Answered step by step

Verified Expert Solution

Question

1 Approved Answer

is 17 A? is 19 A? #16 - #18 A U.S. company has British pound 2 million payables in 90 days. The company decide to

is 17 A? is 19 A?

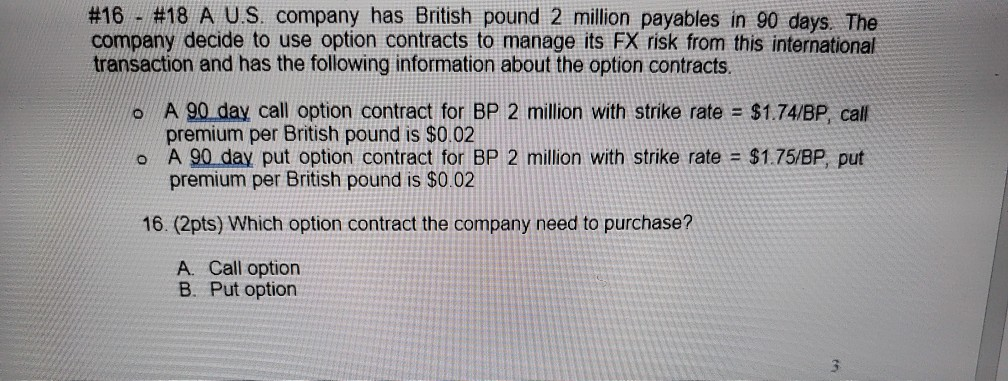

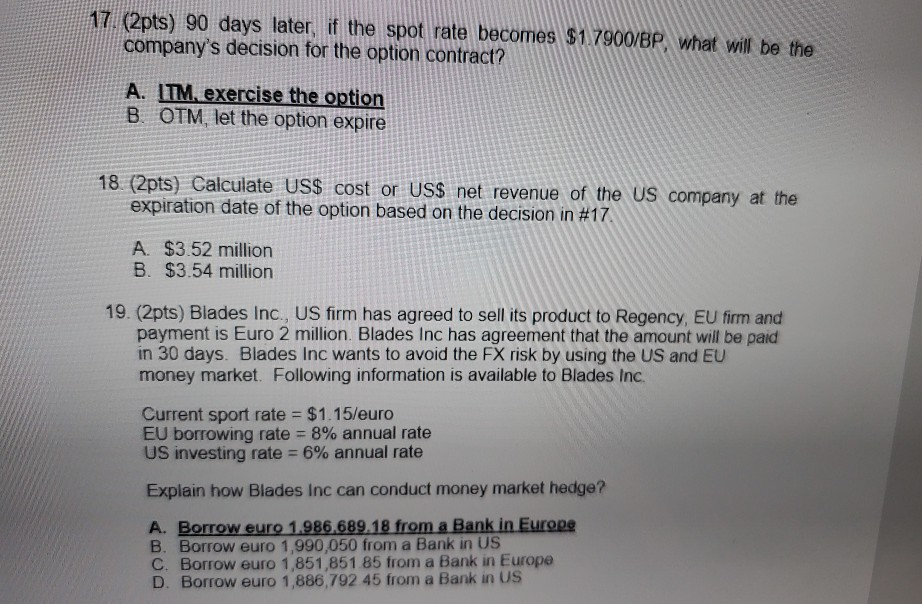

#16 - #18 A U.S. company has British pound 2 million payables in 90 days. The company decide to use option contracts to manage its FX risk from this international transaction and has the following information about the option contracts. 0 A 90 day call option contract for BP 2 million with strike rate = $1.74/BP, call premium per British pound is $0.02 o A 90 day put option contract for BP 2 million with strike rate = $1.75/BP, put premium per British pound is $0.02 16. (2pts) Which option contract the company need to purchase? A. Call option B. Put option 17. (2pts) 90 days later, if the spot rate becomes $1.7900/BP, what will be the company's decision for the option contract? A. ITM, exercise the option B. OTM, let the option expire 18. (2pts) Calculate US$ cost or US$ net revenue of the US company at the expiration date of the option based on the decision in #17 A $3.52 million B. $3.54 million 19. (2pts) Blades Inc., US firm has agreed to sell its product to Regency, EU firm and payment is Euro 2 million. Blades Inc has agreement that the amount will be paid in 30 days. Blades Inc wants to avoid the FX risk by using the US and EU money market. Following information is available to Blades Inc. Current sport rate = $1.15/euro EU borrowing rate = 8% annual rate US investing rate = 6% annual rate Explain how Blades Inc can conduct money market hedge? A. Borrow euro 1.986.689.18 from a Bank in Europe B. Borrow euro 1,990,050 from a Bank in US C. Borrow euro 1,851,851.85 from a Bank in Europe D. Borrow euro 1,886,792.45 from a Bank in USStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started