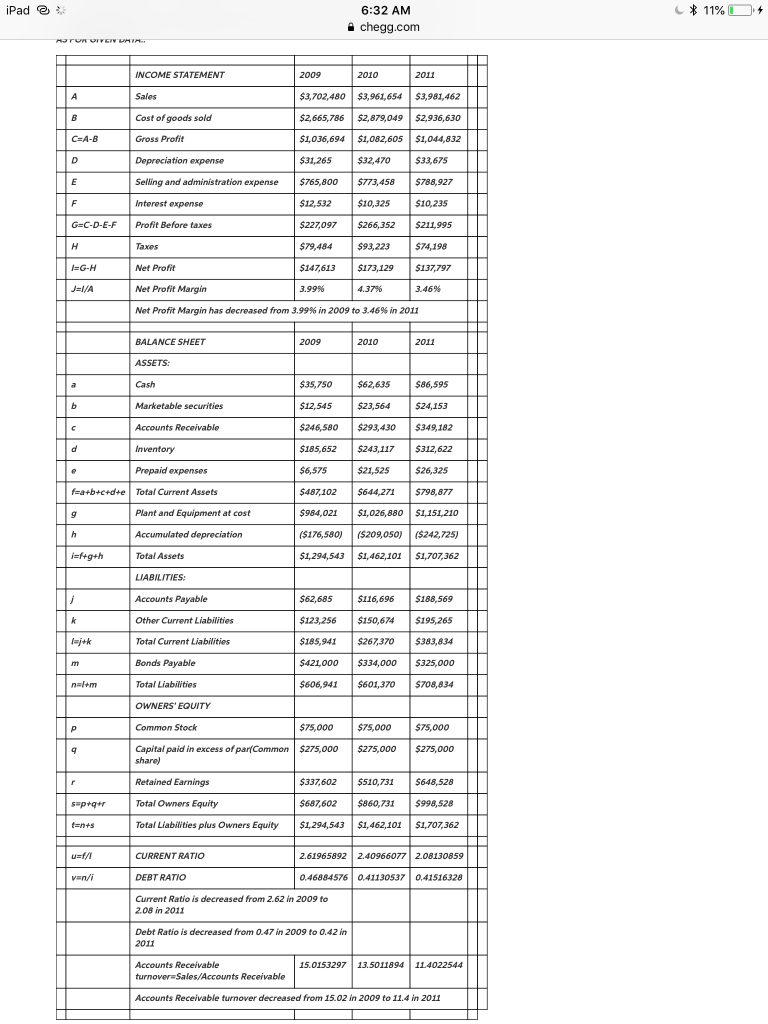

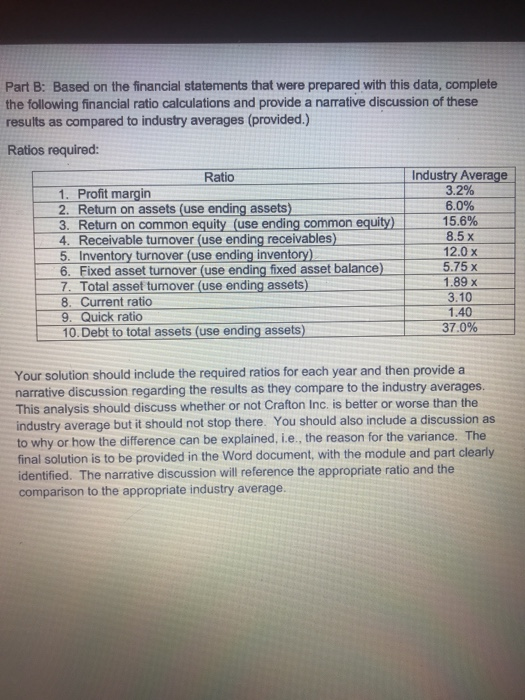

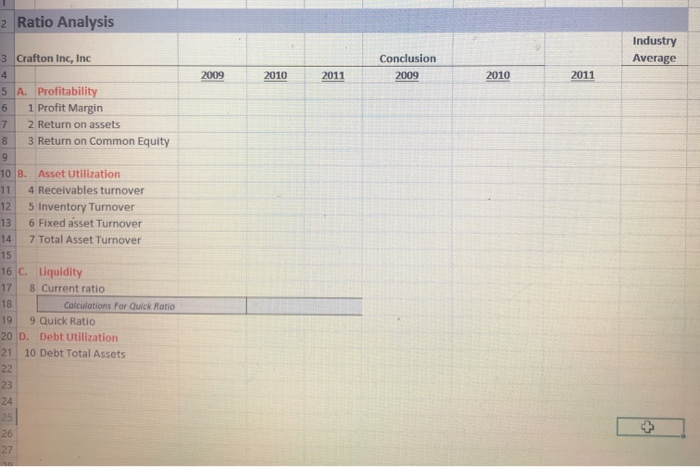

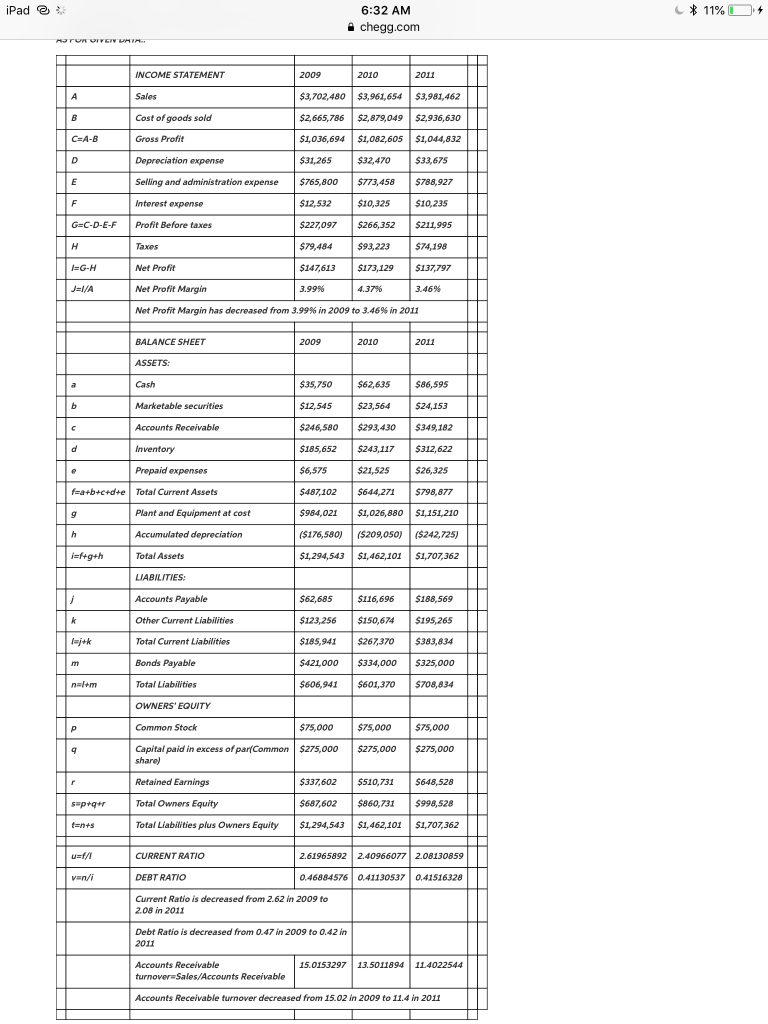

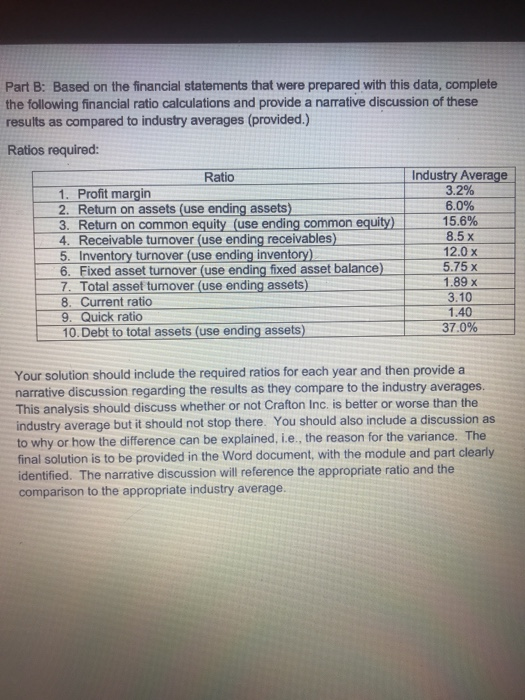

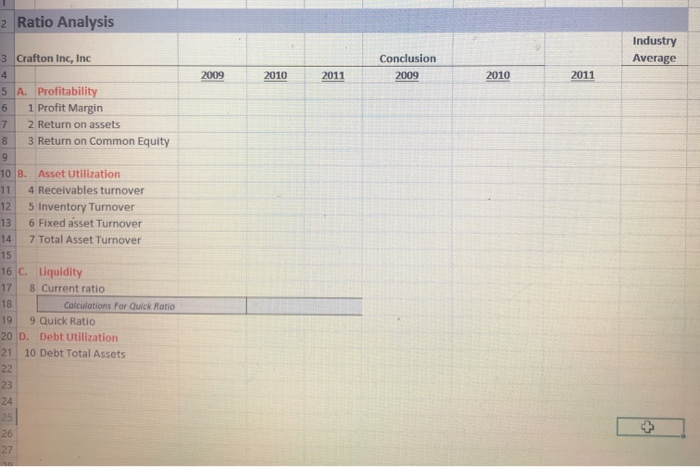

iPad C* 11%O 6:32 AM A chegg.com INCOME STATEMENT 2009 2010 2011 Sales $3,702,480 $3,961,654 Cost of goods sold Gross Profit $3,981,462 $2,936,630 $1,044,832 $2,665,786 $1,036,694 $31,265 $765,800 $2,879,049 $1,082,605 $32,470 $773,458 Depreciation expense $33,675 Selling and administration expense 5788,927 Interest expense $12,532 $10,325 $10.235 G-C-D-E-F Profit Before taxes $227,097 $266,352 5211,995 Taxes $79,484 $93,223 574,198 G-H Jel/A Net Profit $147,613 $173,129 $137,797 Net Profit Margin 3.99% 4.37% 3.46% Net Profit Margin has decreased from 3.99% in 2009 to 3.46% in 2011 BALANCE SHEET 2009 2010 2011 ASSETS: Cash $35,750 $12,545 $62,635 $23,564 Marketable securities $24,153 Accounts Receivable $246,580 $293,430 $349,182 Inventory $185,652 $312,622 $243,117 $21,525 Prepaid expenses $6,575 $26,325 farb+c+dte Total Current Assets $487,102 $644,271 $798,877 $984,021 $1,026,880 $1,151,210 Plant and Equipment at cost Accumulated depreciation ($176,580) $1,294,543 ($209,050) $1,462,101 ($242,725) $1,707,362 lefugih Total Assets LIABILITIES: Accounts Payable $62,685 $116,696 $188,569 $195.265 Other Current Liabilities $123,256 $150,674 yok Total Current Liabilities $185,941 Bonds Payable $421,000 $606,941 $267,370 $334,000 $601,370 $383,834 $325,000 5708,834 nalam Total Liabilities OWNERS' EQUITY Common Stock $75,000 Capital paid in excess of par(Common $275,000 shared $75,000 $275,000 $75,000 $275,000 Retained Earnings $337,602 $510,731 5648,528 spiger Total Owners Equity $687,602 $860,731 $998,528 Total Liabilities plus Owners Equity $1.294,543 $1,462,101 $1,707,362 CURRENT RATIO 2.61965892 2.40966077 2.08130859 0.46884576 0.41130537 0.41516328 veni DEBT RATIO Current Ratio is decreased from 2.62 in 2009 to 2.08 in 2011 Debt Ratio is decreased from 0.47 in 2009 to 0.42 in 2011 Accounts Receivable turnover Sales/Accounts Receivable 15.0153297 13.5011894 114022544 Accounts Receivable turnover decreased from 15.02 in 2009 to 11.4 in 2011 Part B: Based on the financial statements that were prepared with this data, complete the following financial ratio calculations and provide a narrative discussion of these results as compared to industry averages (provided.) Ratios required: Ratio 1. Profit margin 2. Return on assets (use ending assets) 3. Return on common equity (use ending common equity) 4. Receivable turnover (use ending receivables) 5. Inventory turnover (use ending inventory) 