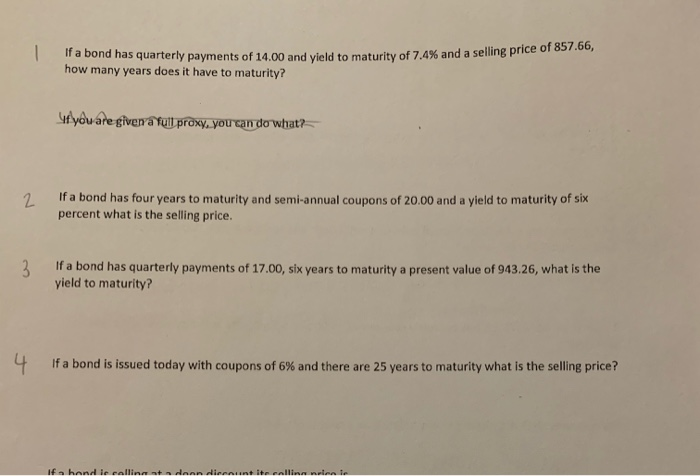

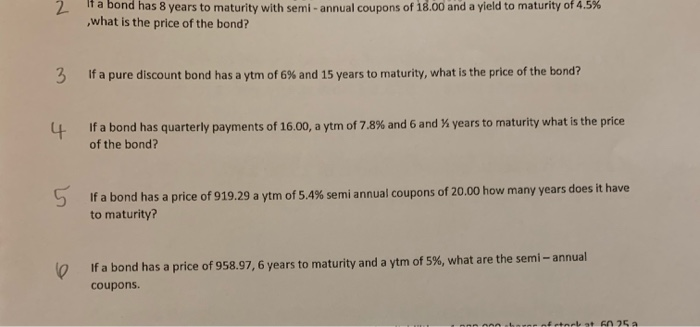

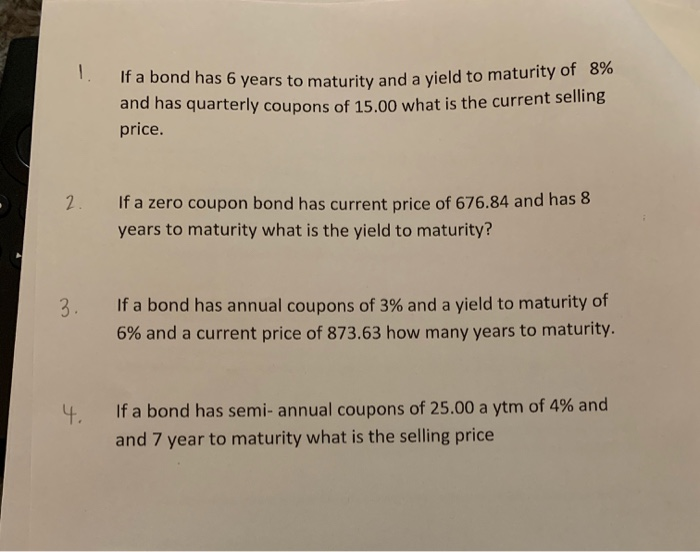

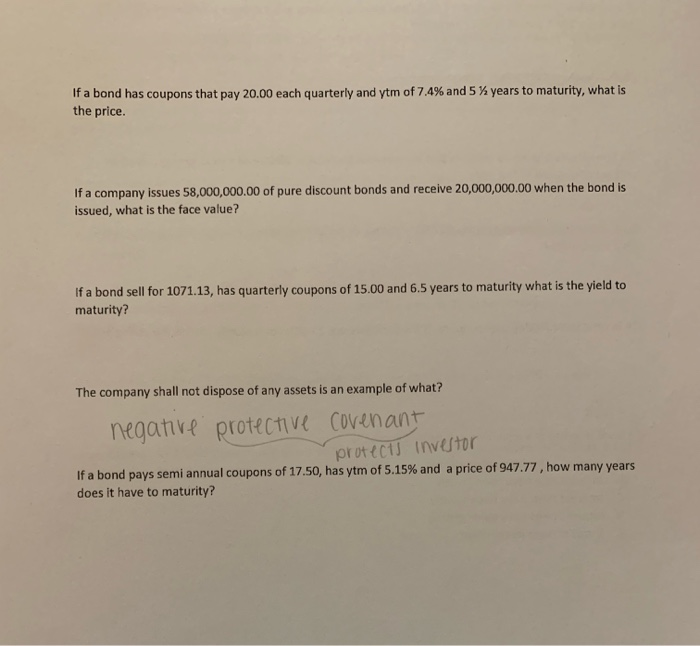

Ir a bond has quarterly payments of 14.00 and violta maturity of 74% and a selling price how many years does it have to maturity? 4f you are given a full proxy, you can do what? If a bond has four years to maturity and semi-annual coupons of 20.00 and a yield to maturity of six percent what is the selling price. If a bond has quarterly payments of 17.00, six years to maturity a present value of 943.26, what is the yield to maturity? 9 if a bond is issued today with coupons of 6% and there are 25 years to maturity what is the selling price? I bondie rolling dann einnite pallinn vele le 2 If a bond has 8 years to maturity with semi-annual coupons of 18.00 and a yield to maturity of 4.5% what is the price of the bond? 3 If a pure discount bond has a ytm of 6% and 15 years to maturity, what is the price of the bond? years to maturity what is the price if a bond has quarterly payments of 16.00, aytm of 7.8% and 6 and of the bond? If a bond has a price of 919.29 aytm of 5.4% semiannual coupons of 20.00 how many years does it have to maturity? If a bond has a price of 958.97, 6 years to maturity and a ytm of 5%, what are the semi-annual coupons. nnn na trl+ 6025 a bond has 6 years to maturity and a yield to maturity of 8% and has quarterly coupons of 15.00 what is the current selling price. 2. If a zero coupon bond has current price of 676.84 and has 8 years to maturity what is the yield to maturity?! 3. If a bond has annual coupons of 3% and a yield to maturity of 6% and a current price of 873.63 how many years to maturity. 4. If a bond has semi-annual coupons of 25.00 a ytm of 4% and and 7 year to maturity what is the selling price If a bond has coupons that pay 20.00 each quarterly and ytm of 7.4% and 5 the price. years to maturity, what is If a company issues 58,000,000.00 of pure discount bonds and receive 20,000,000.00 when the bond is issued, what is the face value? If a bond sell for 1071.13, has quarterly coupons of 15.00 and 6.5 years to maturity what is the yield to maturity? The company shall not dispose of any assets is an example of what? negative protective covenant protects Investor If a bond pays semi annual coupons of 17.50, has ytm of 5.15% and a price of 947.77, how many years does it have to maturity? Ir a bond has quarterly payments of 14.00 and violta maturity of 74% and a selling price how many years does it have to maturity? 