Answered step by step

Verified Expert Solution

Question

1 Approved Answer

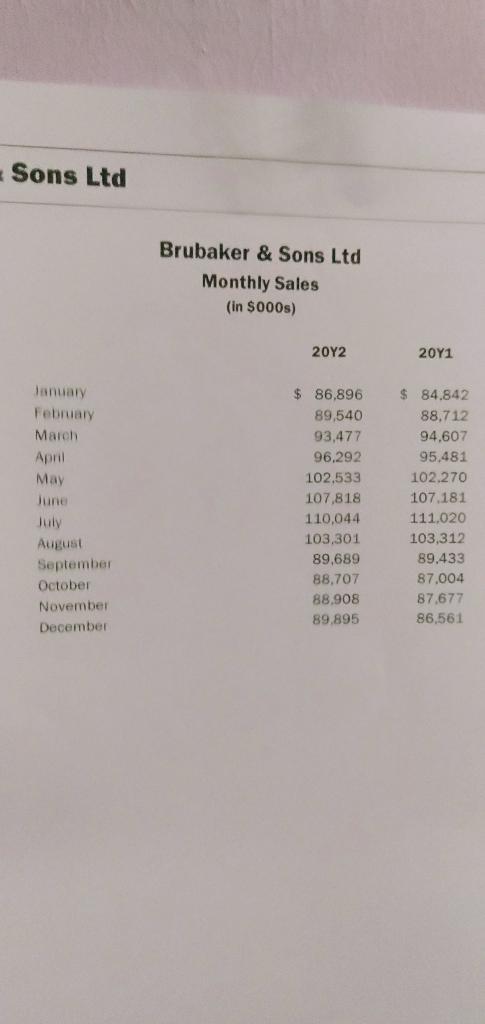

Is Brubaker experiencing seasonal or long-term sales growth (or both) and what is the appropriate way to finance its sales growth? a) Brubaker is experiencing

Is Brubaker experiencing seasonal or long-term sales growth (or both) and what is the appropriate way to finance its sales growth?

- a) Brubaker is experiencing only seasonal sales growth, which should be financed long-term

- b) Brubaker is experiencing seasonal and long-term sales growth, both of which should be financed long-term

- c) Brubaker is experiencing only seasonal sales growth, which should be financed short term

- d) Brubaker is experiencing only long-term sales growth, which should be financed long-term

