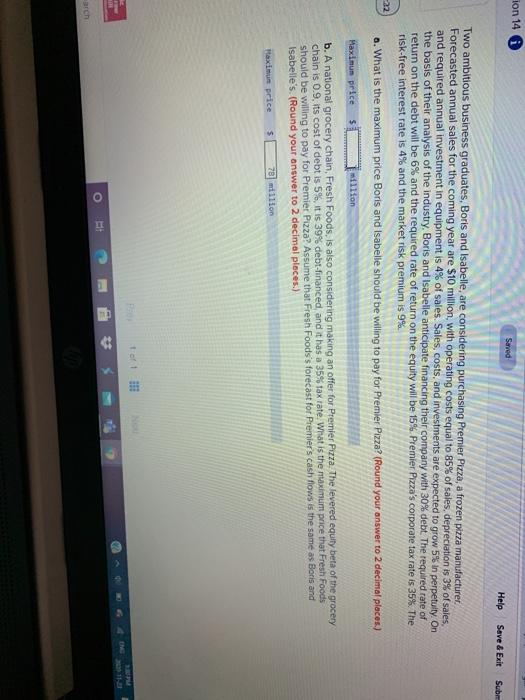

ion 14 Served Help Save & Exit Sub -22 Two ambitious business graduates, Boris and Isabelle, are considering purchasing Premier Pizza, a frozen pizza manufacturer. Forecasted annual sales for the coming year are $10 million, with operating costs equal to 85% of sales, depreciation is 3% of sales. and required annual investment in equipment is 4% of sales Sales, costs, and investments are expected to grow 5% in perpetuity. On the basis of their analysis of the industry, Boris and Isabelle anticipate financing their company with 30% debt. The required rate of return on the debt will be 6% and the required rate of return on the equity will be 15% Premier Pizza's corporate tax rate is 35%. The risk-free interest rate is 4% and the market risk premium is 9% o. What is the maximum price Boris and Isabelle should be willing to pay for Premier Pizza? (Round your answer to 2 decimal places.) Maximun price $ i willion b. A national grocery chain, Fresh Foods is also considering making an offer for Premier Pizza. The levered equity beta of the grocery chain is 0.9, its cost of debt is 5%, it is 39% debt-financed and it has a 35% tax rate. What is the maximum price that Fresh Foods should be willing to pay for Premier Pizza? Assume that Fresh Foods's forecast for Premiers cash flows is the same as Boris and Isabelle's. (Round your answer to 2 decimal places.) Haximus price $ 78 millon i ion 14 Served Help Save & Exit Sub -22 Two ambitious business graduates, Boris and Isabelle, are considering purchasing Premier Pizza, a frozen pizza manufacturer. Forecasted annual sales for the coming year are $10 million, with operating costs equal to 85% of sales, depreciation is 3% of sales. and required annual investment in equipment is 4% of sales Sales, costs, and investments are expected to grow 5% in perpetuity. On the basis of their analysis of the industry, Boris and Isabelle anticipate financing their company with 30% debt. The required rate of return on the debt will be 6% and the required rate of return on the equity will be 15% Premier Pizza's corporate tax rate is 35%. The risk-free interest rate is 4% and the market risk premium is 9% o. What is the maximum price Boris and Isabelle should be willing to pay for Premier Pizza? (Round your answer to 2 decimal places.) Maximun price $ i willion b. A national grocery chain, Fresh Foods is also considering making an offer for Premier Pizza. The levered equity beta of the grocery chain is 0.9, its cost of debt is 5%, it is 39% debt-financed and it has a 35% tax rate. What is the maximum price that Fresh Foods should be willing to pay for Premier Pizza? Assume that Fresh Foods's forecast for Premiers cash flows is the same as Boris and Isabelle's. (Round your answer to 2 decimal places.) Haximus price $ 78 millon