4f you are given a full proxy, you can do what? If a bond has four years to maturity and semi-annual coupons of 20.00 and a yield to maturity of six percent what is the selling price. If a bond has quarterly payments of 17.00, six years to maturity a present value of 943.26, what is the yield to maturity? 9 if a bond is issued today with coupons of 6% and there are 25 years to maturity what is the selling price? I bondie rolling dann einnite pallinn vele le 2 If a bond has 8 years to maturity with semi-annual coupons of 18.00 and a yield to maturity of 4.5% what is the price of the bond? 3 If a pure discount bond has a ytm of 6% and 15 years to maturity, what is the price of the bond? years to maturity what is the price if a bond has quarterly payments of 16.00, aytm of 7.8% and 6 and of the bond? If a bond has a price of 919.29 aytm of 5.4% semiannual coupons of 20.00 how many years does it have to maturity? If a bond has a price of 958.97, 6 years to maturity and a ytm of 5%, what are the semi-annual coupons. nnn na trl+ 6025 a bond has 6 years to maturity and a yield to maturity of 8% and has quarterly coupons of 15.00 what is the current selling price. 2. If a zero coupon bond has current price of 676.84 and has 8 years to maturity what is the yield to maturity?! 3. If a bond has annual coupons of 3% and a yield to maturity of 6% and a current price of 873.63 how many years to maturity. 4. If a bond has semi-annual coupons of 25.00 a ytm of 4% and and 7 year to maturity what is the selling price If a bond has coupons that pay 20.00 each quarterly and ytm of 7.4% and 5 the price. years to maturity, what is If a company issues 58,000,000.00 of pure discount bonds and receive 20,000,000.00 when the bond is issued, what is the face value? If a bond sell for 1071.13, has quarterly coupons of 15.00 and 6.5 years to maturity what is the yield to maturity? The company shall not dispose of any assets is an example of what? negative protective covenant protects Investor If a bond pays semi annual coupons of 17.50, has ytm of 5.15% and a price of 947.77, how many years does it have to maturity