Question

Investors pay a premium when they acquire companies with a high growth potential. This was clearly witnessed in 2020, when the share prices of several

Investors pay a premium when they acquire companies with a high growth potential. This was clearly witnessed in 2020, when the share prices of several technology companies skyrocketed, despite the economic devastation of the COVID-19 pandemic. Many value investors warned that investors were overpaying for the potential growth promised by these companies.

Company D's current market price is R1 210.00 per share. In 2020, the company paid a dividend of R12.10 per share. Next year's dividend is expected to increase by 12.0% and decrease linearly over the next ten years to a long-term stable growth rate of 4.0%. The risk-free rate is 3.5% and the investors require a risk premium of 6.0% to invest in equities. Company D's beta is estimated to be 1.1, implying that its cost of equity is 10.1%.

Calculate the value of stable growth.

Calculate the value of extraordinary growth.

Based on Company D's current market price, what is the implied value of growth?

As a portfolio manager, would you purchase Company D? Motivate your answer.

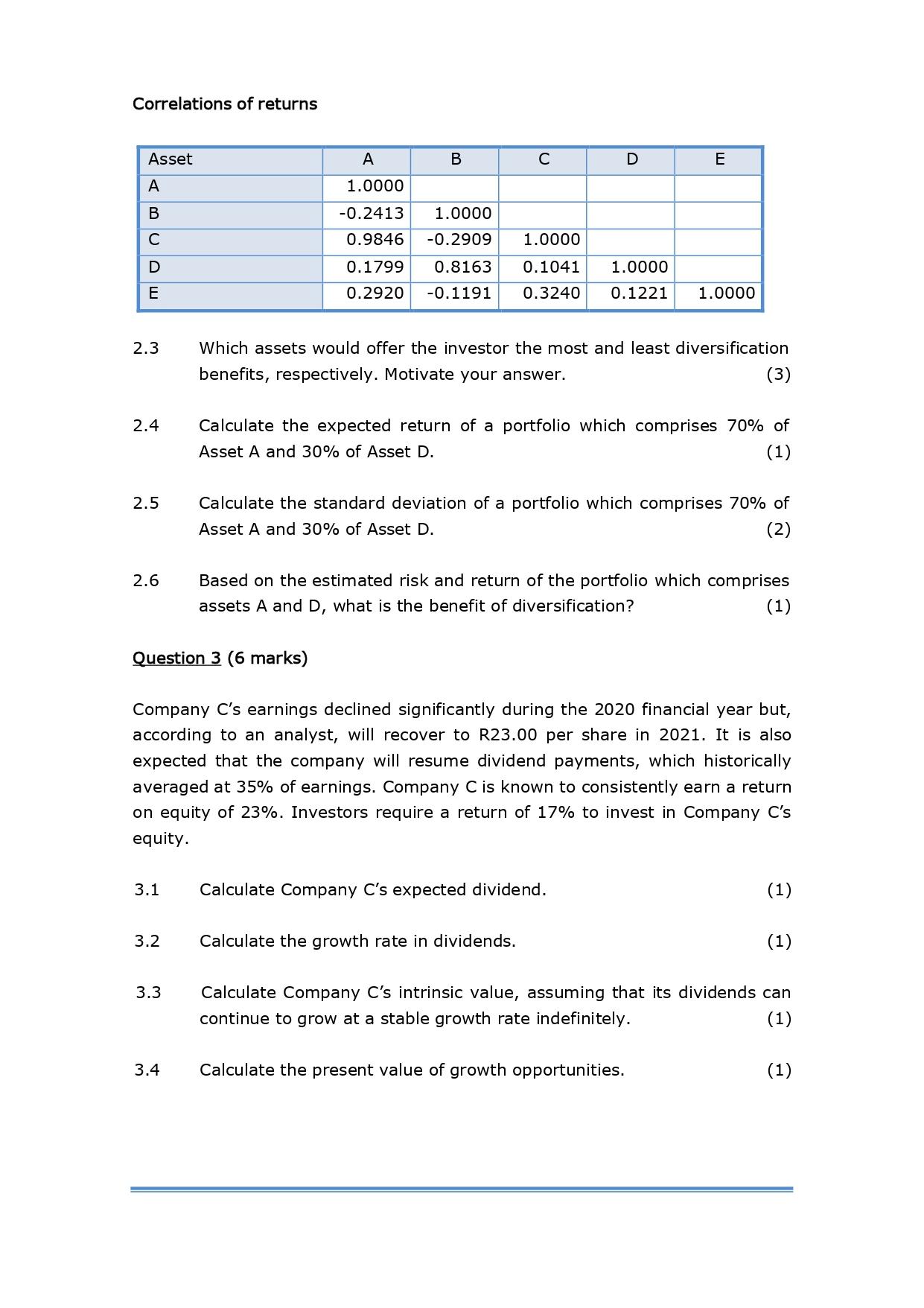

Correlations of returns Asset A B C D E 2.3 2.4 2.5 2.6 3.1 3.2 Question 3 (6 marks) 3.3 B 3.4 A 1.0000 -0.2413 1.0000 0.9846 -0.2909 1.0000 0.1799 0.8163 0.1041 1.0000 0.2920 -0.1191 0.3240 0.1221 C D Which assets would offer the investor the most and least diversification benefits, respectively. Motivate your answer. E Calculate the expected return of a portfolio which comprises 70% of Asset A and 30% of Asset D. (1) Company C's earnings declined significantly during the 2020 financial year but, according to an analyst, will recover to R23.00 per share in 2021. It is also expected that the company will resume dividend payments, which historically averaged at 35% of earnings. Company C is known to consistently earn a return on equity of 23%. Investors require a return of 17% to invest in Company C's equity. 1.0000 Calculate the standard deviation of a portfolio which comprises 70% of Asset A and 30% of Asset D. (2) Calculate Company C's expected dividend. Calculate the growth rate in dividends. Based on the estimated risk and return of the portfolio which comprises assets A and D, what is the benefit of diversification? (1) (3) Calculate the present value of growth opportunities. (1) (1) Calculate Company C's intrinsic value, assuming that its dividends can continue to grow at a stable growth rate indefinitely. (1) (1)

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Question 1 To calculate the value of stable growth we can use the Gordon Growth Model Value of stable growth Dividend Cost of equity Stable gro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started