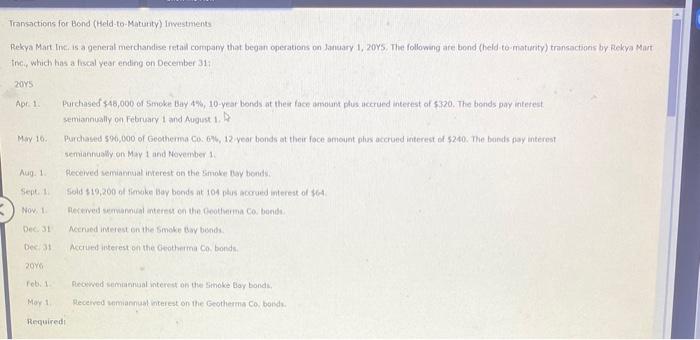

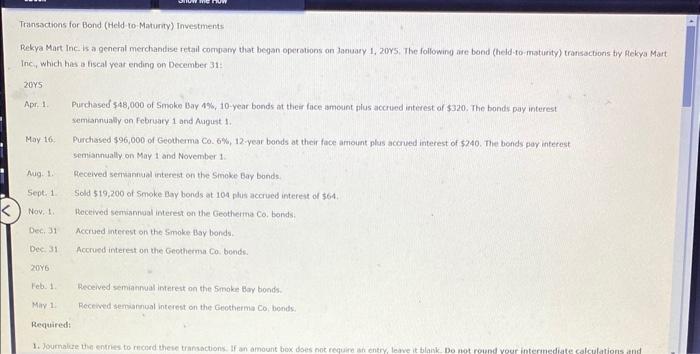

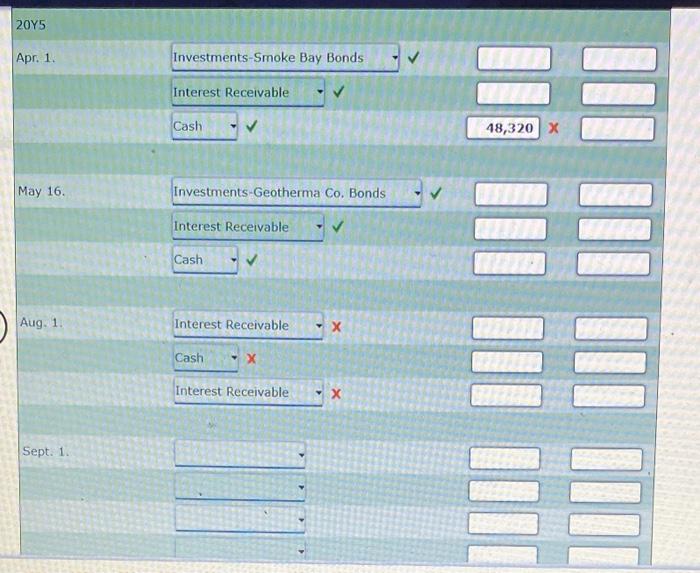

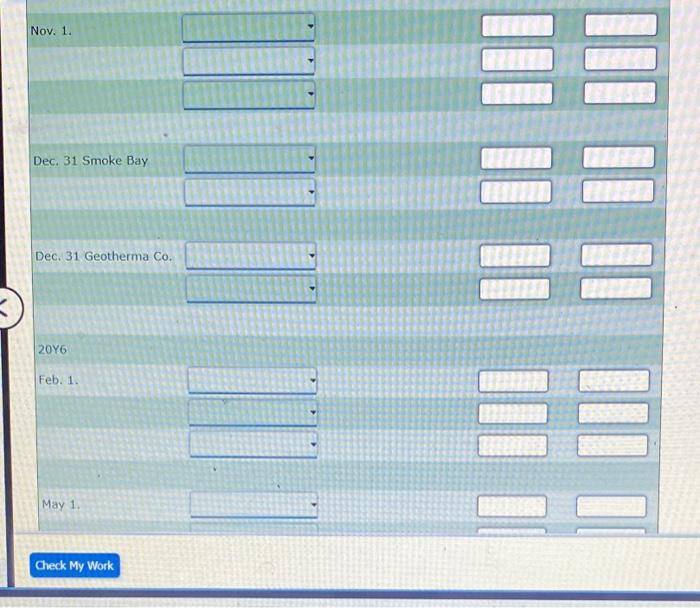

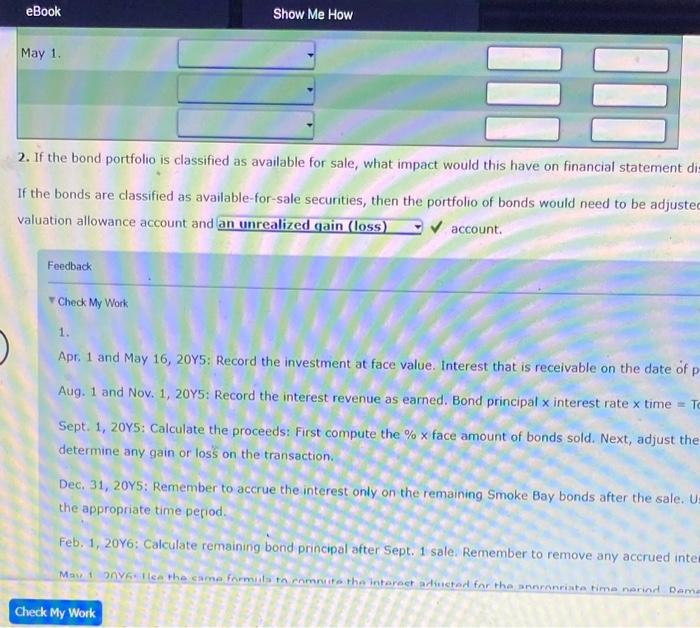

Iransthens for tond (Heid-to-Matunty) investirents Rekya Mart Lik. is a general merchandise retall compamy that began operations on Jareary 1, 20Ys. The following are bond (held-to-matienty) transacions by Rekya Mart Incy, which has a fiscal year ending on December 31: 205 Apr.1. Furchased 448,000 or Smoke Bay 4%,10-year bonds at then face amount plus accrued interest of s320. The bonds pay interest. semiannually os February 1 and August. 1 . May 16. Parchased 590,000 of Geothemma C0,676,12 year bonds at their foce amount phas accrued interest of 5240 . The bands pay interest semianndaly on May 1 and Novenser 1. hug. 1. feccerved semianrial interest on the Simoke tay bonds. Non.1. Rerened semannual intereg on the Deotherma Co. bondi: Dec.31 Acenaed imerest on the smoke day bunda. Desian Accrued inserest en the Geotherina Co. bonds. 206 feb.1. Reowod semannual intereat on the Smoke Boy bonds, Mor 1 Recerved uamiannuat interest on the Geothenma Co, bonds. Required Transactions for Bond (Held-to-Maturiy) Investments Rekya Mart Ine is a general merchandise petail cornyany that began operotions on January 1, 20ys; The following are bond (held-to-maturity) transactons ty Aekya Mart Inc, which has a fiscal vear ending on December 31 : 20Y5 Apr. 1. Purchased $48,000 of Smoke Bay 4%,10-year bonds at their face-smeunt plus accrued interest of $320. The bonds pay interest semannualey on Febryacy 1 and August 1 . May 16: Purchesed $96,000 of Geothema Co. 6%,12 year bonds at their face arnount plus aconued interest of $240. The bonds pay inferest semiannually on May 1 and November 1. Aug. 1. Received sermannual interent on the Smoke Eay bonds. Sept:- Sold 519,200 of Smoke Bary bonds at 104 plis accrued interest of 564 . Nov, L. Aoceived semiannual interest on the Geothemma Co. bonds: Dec. 31 Accrued interest on the Smoke bay bonds. Des. 31 Accrued interet on the Geotherma. Co. boode. 206 Feb.1. Received semannual interest on the Smoke Eay bonds. May 1: Received seriannoal interest on the Geotherma Co, bends: Required: 1. Joumaleze Ue entries to meced theie transactions. If an amount box does not reguire an entry, leave it blank. Do mot rount vour intermediate calculations and 20Y5 Apr. 1. May 16. Investments-Geotherma Co. Bonds Interest Receivable Cash Aug. 1. Sept. 1. Nov. 1. Dec. 31 Smoke Bay Dec. 31 Geotherma Co. 20Y6 Feb. 1. May 1. Check My Work 2. If the bond portfolio is classified as available for sale, what impact would this have on financial statement di If the bonds are classified as available-for-sale securities, then the portfolio of bonds would need to be adjuste valuation allowance account and account. Feedback v Check My Work 1. Apr. 1 and May 16, 20Y5: Record the investment at face value. Interest that is receivable on the date of Aug. 1 and Nov. 1, 20Y5: Record the interest revenue as earned. Bond principal x interest rate x time =T Sept. 1, 20YS: Calculate the proceeds: First compute the % face amount of bonds sold. Next, adjust the determine any gain or lossis on the transaction. Dec. 31, 20Y5: Remember to accrue the interest only on the remaining Smoke Bay bonds after the sale. U the appropriate time period. Feb. 1, 20Y6: Calculate remaining bond principal after Sept. 1 sale. Remember to remove any accrued inte