Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Investor has a line of credit with Big Bank. Investor may borrow up to $25M. Borrowings may be in USD, GBP or EUR. Spot

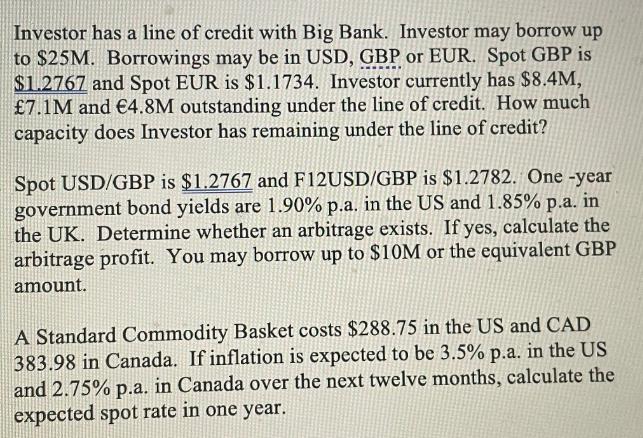

Investor has a line of credit with Big Bank. Investor may borrow up to $25M. Borrowings may be in USD, GBP or EUR. Spot GBP is $1.2767 and Spot EUR is $1.1734. Investor currently has $8.4M, 7.1M and 4.8M outstanding under the line of credit. How much capacity does Investor has remaining under the line of credit? Spot USD/GBP is $1.2767 and F12USD/GBP is $1.2782. One -year government bond yields are 1.90% p.a. in the US and 1.85% p.a. in the UK. Determine whether an arbitrage exists. If yes, calculate the arbitrage profit. You may borrow up to $10M or the equivalent GBP amount. A Standard Commodity Basket costs $288.75 in the US and CAD 383.98 in Canada. If inflation is expected to be 3.5% p.a. in the US and 2.75% p.a. in Canada over the next twelve months, calculate the expected spot rate in one year.

Step by Step Solution

★★★★★

3.30 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

The investor currently has 84M 71M 48M 203M outstanding under the line of credit Therefore the inves...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started