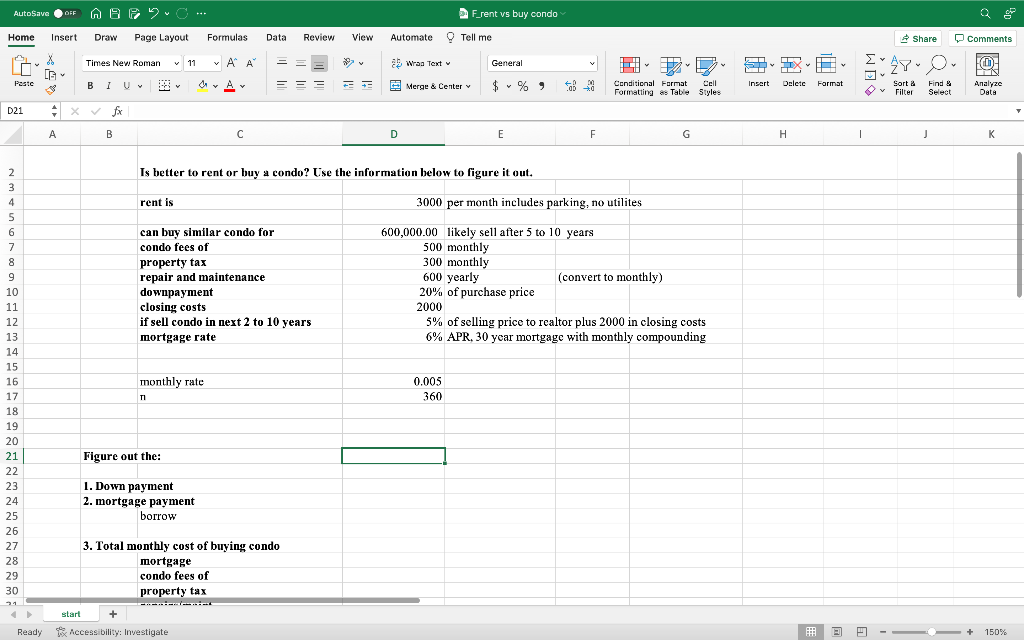

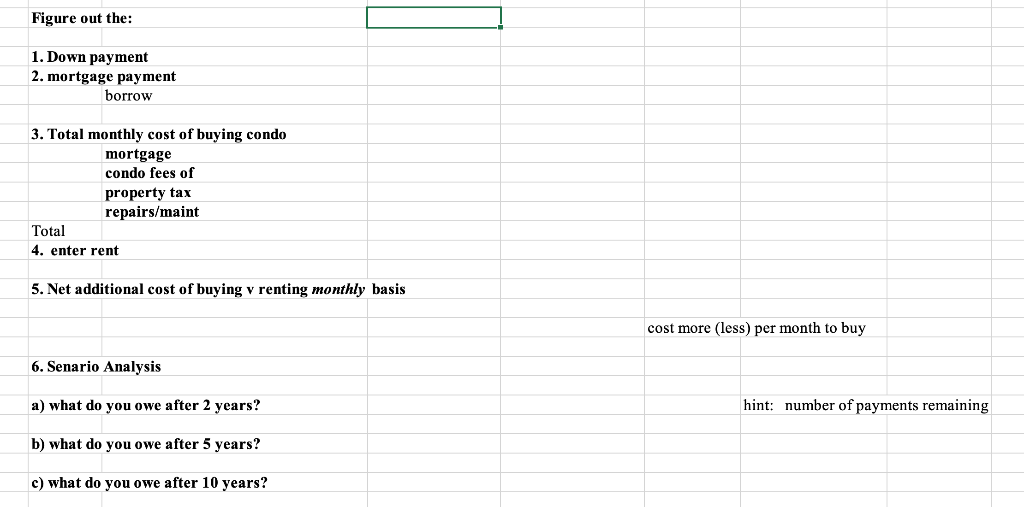

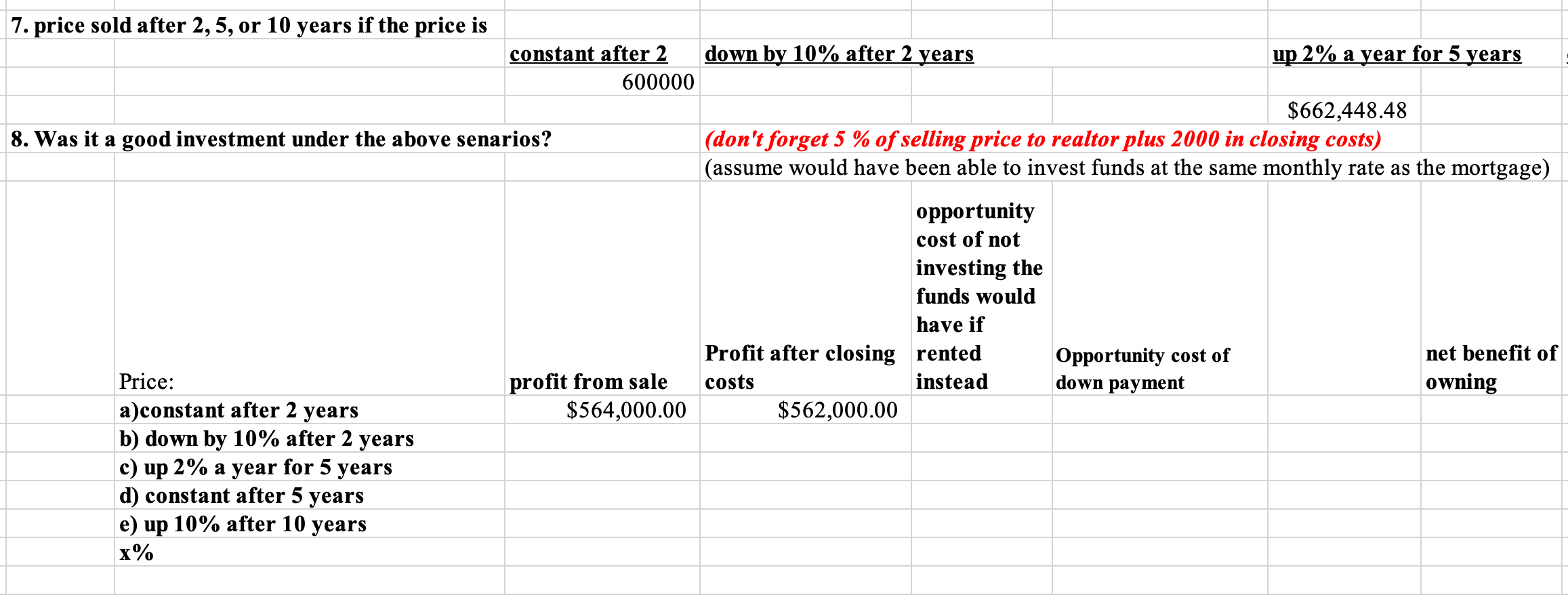

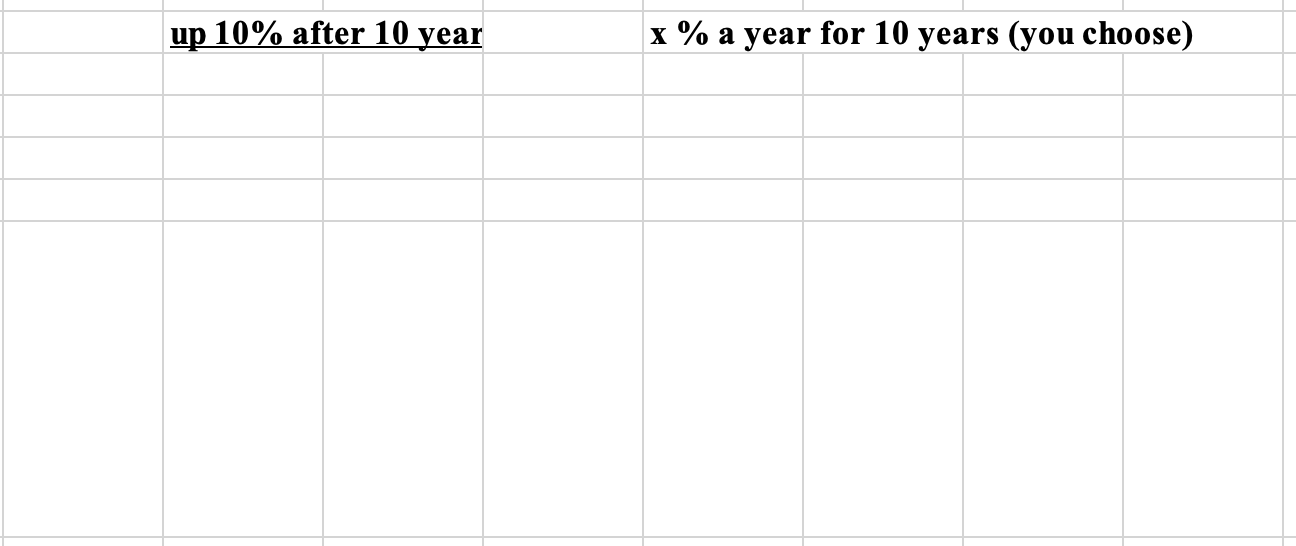

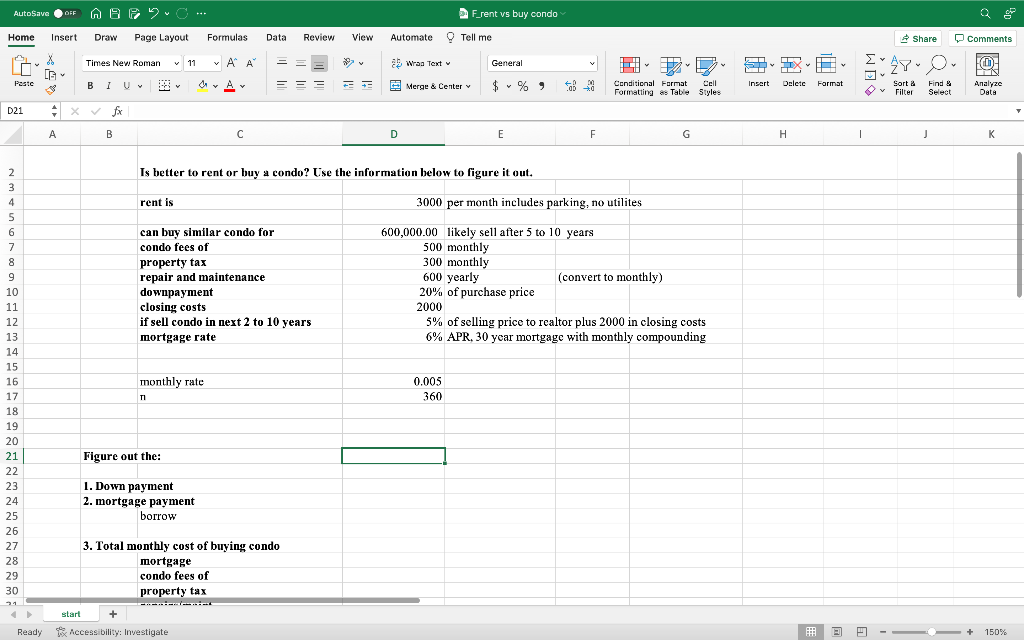

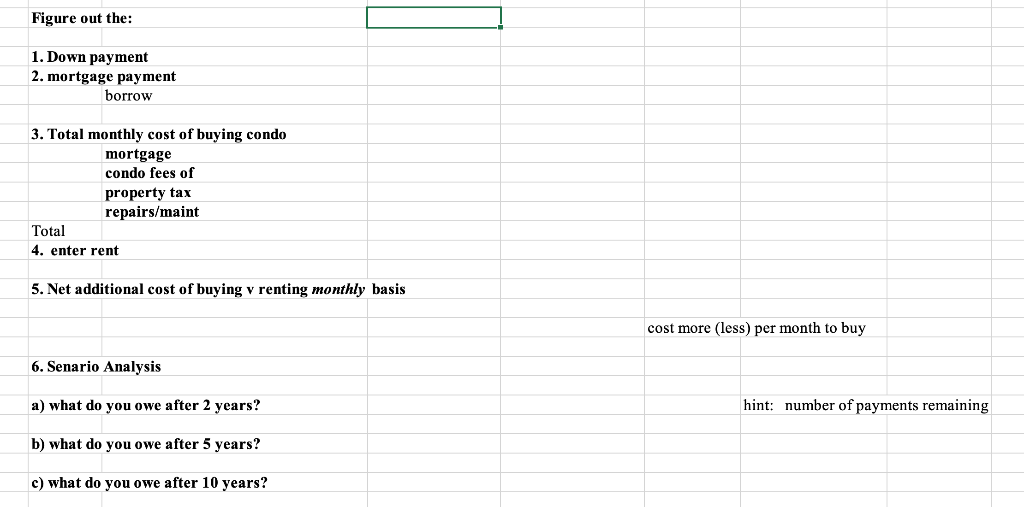

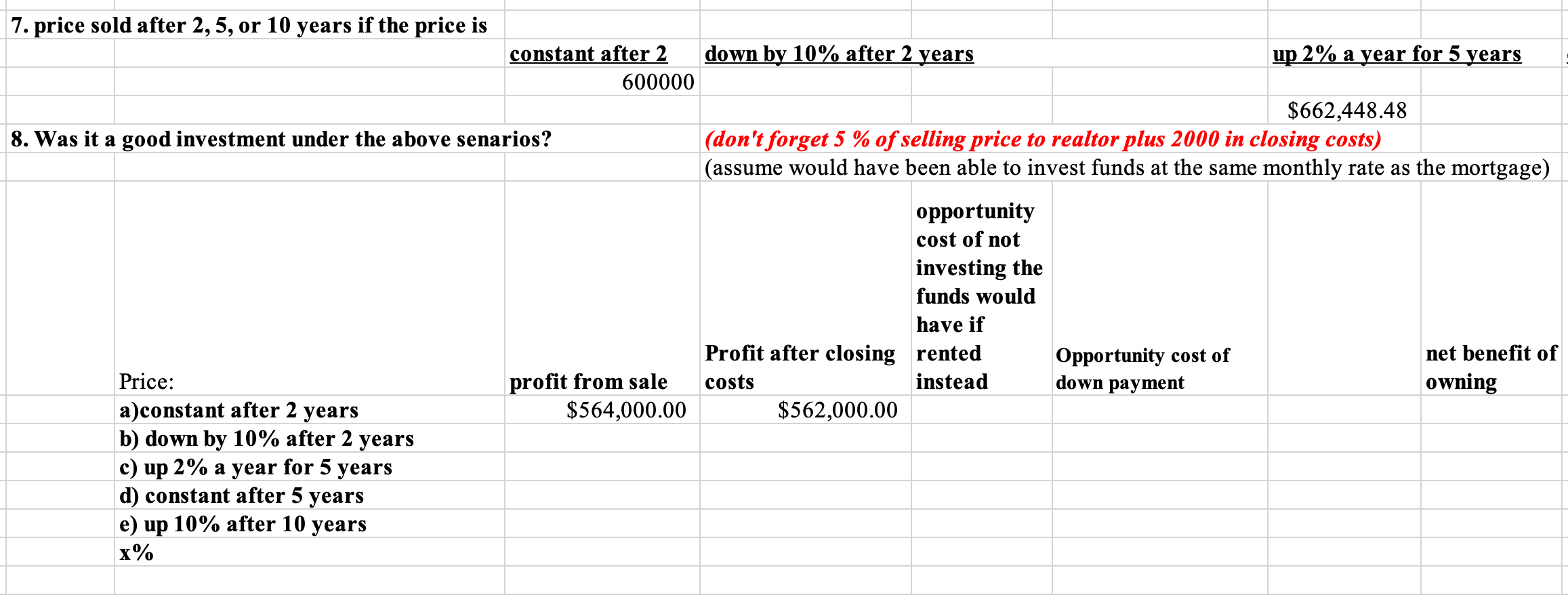

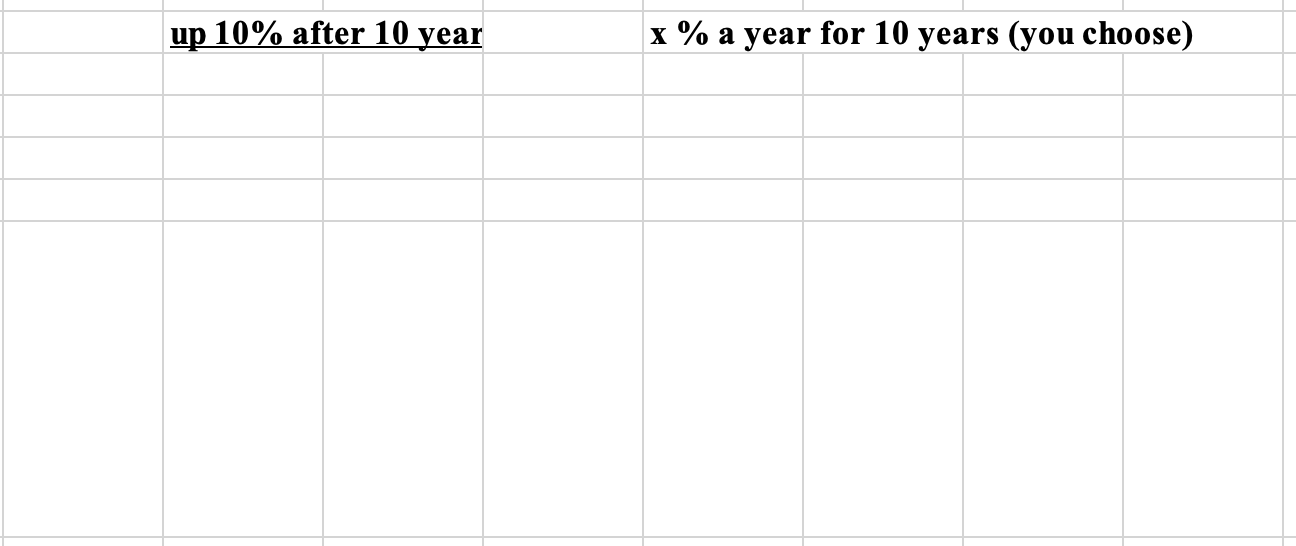

Is better to rent or buy a condo? Cse the information below to figure it out. Ready Lix Accessibilly: Investigate Figure out the: 1. Down payment 