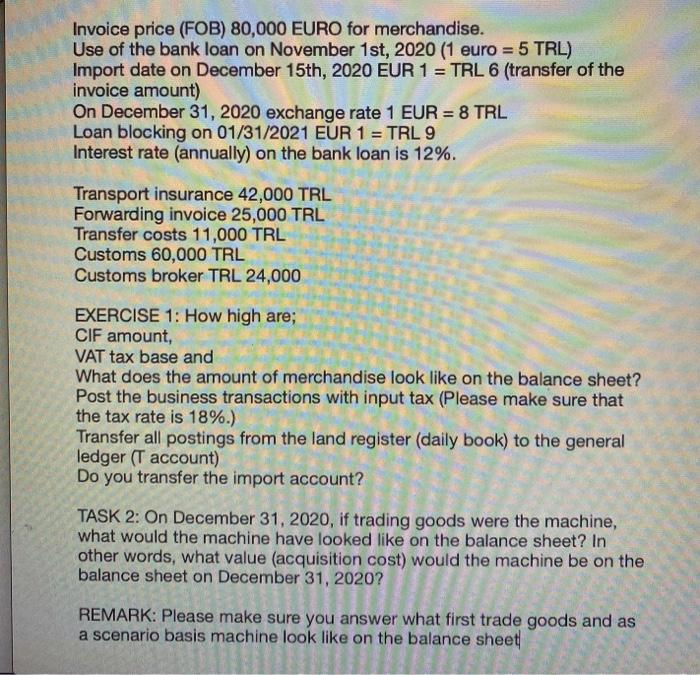

Invoice price (FOB) 80,000 EURO for merchandise. Use of the bank loan on November 1st, 2020 (1 euro = 5 TRL) Import date on December 15th, 2020 EUR 1 = TRL 6 (transfer of the invoice amount) On December 31, 2020 exchange rate 1 EUR = 8 TRL Loan blocking on 01/31/2021 EUR 1 = TRL 9 Interest rate (annually) on the bank loan is 12%. Transport insurance 42,000 TRL Forwarding invoice 25,000 TRL Transfer costs 11,000 TRL Customs 60,000 TRL Customs broker TRL 24,000 EXERCISE 1: How high are; CIF amount, VAT tax base and What does the amount of merchandise look like on the balance sheet? Post the business transactions with input tax (Please make sure that the tax rate is 18%.) Transfer all postings from the land register (daily book) to the general ledger (T account) Do you transfer the import account? TASK 2: On December 31, 2020, if trading goods were the machine, what would the machine have looked like on the balance sheet? In other words, what value (acquisition cost) would the machine be on the balance sheet on December 31, 2020? REMARK: Please make sure you answer what first trade goods and as a scenario basis machine look like on the balance sheet Invoice price (FOB) 80,000 EURO for merchandise. Use of the bank loan on November 1st, 2020 (1 euro = 5 TRL) Import date on December 15th, 2020 EUR 1 = TRL 6 (transfer of the invoice amount) On December 31, 2020 exchange rate 1 EUR = 8 TRL Loan blocking on 01/31/2021 EUR 1 = TRL 9 Interest rate (annually) on the bank loan is 12%. Transport insurance 42,000 TRL Forwarding invoice 25,000 TRL Transfer costs 11,000 TRL Customs 60,000 TRL Customs broker TRL 24,000 EXERCISE 1: How high are; CIF amount, VAT tax base and What does the amount of merchandise look like on the balance sheet? Post the business transactions with input tax (Please make sure that the tax rate is 18%.) Transfer all postings from the land register (daily book) to the general ledger (T account) Do you transfer the import account? TASK 2: On December 31, 2020, if trading goods were the machine, what would the machine have looked like on the balance sheet? In other words, what value (acquisition cost) would the machine be on the balance sheet on December 31, 2020? REMARK: Please make sure you answer what first trade goods and as a scenario basis machine look like on the balance sheet