Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company XYZ pays no dividends for the next seven years. In year 8, the dividend is expected to be D8 $20, and in subsequent

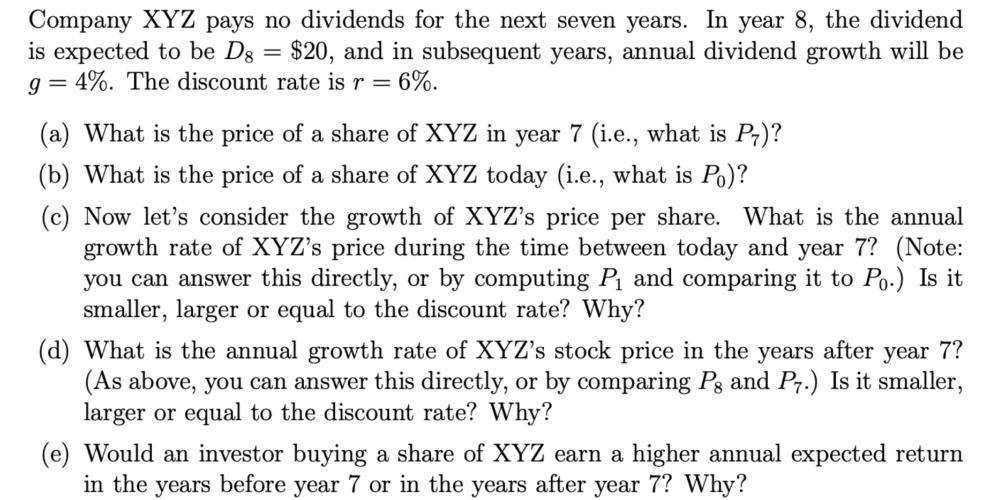

Company XYZ pays no dividends for the next seven years. In year 8, the dividend is expected to be D8 $20, and in subsequent years, annual dividend growth will be 9 = 4%. The discount rate is r = 6%. = (a) What is the price of a share of XYZ in year 7 (i.e., what is P7)? (b) What is the price of a share of XYZ today (i.e., what is Po)? (c) Now let's consider the growth of XYZ's price per share. What is the annual growth rate of XYZ's price during the time between today and year 7? (Note: you can answer this directly, or by computing P and comparing it to Po.) Is it smaller, larger or equal to the discount rate? Why? (d) What is the annual growth rate of XYZ's stock price in the years after year 7? (As above, you can answer this directly, or by comparing Pg and P7.) Is it smaller, larger or equal to the discount rate? Why? (e) Would an investor buying a share of XYZ earn a higher annual expected return in the years before year 7 or in the years after year 7? Why?

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem we will use the Gordon Growth Model for dividends and stock prices Given infor...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started