Answered step by step

Verified Expert Solution

Question

1 Approved Answer

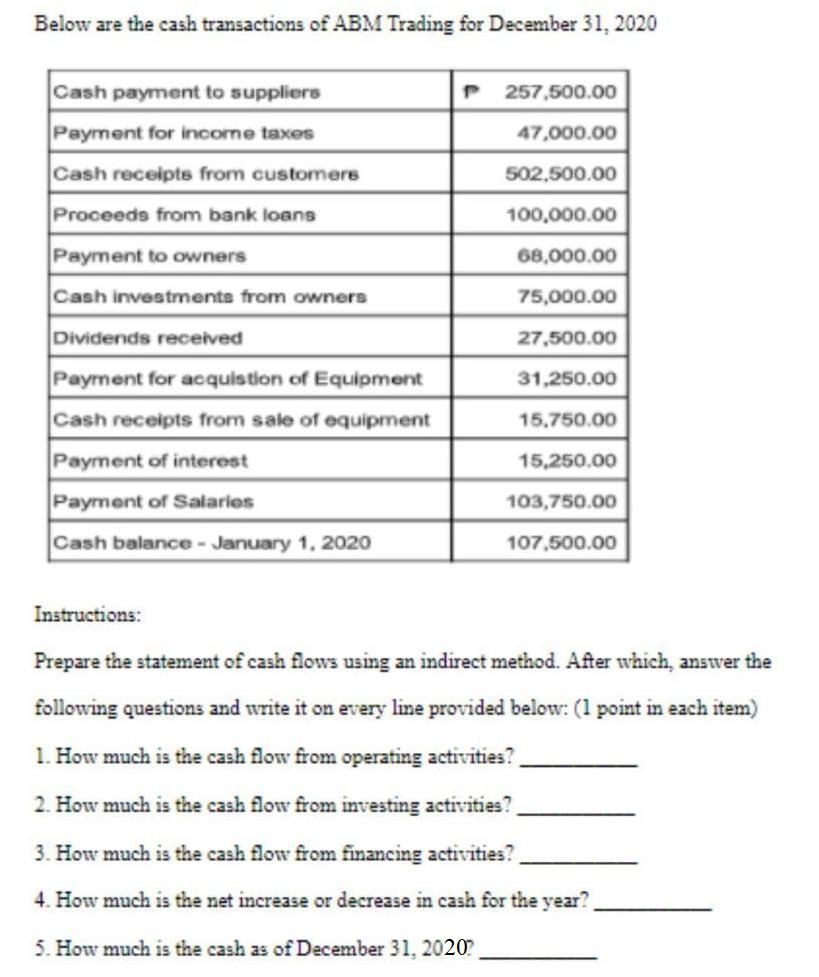

Below are the cash transactions of ABM Trading for December 31, 2020 Cash payment to suppliers Payment for income taxes Cash receipts from customers

Below are the cash transactions of ABM Trading for December 31, 2020 Cash payment to suppliers Payment for income taxes Cash receipts from customers Proceeds from bank loans Payment to owners Cash investments from owners Dividends received Payment for acquistion of Equipment Cash receipts from sale of equipment Payment of interest Payment of Salaries Cash balance - January 1, 2020 P 257,500.00 47,000.00 502,500.00 100,000.00 68,000.00 75,000.00 27,500.00 31,250.00 15,750.00 15,250.00 103,750.00 107,500.00 Instructions: Prepare the statement of cash flows using an indirect method. After which, answer the following questions and write it on every line provided below: (1 point in each item) 1. How much is the cash flow from operating activities? 2. How much is the cash flow from investing activities? 3. How much is the cash flow from financing activities? 4. How much is the net increase or decrease in cash for the year? 5. How much is the cash as of December 31, 2020?

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Statement of cash flow For the year ended December 31 2020 Cash flow from operating activities Cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started