6. Fixed asset turnover (use ending fixed asset balance) 7. Total asset tumover (use ending assets) 8. Current ratio 9. Quick ratio 10. Debt to total assets (use ending assets) Industry Average 3.2% 6.0% 15.6% 8.5 x 12.0 x 5.75 x 1.89 x 3.10 1.40 37.0% Your solution should include the required ratios for each year and then provide a narrative discussion regarding the results as they compare to the industry averages This analysis should discuss whether or not Crafton Inc. is better or worse than the industry average but it should not stop there. You should also include a discussion as to why or how the difference can be explained, i.e., the reason for the variance. The final solution is to be provided in the Word document, with the module and part clearly identified. The narrative discussion will reference the appropriate ratio and the comparison to the appropriate industry average. 2 Ratio Analysis Industry Average 3 Crafton Inc, Inc Conclusion 2009 2009 2010 2011 2010 2011 5 6 7 8 A. Profitability 1 Profit Margin 2 Return on assets 3 Return on Common Equity 10 B. Asset utilization 11 4 Receivables turnover 12 5 Inventory Turnover 13 6 Fixed asset Turnover 14 7 Total Asset Turnover 15 16 C. Liquidity 17 8. Current ratio 18 Calculations For Quick Ratio 19 9 Quick Ratio 20 D. Debt utilization 21 10 Debt Total Assets 23