2. mortgage payment borrow 3. Total monthly cost of buying condo mortgage condo fees of property tax repairs/maint Total 4. enter rent 5. Net additional cost of buying v renting monthly basis cost more (less) per month to buy 6. Senario Analysis a) what do you owe after 2 years? hint: number of payments remaining b) what do you owe after 5 years? c) what do you owe after 10 years? 7. price sold after 2,5 , or 10 years if the price is constant after 2 down by 10% after 2 years up 2% a year for 5 years $662,448.48 8. Was it a good investment under the above senarios? (don't forget 5% of selling price to realtor plus 2000 in closing costs) (assume would have been able to invest funds at the same monthly rate as the mortgage) b) down by 10% after 2 years c) up 2% a year for 5 years d) constant after 5 years e) up 10% after 10 years x% up 10% after 10 year x \% a year for 10 years (you choose) Is better to rent or buy a condo? Cse the information below to figure it out. Ready Lix Accessibilly: Investigate Figure out the: 1. Down payment 2. mortgage payment borrow 3. Total monthly cost of buying condo mortgage condo fees of property tax repairs/maint Total 4. enter rent 5. Net additional cost of buying v renting monthly basis cost more (less) per month to buy 6. Senario Analysis a) what do you owe after 2 years? hint: number of payments remaining b) what do you owe after 5 years? c) what do you owe after 10 years? 7. price sold after 2,5 , or 10 years if the price is constant after 2 down by 10% after 2 years up 2% a year for 5 years $662,448.48 8. Was it a good investment under the above senarios? (don't forget 5% of selling price to realtor plus 2000 in closing costs) (assume would have been able to invest funds at the same monthly rate as the mortgage) b) down by 10% after 2 years c) up 2% a year for 5 years d) constant after 5 years e) up 10% after 10 years x% up 10% after 10 year x \% a year for 10 years (you choose)