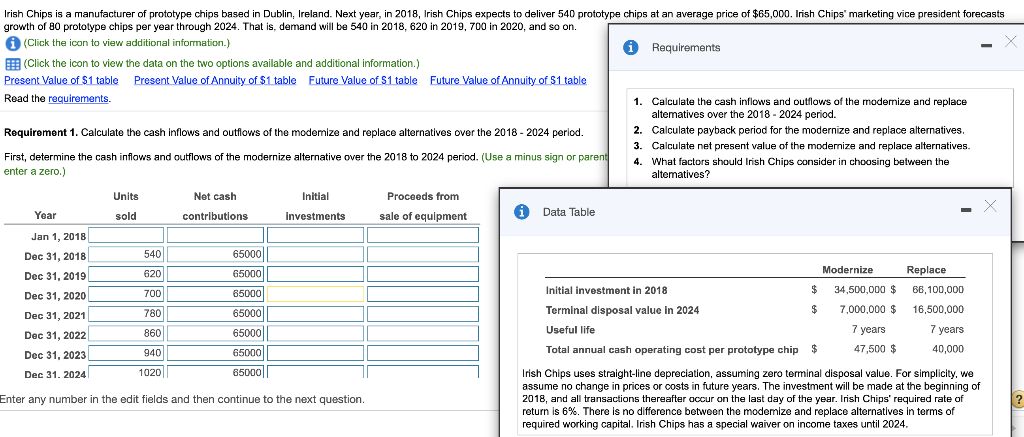

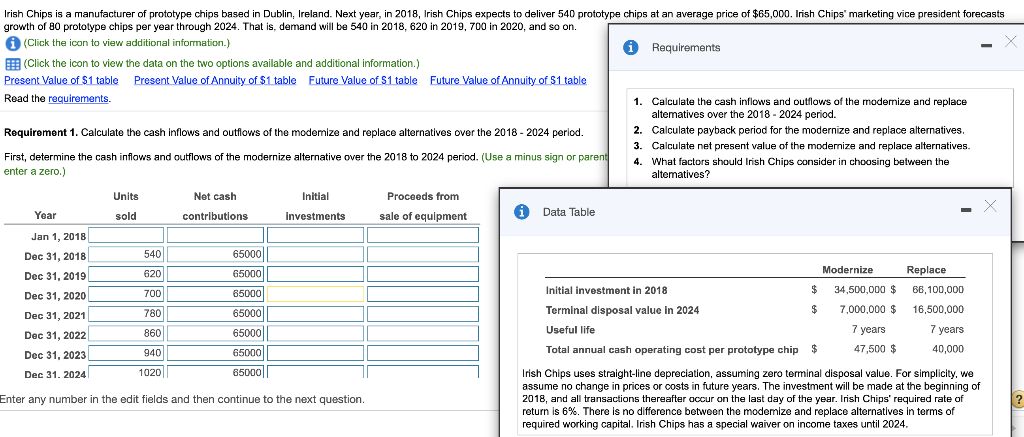

Irish Chips is a manufacturer of prototype chips based in Dublin, Ireland. Next year, in 2018, Irish Chips expects to deliver 540 prototype chips at an average price of $65,000. Irish Chips' marketing vice president forecasts growth of 80 prototype chips per year through 2024. That is, demand will be 540 in 2018, 620 in 2019, 700 in 2020, and so on. (Click the icon to view additional information.) Requirements (Click the icon to view the data on the two options available and additional information.) Present Value of $1 table Present Value of Annuity of $1 table Future Value of $1 table Future Value of Annuity of $1 table Read the requirements. 1. Calculate the cash inflows and outflows of the modemize and replace altematives over the 2018 - 2024 period. Requirement 1. Calculate the cash inflows and outflows of the modemize and replace alternatives over the 2018 - 2024 period. 2. Calculate payback period for the modernize and replace alternatives. 3. Calculate net present value of the modernize and replace alternatives. First, determine the cash inflows and outflows of the modernize alternative over the 2018 to 2024 period. (Use a minus sign or parent 4. What factors should Irish Chips consider in choosing between the enter a zero.) altematives? Initial Proceeds from Units sold Net cash contributions Year Investments sale of equipment i Data Table Jan 1, 2018 Dec 31, 2018 Dec 31, 2019 Dec 31, 2020 Dec 31, 2021 Dec 31, 2022 Dec 31, 2023 Dec 31, 2024 780 860 940 1020 65000 65000 65000 65000 65000 65000 65000| Initial investment in 2018 Terminal disposal value in 2024 Useful life Total annual cash operating cost per prototype chip Modernize $ 34,500,000 $ $ 7,000,000 $ 7 years $ 47,500 $ Replace 66,100,000 16,500,000 7 years 40,000 Enter any number in the edit fields and then continue to the next question. Irish Chips uses straight-line depreciation, assuming zero terminal disposal value. For simplicity, we assume no change in prices or costs in future years. The investment will be made at the beginning of 2018, and all transactions thereafter occur on the last day of the year. Irish Chips' required rate of return is 6%. There is no difference between the modernize and replace alternatives in terms of required working capital. Irish Chips has a special waiver on income taxes until 2024