Question

Investor profile: Pete is 62 years old, married, and has three adult children. He is currently employed in the energy industry and earns roughly $1

Investor profile:

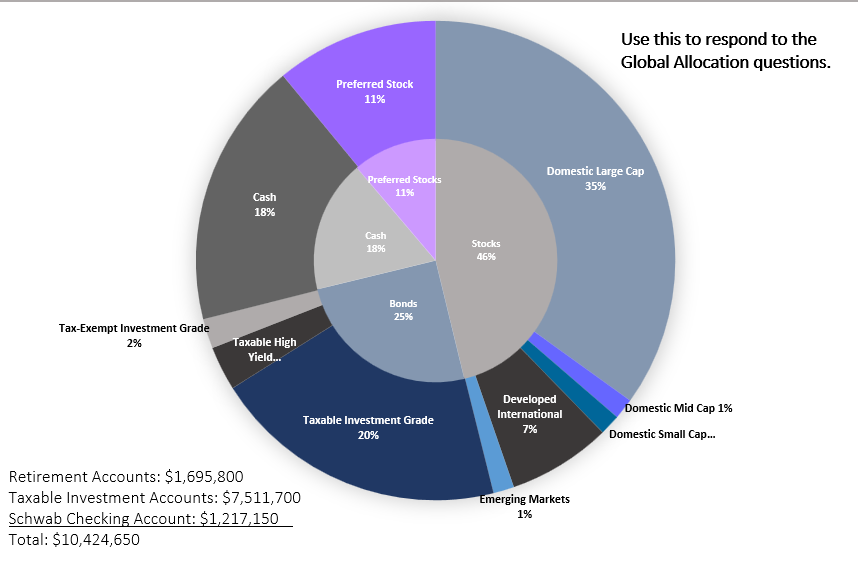

Pete is 62 years old, married, and has three adult children. He is currently employed in the energy industry and earns roughly $1 million annually. He anticipates retiring completely from this position in three years and relying solely on his portfolio to maintain his and wifes combined spending level of $400K annually. In addition to these portfolio assets, they also own a $2 million home in The Woodlands. Pete and his wife have no other financial assets or business interests. Beyond the value held in this portfolio, the only income they will receive is Social Security, which is not particularly impactful given their level of assets and spending.

Pete is more risk averse than the average client. His approach to investing generally places wealth preservation as the top priority, followed by keeping up with inflation, and capital appreciation after that. The volatility in financial markets during the onset of the Covid crisis was unsettling to Pete despite his ability to weather the storm. At retirement, Pete and his wife plan to downsize their house. However, given the run-up in real estate value in the wake of Covid, and despite the rise in interest rates, Pete believes that he can sell his current house for $2.5 million after a neighbors house for $2.4 million in early 2022. He and his wife are emotionally attached to house as this is where they raised their three children.

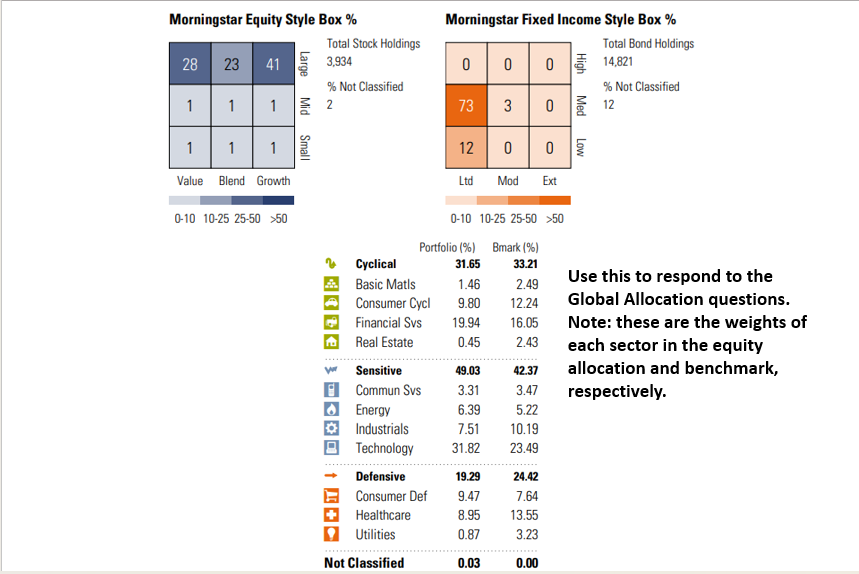

Describe the allocation in terms of risk assets (stocks) versus safe assets (bonds and cash) in percentage terms. How does the allocation to domestic stocks compare to that of the global stock market?

Describe the allocation in terms of risk assets (stocks) versus safe assets (bonds and cash) in percentage terms. How does the allocation to domestic stocks compare to that of the global stock market?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started