Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Is Apple's explanation for why it adopted the new rules retrospectively clear (exhibit 1)? is it valid? arrangements that include software elements (new accounting principles).

Is Apple's explanation for why it adopted the new rules retrospectively clear (exhibit 1)? is it valid?

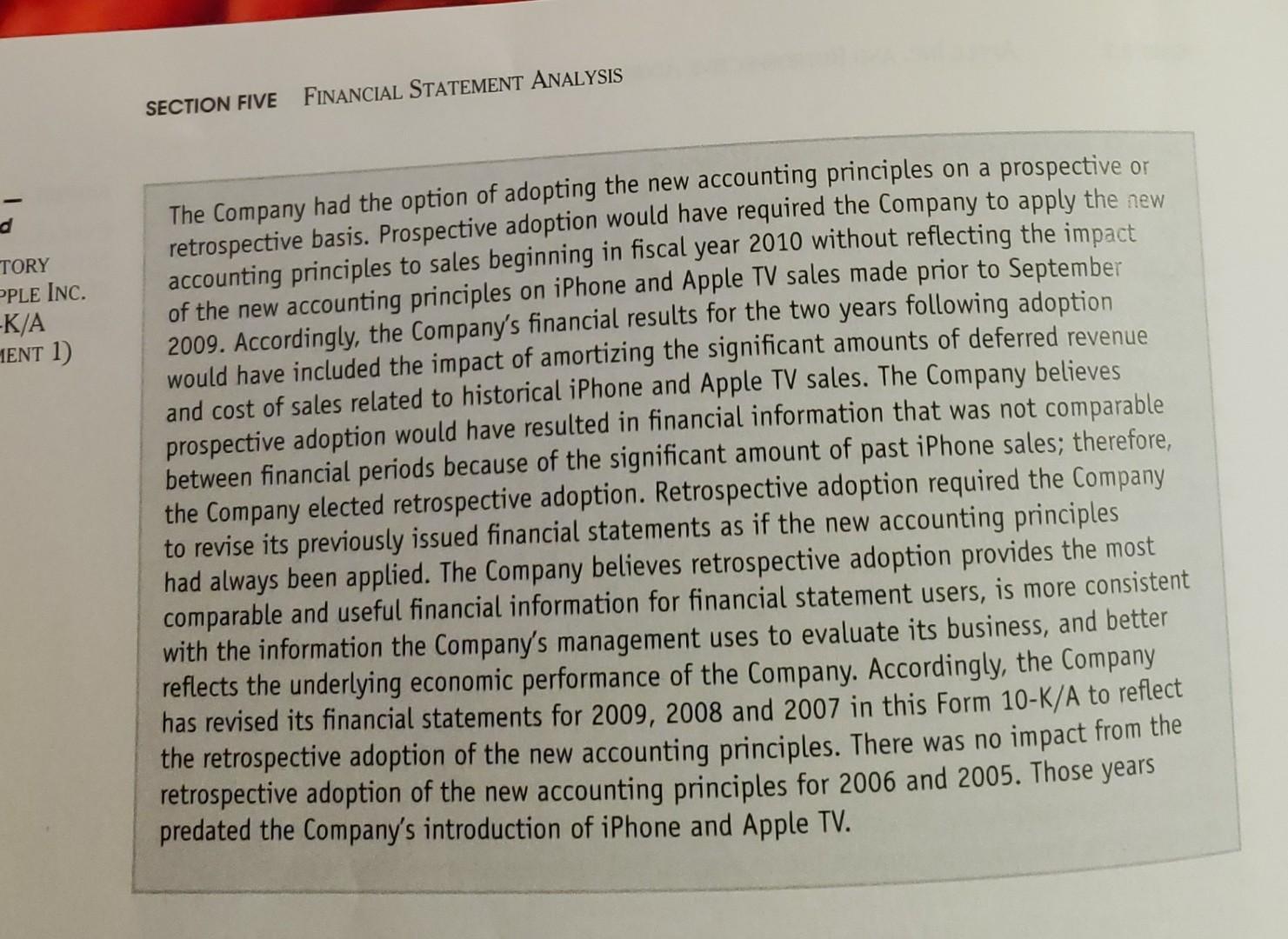

arrangements that include software elements ("new accounting principles"). The new standards related to revenue recognition for arrangements with multiple deliverables and adoption of the Financial Accounting Standards Board's ("FASB") amended accounting 10-K"). As amended by this Form 10-K/A, the Form 10-K reflects the Company's retrospective on October 27, 2009 (the "Original Filing" and together with the Form 10-K/A, the "Form 10-K (the "Form 10-K/A") to amend its Annual Report on Form 10-K for the year ended September 26, 2009, which was filed with the Securities and Exchange Commission ("SEC") Apple Inc. (the "Company") is filing this Amendment No. 1 to the Annual Report on Form APPLE INC. AND RETROSPECTIVE ADOPTION OF REVENUE RECOGNITION RULES CASE 5.3 Explanatory Note E E: No (A accounting principles permit prospective or retrospective adoption, and the Company elected retrospective adoption. The Company adopted the new accounting principles during the first quarter of 2010, as reflected in the Company's financial statements included in its Ouarterly Report on Form 10-Q for the quarter ended December 26, 2009, which was filed with the SEC on January 25, 2010. The new accounting principles significantly change how the Company accounts for certain revenue arrangements that include both hardware and software elements as described further below. Under the historical accounting principles, the Company was required to account for sales of both iPhone and Apple TV using subscription accounting because the Company indicated it might from time-to-time provide future unspecified software upgrades and features for those products free of charge. Under subscription accounting, revenue and associated product cost of sales for iPhone and Apple TV were deferred at the time of sale and recognized on a straight-line basis over each product's estimated economic life. This resulted in the deferral of significant amounts of revenue and cost of sales related to iPhone and Apple TV. Costs incurred by the Company for engineering, sales, marketing and warranty were expensed as incurred. As of September 26, 2009, based on the historical accounting principles, total accumulated deferred revenue and deferred costs associated with past iPhone and Apple TV sales were $12.1 billion and $5.2 billion, respectively. The new accounting principles generally require the Company to account for the sale of both iPhone and Apple TV as two deliverables. The first deliverable is the hardware and software delivered at the time of sale, and the second deliverable is the right included with the purchase of iPhone and Apple TV to receive on a when-and-if-available basis future unspecified software upgrades and features relating to the product's software. The new accounting principles result in the recognition of substantially all of the revenue and product costs from sales of iPhone and Apple TV at the time of sale. Additionally, the Company is required to estimate a standalone selling price for the unspecified software upgrade right included with the sale of iPhone and Apple TV and recognizes that amount ratably over the 24-month estimated life of the related hardware device. For all periods presented, the Company's estimated selling price for the software upgrade right included with each TPhone and Apple TV sold is $25 and $10, respectively. The adoption of the new accounting principles increased the Company's net sales by $6.4 billion, $5.0 billion and $572 million for de, 2008 and 2007, respectively. As of September 26, 2009, the revised total accumulated dererred revenue associated with iPhone and Apple TV sales to date was $483 million; revised accumulated deferred costs for such sales were zero. (continued)

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

It was totally good and valid for Apple to begin to account for its iPhone sales under the new rules ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started