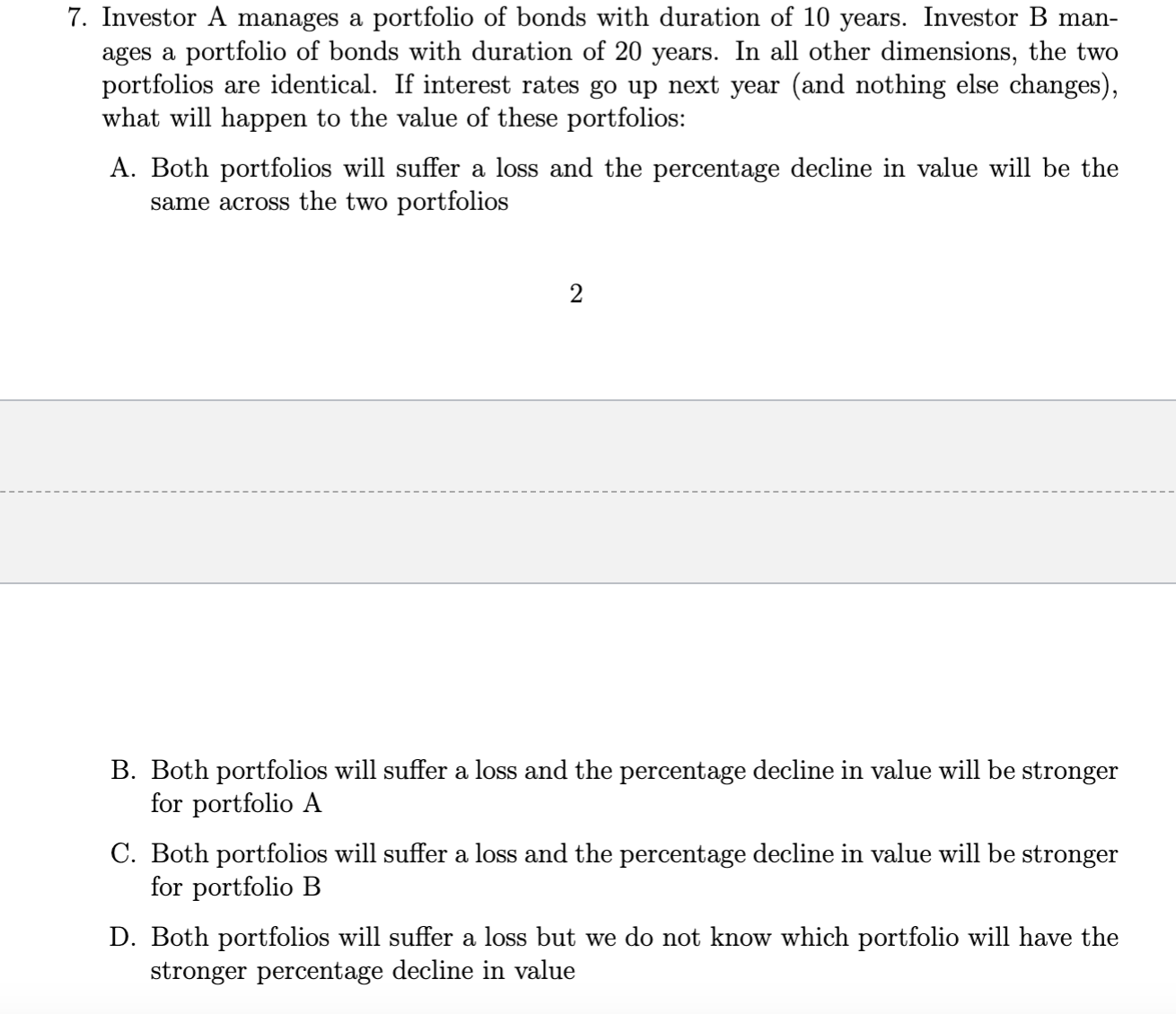

Investor A manages a portfolio of bonds with duration of 1 0 years. Investor B man - ages a portfolio of bonds with duration of

Investor A manages a portfolio of bonds with duration of years. Investor B man

ages a portfolio of bonds with duration of years. In all other dimensions, the two

portfolios are identical. If interest rates go up next year and nothing else changes

what will happen to the value of these portfolios:

A Both portfolios will suffer a loss and the percentage decline in value will be the

same across the two portfolios

B Both portfolios will suffer a loss and the percentage decline in value will be stronger

for portfolio

C Both portfolios will suffer a loss and the percentage decline in value will be stronger

for portfolio B

D Both portfolios will suffer a loss but we do not know which portfolio will have the

stronger percentage decline in value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started