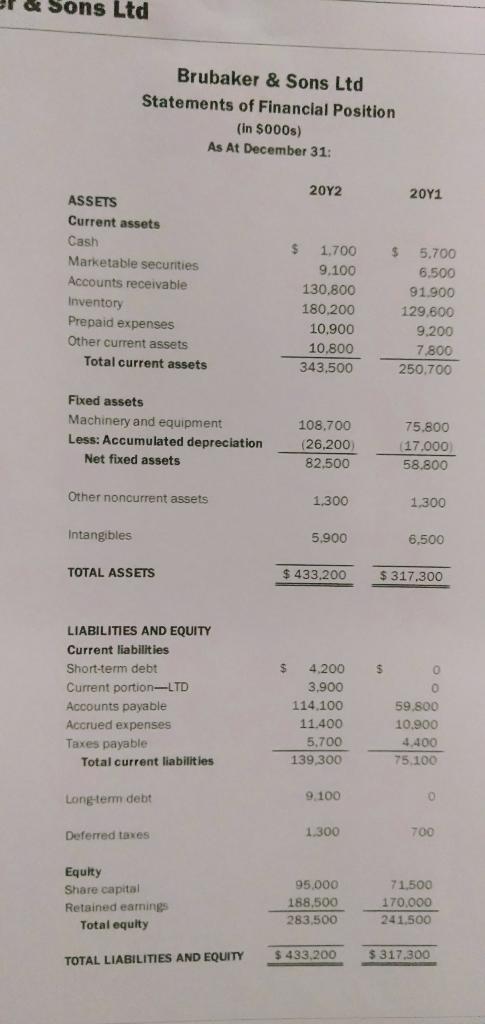

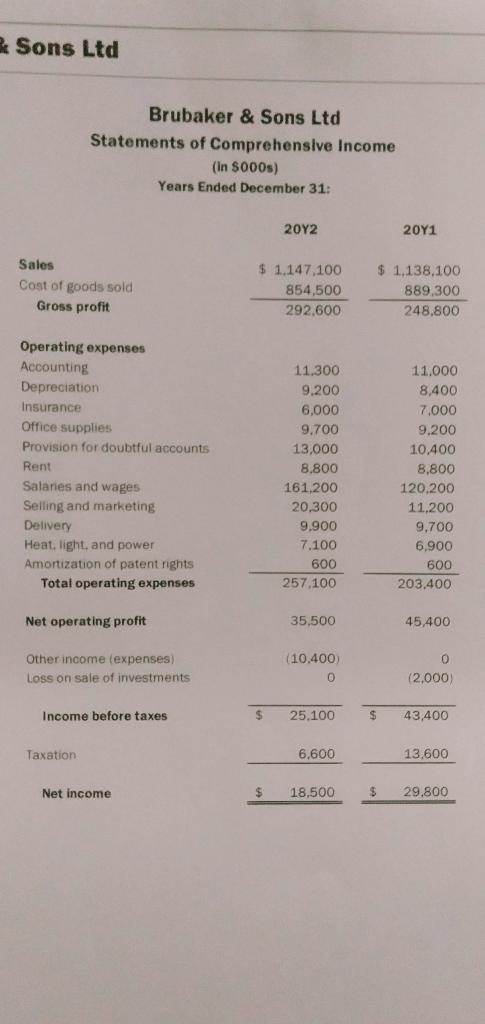

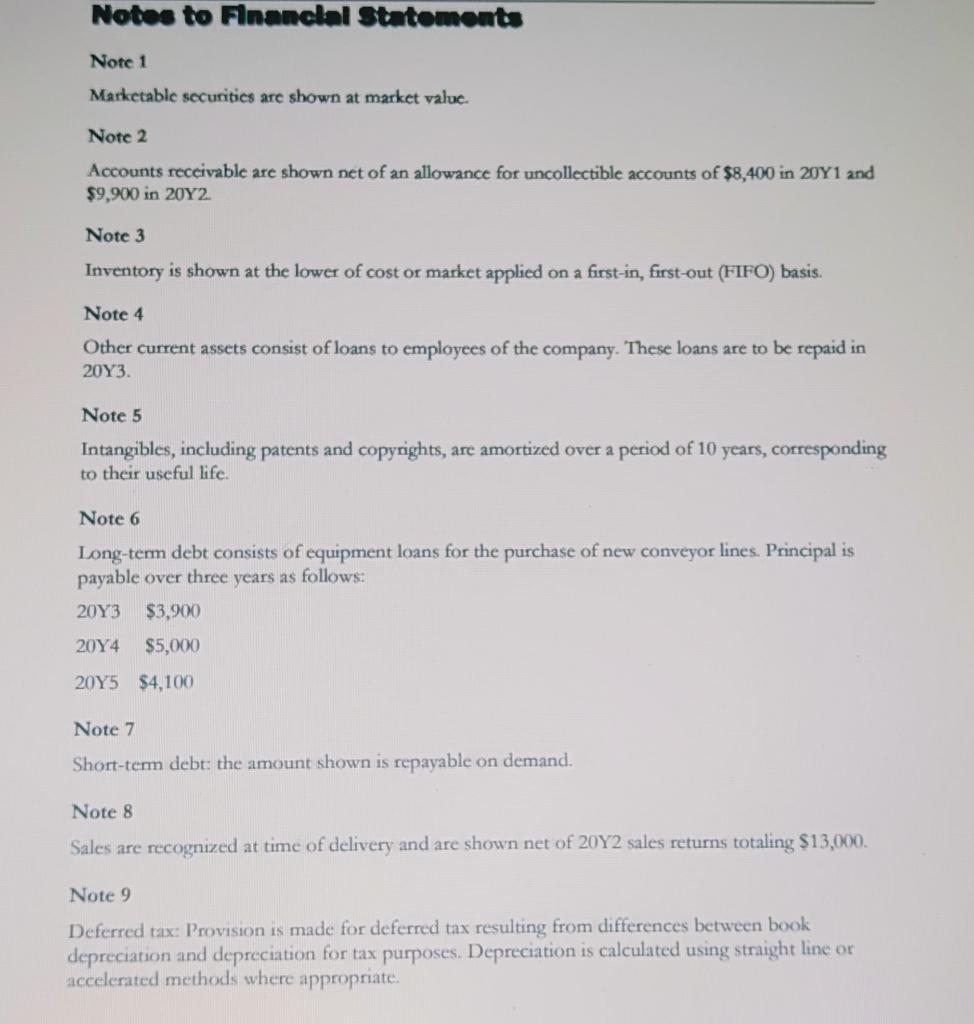

Brubaker & Sons Ltd Brubaker & Sons Ltd The following case information includes: Part A Statements of financial position Statements of comprehensive income Monthly sales Notes to financial statements & Sons Ltd Brubaker & Sons Ltd Statements of Financial Position (in $000s) As At December 31: 2012 2011 ASSETS Current assets Cash Marketable securities Accounts receivable Inventory Prepaid expenses Other current assets Total current assets $ 1,700 9.100 130.800 180.200 10.900 10.800 343,500 $ 5.700 6.500 91.900 129,600 9.200 7.800 250.700 Fixed assets Machinery and equipment Less: Accumulated depreciation Net fixed assets 108.700 (26.200 82,500 75.800 (17.000 58.800 Other noncurrent assets 1,300 1.300 Intangibles 5.900 6.500 TOTAL ASSETS $ 433.200 $317.300 $ 0 LIABILITIES AND EQUITY Current liabilities Short-term debt Current portion-LTD Accounts payable Accrued expenses Taxes payable Total current liabilities $ 4.200 3,900 114.100 11.400 5.700 139,300 59.800 10.900 4.400 75.100 Long-term debt 9.100 0 Deferred taxes 1.300 700 Equity Share capital Retained earnings Total equity 95.000 168,500 283,500 71,500 170.000 241.500 $ 433.200 $ 317.300 TOTAL LIABILITIES AND EQUITY * Sons Ltd Brubaker & Sons Ltd Statements of Comprehensive Income (In S000s) Years Ended December 31: 20Y2 2011 Sales Cost of goods sold Gross profit $ 1.147.100 854,500 292,600 $ 1,138,100 889.300 248,800 Operating expenses Accounting Depreciation Insurance Office supplies Provision for doubtful accounts Rent Salaries and wages Selling and marketing Delivery Heat, light, and power Amortization of patent nights Total operating expenses 11.300 9.200 6,000 9.700 13.000 8.800 161,200 20.300 9.900 