Question

Irons Ltd entered into a non-cancellable, five-year lease agreement on 1 April 2010. The lease was for a piece of equipment, which at inception had

Irons Ltd entered into a non-cancellable, five-year lease agreement on 1 April 2010. The lease was for a piece of equipment, which at inception had a fair value of $1,135,512. The machinery is expected to have an economic life of six years, after which time it will have an expected salvage value of $210,000. There are to be five annual payments of $350,000, the first to be made on 31 March 2011 (i.e. at the end of the year). Included in the $350,000 is $35,000 representing payment to for insurance and maintenance (i.e. Executory costs). Ownership will be transferred at the end of the lease and the implicit interest rate is 12% (to make fair value equal PV of MLP) and straight line depreciation is used (Assume 31 March Year-end).

Question: Explain why the lease payment is not $350,000?

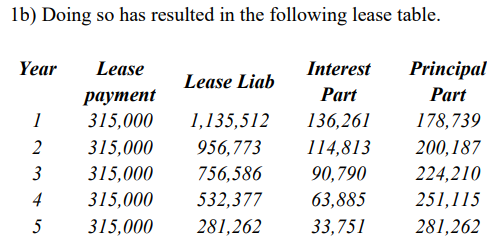

1b) Doing so has resulted in the following lease table. Year Lease Liab Lease payment 315,000 315,000 315,000 315,000 315,000 1,135,512 956,773 756,586 532,377 281,262 Interest Part 136,261 114,813 90,790 63,885 33,751 Principal Part 178,739 200,187 224,210 251,115 281,262Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started