7.100 600 257.100 11.000 8,400 7,000 9.200 10,400 8,800 120.200 11.200 9.700 6,900 600 203,400 Net operating profit 35,500 45.400 Other income (expenses) Loss on sale of investments (10.400) 0 0 (2.000 Income before taxes $ 25.100 $ 43,400 Taxation 6,600 13,600 Net income $ 18,500 $ 29.800 Sons Ltd Brubaker & Sons Ltd Monthly Sales (in 8000s) 20Y2 2011 January February March April May June July August September October November December $ 86,896 89,540 93,477 96.292 102,533 107,818 110,044 103,301 89,689 88,707 88.908 89.895 $ 84.842 88,712 94.607 95,481 102,270 107.181 111,020 103.312 89.433 87.004 87.677 86,561 Notes to Financlal Statements Note 1 Marketablc securities are shown at market value. Note 2 Accounts receivable are shown net of an allowance for uncollectible accounts of $8,400 in 20Y1 and $9,900 in 20Y2 Note 3 Inventory is shown at the lower of cost or market applied on a first-in, first-out (FIFO) basis. Note 4 Other current assets consist of loans to employees of the company. These loans are to be repaid in 2013 Note 5 Intangibles, including patents and copyrights are amortized over a period of 10 years, corresponding to their useful life. Note 6 Long-term debt consists of equipment loans for the purchase of new conveyor lines. Principal is payable over three years as follows: 20Y3 $3,900 $5,000 2014 2015 $4,100 Note 7 Short-term debt: the amount shown is repayable on demand. Note 8 Sales are recognized at time of delivery and are shown net of 20Y2 sales returns totaling $13,000. Note 9 Deferred tax: Provision is made for deferred tax resulting from differences between book depreciation and depreciation for tax purposes. Depreciation is calculated using straight line or accelerated methods where appropriate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started